Trump Meme Coin 'Investment Caution'... Much Riskier Than Major Cryptocurrencies

Summary

- Trump Meme Coin lacks underlying assets or practical purposes, requiring caution when investing.

- The absence of tangible assets and the small coin pool of meme coins lead to high volatility and emphasize vulnerability to rug pull scams.

- It is reported that meme coins are riskier than major cryptocurrencies like Bitcoin, requiring special caution from investors.

No underlying assets or practical purposes to support value

Small coin pool and mostly held by insiders, leading to high volatility

Prone to rug pull scams

Trump Meme Coin has appeared on domestic virtual asset exchanges. However, meme coins are among the most risky digital assets and require special caution when investing.

Meme coins are cryptocurrencies that start as internet memes or jokes. Skeptics of cryptocurrencies often use meme coins as an example to argue that digital assets are unreliable and can never compete with traditional finance.

Last week, when President Donald Trump and his wife launched two meme coins, senior officials in the U.S. digital asset industry expressed concerns that it would harm the industry by undermining the credibility of cryptocurrencies.

There are several reasons why meme coins are riskier than cryptocurrencies like Bitcoin or Ethereum.

Well-known cryptocurrencies were created to mimic traditional currencies and improve functionality or to pay for online services. However, meme coins usually start as jokes or social experiments. They lack underlying assets to support their value and have no practical purpose.

For retail investors, meme coins are cheaper than Bitcoin and Ethereum, making them easier to invest in. However, investing in meme coins without tangible assets to support their value can be much riskier. They can also surge or plummet within minutes because the available coin pool is smaller than that of major cryptocurrencies, and most are held by the creators and their insiders.

Meme coin investors are also vulnerable to scams known as rug pulls. This is when coin developers abandon the project or suddenly liquidate their holdings, rendering the tokens worthless.

Unlike existing digital assets like Bitcoin or Ethereum, meme coins rarely have third-party auditors for their code. This makes it easier for hackers to exploit software vulnerabilities and steal investors' money.

Even