Trump's Message Spurs 'Animal Spirits'... New York Stock Exchange Breaks Downtrend [Kim Hyun-seok's Wall Street Now]

Summary

- The New York Stock Exchange reported that investor interest surged again due to Trump's announcement of a 'good call,' leading to an upward trend.

- Economic data suggests that the U.S. economy is in a 'Goldilocks' state, with notable improvements in industrial production and housing starts.

- Bitcoin is showing strength due to expectations of related policies following Trump's inauguration, potentially offering long-term investment opportunities.

<January 17, Friday>

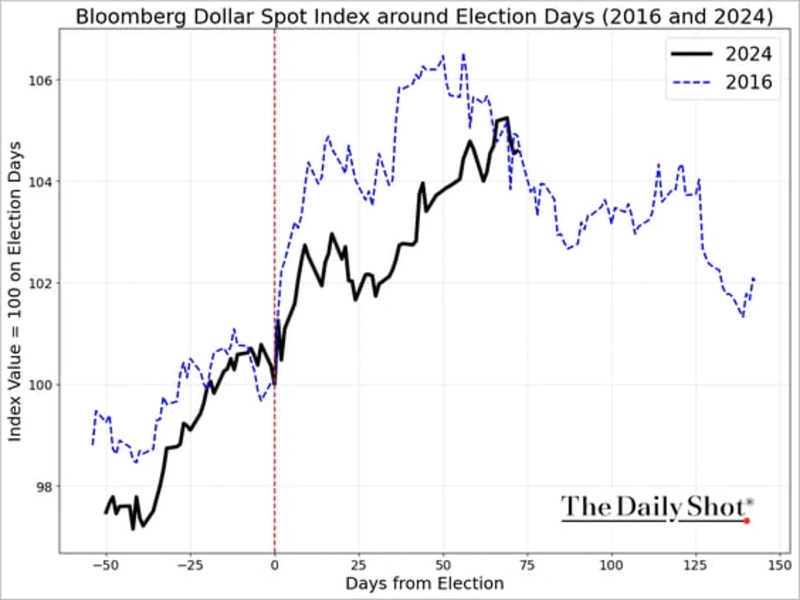

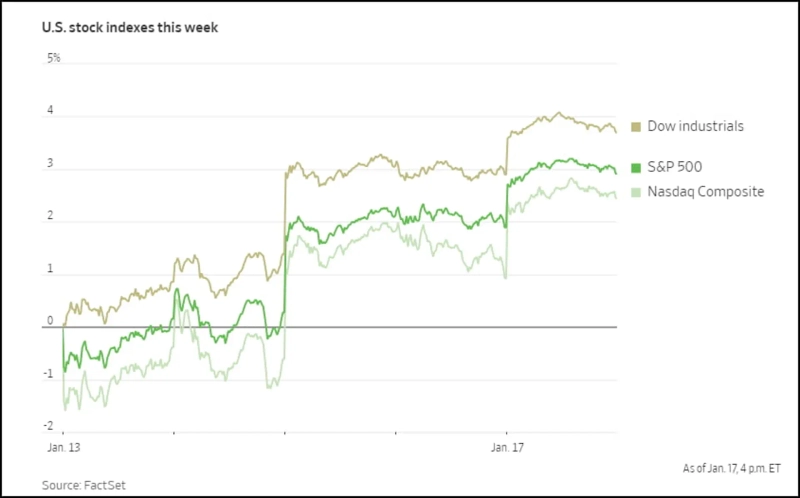

The New York Stock Exchange saw its biggest weekly gain since early November last year, following Trump's election. Despite concerns that the Trump administration, set to begin on the 20th, would immediately impose tariffs, President-elect Donald Trump announced on the 17th (Eastern Time) just before the market opened that he had a "good call" with Chinese President Xi Jinping regarding trade, reviving the 'Trump Trade.' Recent economic data has shown that the U.S. economy is in a 'Goldilocks' state (moderate growth and slowing inflation), and despite fluctuations in big tech, over 70% of S&P 500 stocks rose daily. Today, the market was heated as Tesla, Nvidia, and Apple rebounded sharply after yesterday's plunge. Technically, there was analysis that the S&P 500 index broke its downtrend. However, there is strong speculation that the market will continue to be volatile due to ongoing policy uncertainties such as tariffs.

Several factors have revived the Trump Trade.

① Trump-Xi "Good Call"

Next Monday is Martin Luther King Jr. Day, a holiday. However, it's not an ordinary holiday. It's also the inauguration day for President Trump. The Wall Street Journal (WSJ) reported that "the Trump camp has already prepared about 100 executive orders and aims for swift action after the inauguration." Measures related to immigration and tariffs are expected to be included.

In the early morning, there was a preference for safe assets. In the New York bond market, Treasury yields continued to decline. The 10-year Treasury yield recorded 4.566% around 8 a.m. This is a drop of 25 basis points in less than a week compared to over 4.8% on the 13th. Bloomberg reported that spreads are widening in the European high-yield bond market. Catherine Braganza, a bond analyst at Insight Investment, said in a Bloomberg interview, "There is a high possibility that tariffs will be announced next Monday. The biggest direct victims could be European high-yield companies."

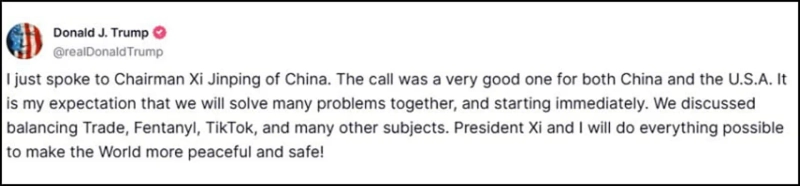

However, just before the New York Stock Exchange opened at 9:28 a.m., Trump announced on 'Truth Social,' "I just had a call with President Xi. It was a good call for both China and the U.S. We expect to solve many problems and hope to start immediately. We discussed trade balance, fentanyl, TikTok, and many other topics. President Xi and I will do everything possible to make the world more peaceful and secure." According to Chinese state-run CCTV, President Xi said, "I hope for a good start to China-U.S. relations. I am willing to push for greater progress from a new starting point. The essence of China-U.S. economic and trade relations is mutual benefit and win-win, and confrontation and conflict should not be our choice." CCTV reported, "The two leaders agreed to create a strategic communication channel and maintain regular contact on major issues."

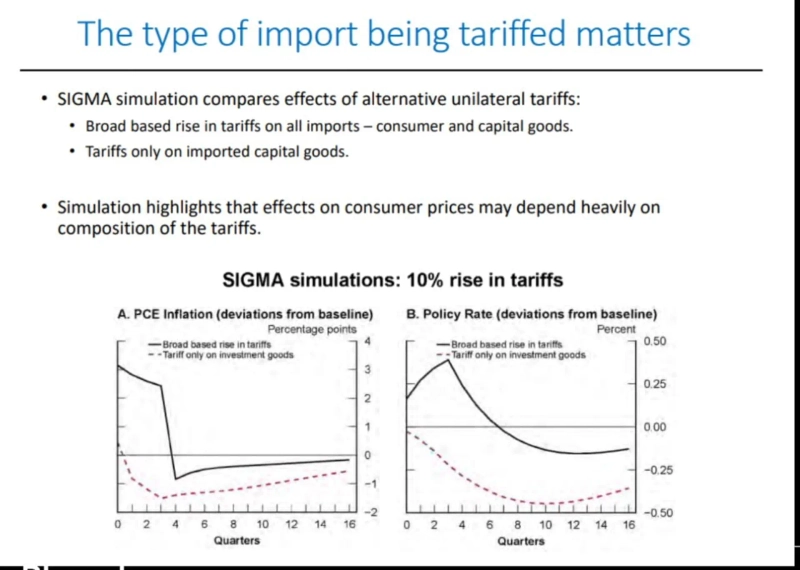

Of course, Trump has always called President Xi "a friend" during the first trade war. However, Trump's message amid tariff concerns excited investors. David Kudla, CEO of Mainstay Capital, said, "Trump may plan to use tariffs not just as an economic tool but as a diplomatic tool. He will likely use tariffs very broadly but will use them more as a negotiation tool to threaten and gain rather than implement them immediately as an economic tool." Bloomberg economist Anna Wong cited a 2018 Fed research paper, stating, "If tariffs are imposed only on intermediate goods and not on final consumer goods, it could actually lead to deflation." She added, "Fed Chair Jerome Powell also mentioned in a recent press conference that whether inflation worsens depends on which products tariffs are imposed on."

There is also analysis that the stock market tends to rise after a new president takes office. Jefferies analyzed data since 1929 and found that the average return of the S&P 500 index in the three months before the inauguration was only about 1%, but it rose by 3.7% in the three months after the event. Jefferies stated, "The index typically trades choppily around the inauguration, but the situation begins to improve after a few months." Additionally, it rises by 8.3% six months later and about 9.5% twelve months later.

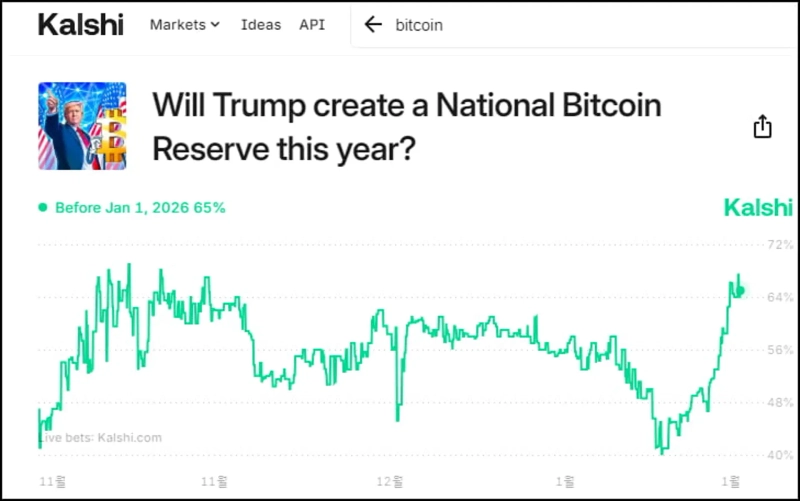

The revived Trump enthusiasm is evident in Bitcoin. Bitcoin rose to as high as $105,000, the highest since December 18. Bloomberg reported that Trump plans to prioritize cryptocurrency in policy after taking office and issue an executive order to form an advisory committee to give the industry a voice. The New York Times (NYT) reported the previous day that Republican Senator Cynthia Lummis, a cryptocurrency advocate, recently discussed with the Trump camp a plan to purchase 1 million Bitcoins over five years. Currently, 66% of bets on the online prediction market Kalshi predict that Trump will strategically stockpile Bitcoin this year. Ned Davis Research stated, "Cryptocurrency investors should be excited about the new administration. Bitcoin, in particular, has had good seasonality in February. The probability of a rise is 85.7%, with a median return of 15.4%, making it the second-best month after October."

② Economic Data is Goldilocks

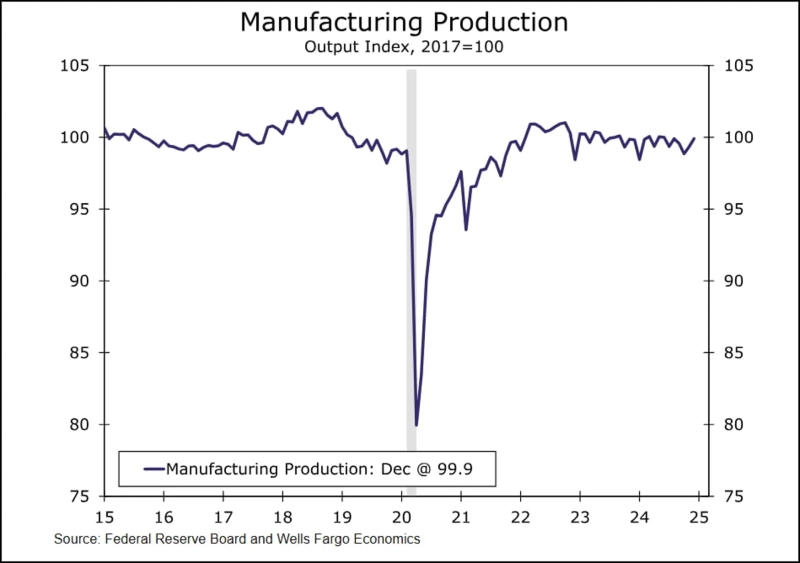

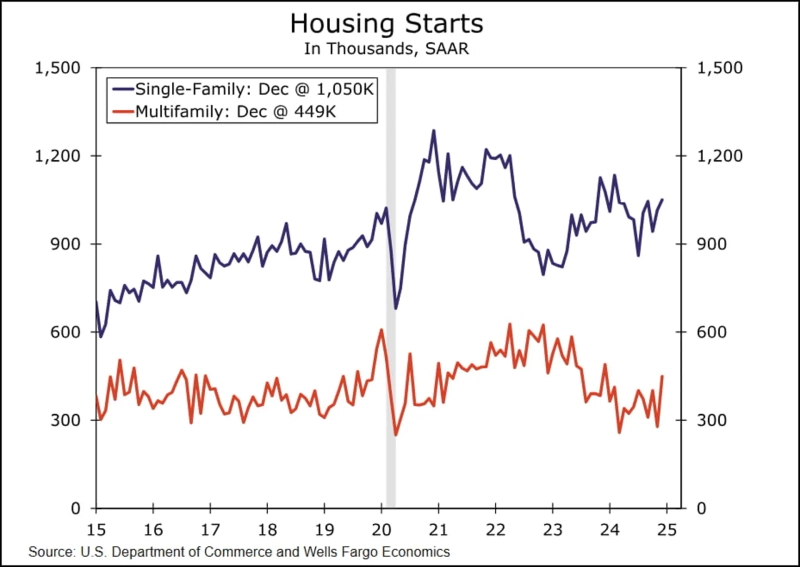

Moreover, there are signs that the economy is improving ahead of Trump's inauguration. This is especially true in manufacturing and real estate, which have been suffering from high interest rates.

Industrial production rose by 0.9% in December, much higher than Wall Street's consensus of 0.3%. The November figure was also revised upward from an initial -0.1% to +0.2%. By industry, manufacturing production improved further from 0.4% in November to 0.6% in December. Mining increased by 1.8% due to expanded oil and gas production. Utilities rose by 1.9% due to increased heating demand. Wells Fargo stated, "The surge in industrial production is partly due to the rebound in aircraft production following the end of the Boeing strike, exaggerating the current situation in this sector. Optimism from deregulation and tax cuts is spreading after the election. However, it is still unclear what will happen with tariffs, and many companies are waiting for capital expenditures."

Housing starts in December surged by 15.8% compared to the previous month. The figures for October and November were also revised upward. This is due to a 61.5% surge in the volatile multi-family starts. It increased significantly in the South, attributed to recovery from hurricane impacts. Building permits for housing decreased by 0.7%. TD Bank analyzed, "Housing construction broke the three-month trend of declining starts. The National Association of Home Builders (NAHB) housing market index has improved over the past three months due to expectations of deregulation by the new administration, but it is still in a contraction phase (below 50) at 47 in January. Housing construction is expected to increase in 2025, but there is a high possibility of a short-term recession due to fiscal uncertainty and high interest rates."

Regardless of the reasons, the atmosphere is indeed improving. Recent employment, services, manufacturing PMI, and retail sales data have all improved, and the small business optimism index has also risen significantly. Moreover, consumer prices (CPI) and producer prices (PPI) have slowed more than expected. Growth is decent, and inflation is low, which is a 'Goldilocks' scenario.

Goldman Sachs raised its fourth-quarter GDP estimate from 2.5% to 2.6% after today's data. It was 2.3% until last week. The New York Fed's GDP Nowcast also raised its estimate by 0.2 percentage points to 2.56%. This is an upward revision of 0.66 percentage points compared to 1.90% two weeks ago.

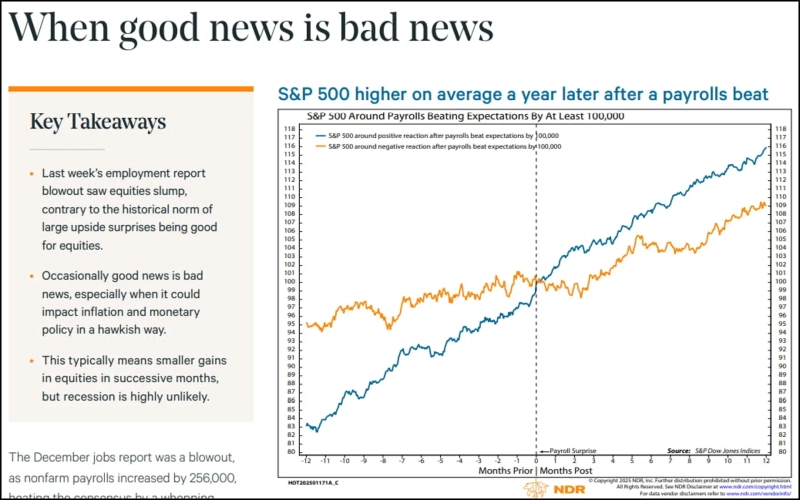

Despite such good data, the financial markets have recently reacted negatively. Last Friday, the S&P 500 index fell by 1.6% due to good employment data in December. This is because it lowers expectations for a rate cut by the U.S. central bank (Fed). This is known as the phenomenon where 'good news is bad news.'

However, according to Ned Davis Research, even when 'good news is bad news,' there are few cases where stock prices fall a year later. This is because there are hardly any cases where a recession continues when good employment data is released. Ned Davis Research looked for cases where employment data exceeded expectations by 100,000 and divided them into cases where the stock market reacted as 'good news' and 'bad news.' Although there was a difference in future 12-month returns, both cases showed an upward trend. Ned Davis stated, "Typically, the worst bear markets are associated with recessions. Overall, strong data is evidence that the upward trend in stock prices will continue. However, there may be short-term weakness, and 6-12 month returns are often relatively low."

③ Will Long-term Interest Rates Stabilize?

Today, long-term interest rates remained stable despite good data. In the New York bond market, the 10-year Treasury yield was trading at 4.611%, up 0.5 basis points, at 3:07 p.m. The 2-year yield was trading at 4.272%, up 3.4 basis points.

The Congressional Budget Office (CBO) raised its 2025 fiscal deficit estimate from $1.832 trillion to $1.865 trillion and predicted that the Treasury debt ratio would rise to 99.9% this year and 118.5% by 2035. However, there was little impact.

The stability in interest rates was also influenced by dovish remarks from Christopher Waller, who has been leading Fed sentiment. Waller said, "The December inflation data was very good. If the data cooperates, there could be 3-4 rate cuts this year. I don't think March is completely off the table for rate cuts." Waller also stated, "I don't see tariffs having a huge inflationary effect."

There are quite a few people in the market who share Waller's view. According to a bond investor survey by Evercore ISI, bond managers still expect the 10-year Treasury yield to decline. Although the possibility of a recession has essentially disappeared, they still expect inflation and yields to decline.

On Wall Street, there is still heated debate over the direction of the 10-year yield. The forecast range is wide, from below 4% to above 5%. Wells Fargo predicts it will fall to 4.25% by the end of the year, based on the expectation that the economic (labor market) slowdown will continue. Lisa Shalett, Chief Investment Officer at Morgan Stanley Investment Management, argued, "Consider using this Treasury sell-off as an entry point." However, Bank of America raised its year-end forecast to 4.75% from 4.25% this week, expecting the Fed to "hold off on rate cuts in the long term." TS Lombard expects it to rise above 5%. T. Rowe Price and Nomura predict it could reach 6% this year.

Nomura economist Rob Subbaraman argued in a report titled 'Why the 10-year U.S. Treasury Yield Could Rise to 5-6%' that "although the recent 10-year yield has risen to 4.6%, higher than the average of 3.3% since 2000, the correct reference case may be the 1990s (nominal 6.7%, real 3.7%) and 1980s (nominal 10.6%, real 5.0%), not the past 20 years. The 10-year yield is still low considering the two main factors (CPI inflation, fiscal balance). Especially considering the current stage of the economic cycle (close to full employment), this is even more so."

However, even Charlie McElligott, a cross-asset strategist at the same Nomura, disagrees. McElligott argued, "The market is betting that rates can stay high. But given that high rates 'always break something,' the possibility of rates falling is underestimated." He added, "Even without a recession, mortgage rates exceeding 7% again and credit card loan interest rates approaching record highs will suppress inflationary pressures. This will give the Fed more room to lower rates in the second half."

④ Rebound in Big Tech Stocks

Yesterday, big tech stocks like Apple, Tesla, and Nvidia, which had plummeted, also rebounded. Apple fell 4.04% yesterday, recording its largest drop since August 5 last year (4.82%↓). This came after news that its market share in the Chinese smartphone market fell by 17% in a year, dropping to third place behind Vivo and Huawei. TSMC's earnings announcement was also negative. Dan Niles, founder of Niles Investment, pointed out, "TSMC's fourth-quarter smartphone revenue, which makes chips for iPhones, increased by 17% compared to the previous quarter, but it decreased compared to the 27% increase in the fourth quarter of 2023. Yet, Apple's stock is still trading at a price-to-earnings ratio (P/E) of 30 times."

However, today Evercore ISI added Apple to its 'Tactical Outperform' list. "Apple can deliver results in line with expectations due to growth in emerging markets and strengths in services and wearables (new iPods, Apple Watch)." Evercore stated, "China remains a key wildcard, but there are reports that Huawei is struggling to secure enough smartphone chips. This will be favorable for Apple. Apple is also expected to unveil a new SE model in March, which could further raise estimates for the June quarter. Investor interest is gradually shifting to the iPhone 17, known as the new form factor (foldable?), and the story of better-than-feared China sales will positively impact the stock over time."

Along with Apple, Tesla, Nvidia, and others also started strong. Intel's stock soared after reports of a potential acquisition by another company. Rivian's stock rose on expectations of strengthening its partnership with Volkswagen.

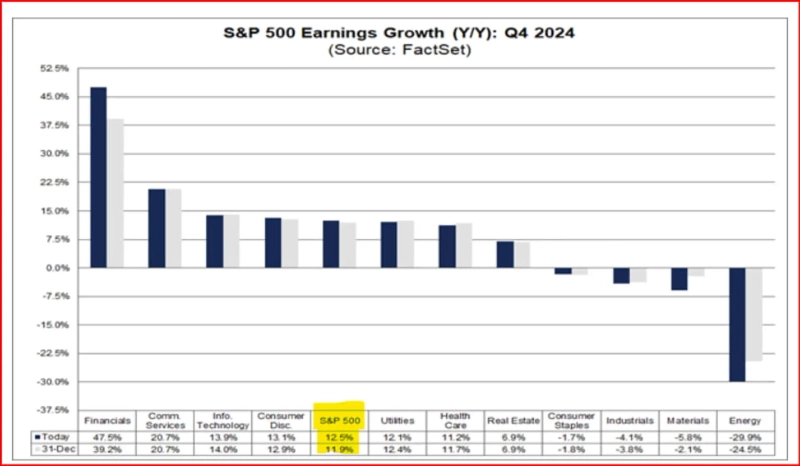

⑤ Strong Earnings

The fourth-quarter earnings season also started strong. According to FactSet, 9% of S&P 500 companies reported fourth-quarter earnings by this week, and 79% of them posted earnings per share (EPS) higher than Wall Street estimates. This is higher than the 5-year average of 77% and the 10-year average of 75%. Overall, companies reported earnings 9.1% higher than estimates, also higher than the 5-year average of 8.5% and the 10-year average of 6.7%. FactSet calculated the fourth-quarter earnings growth rate, including estimates for companies that have not yet reported, at 12.5%. This is higher than last week's 11.5%. If the fourth-quarter growth rate is indeed 12.5%, it will be the highest since the fourth quarter of 2021 (31.4%). It is also the sixth consecutive quarter of growth.

UBS stated, "We expect S&P 500 company earnings to grow by 9% this year, leading the index to 6600 by the end of the year. Large-cap stocks have more exposure to AI and better earnings growth trends, and they are less dependent on rate cuts, so they are expected to outperform mid- and small-cap stocks. By sector, we prefer IT, technology, finance, utilities, communication services, and consumer discretionary."

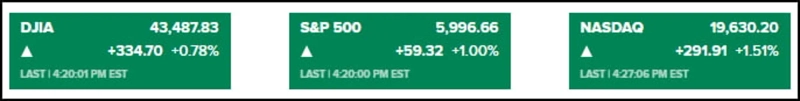

In the end, the New York Stock Exchange maintained its upward trend throughout the day. Despite a three-day holiday (long weekend) ahead of Trump's inauguration, there was little selling at the end of the session. The S&P 500 index rose by 1.0%, the NASDAQ by 1.51%, and the Dow by 0.78%. For the week, the S&P rose by 2.9%, the NASDAQ by 2.4%, and the Dow jumped by 3.7%.

Big tech led the market. Nvidia rose by 3.10%, Tesla by 3.06%, and Apple rebounded by 0.75%. All of the Magnificent 7 stocks rose. However, Meta only rose by 0.2% due to the Trump camp's move to 'keep TikTok alive' despite the Supreme Court's decision. By sector, ▲Consumer Discretionary (1.71%) ▲IT (1.65%) ▲Communication Services (1.10%) ▲Consumer Staples (0.85%) ▲Finance (0.83%) rose significantly. ▲Real Estate (-0.04%) ▲Healthcare (-0.67%) showed a downward trend.

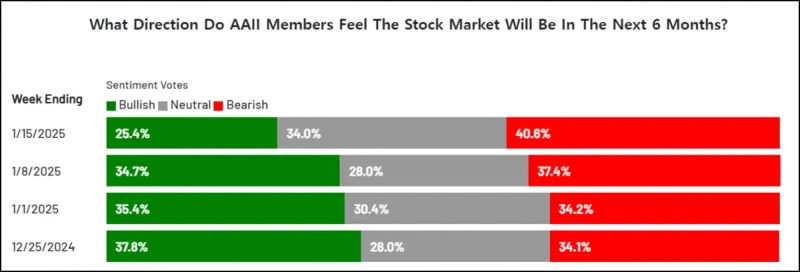

Tom Lee, founder of Fundstrat, continues to argue that the market hit bottom on the 14th. He suggests that there are signs of a bottom internally in the market, such as the proportion of S&P 500 stocks trading above their 50-day moving average falling to 16%, the lowest since November 2023, and the American Association of Individual Investors (AAII) bull/bear sentiment ratio dropping by more than -15%, indicating "imminent investor capitulation." He also stated, "The first five days of January showed positive returns, and historically, this has led to an 82% chance of a rise for the year."

Bespoke Investment Group analyzed, "Both the S&P 500 index and the NASDAQ 100 index are trading above the upper end of the short-term downtrend channel formed in early December," indicating that the short-term downtrend has been broken. The core assets of the Trump Trade, such as Tesla and Bitcoin, are also in the same situation.

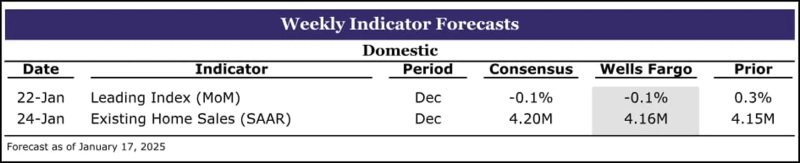

Next week will be quiet in terms of data and the Fed. Notable economic data includes the Conference Board's December Leading Economic Index on Wednesday (22nd) and December existing home sales on Friday (24th). The Fed will enter a blackout period ahead of the Federal Open Market Committee (FOMC) meeting on the 28th.

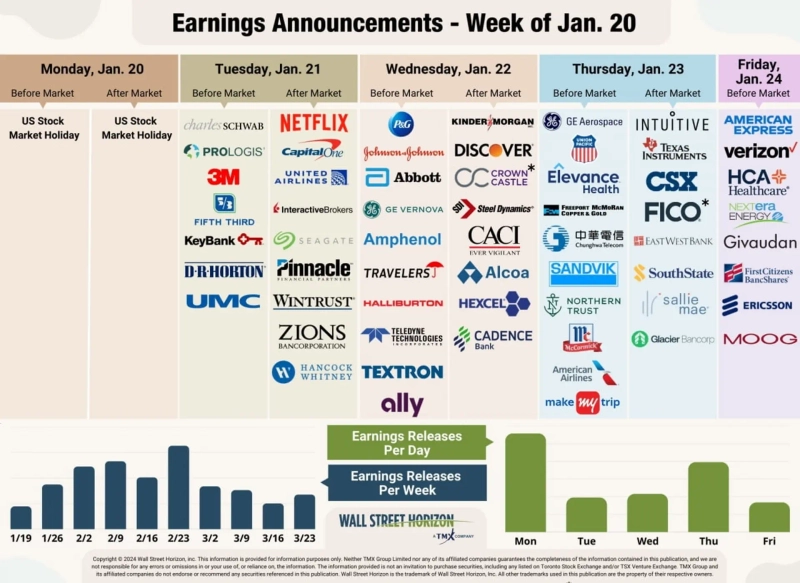

The earnings season will be busy. 3M (MMM), Netflix (NFLX), Verizon (VZ), United Airlines (UAL), American Express (AXP), and American Airlines (AAL) will report earnings. The transportation sector, including airlines and railroads, is heavily represented.

The Bank of Japan's (BoJ) interest rate decision will also be announced on the 24th. Japanese media reports are predicting a 25 basis point increase to 0.50%. The yen rose by 0.5% against the dollar today, rising more than 1% this week. If tariffs affecting Japan are announced on the 20th, there is speculation that the rate hike will be delayed.

The key next week will be the executive orders issued immediately after Trump's inauguration. The WSJ noted, "During Trump's first term, broad tax cuts were implemented before selective tariffs. This meant that the economy already had strong momentum when the negative impact of trade disruptions hit. However, this time, the order may be reversed. Moreover, tariffs could be much broader, and the amount of new tax cuts could be smaller. This seems like a factor that could lead to a recession."

New York = Kim Hyun-seok, Correspondent realist@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.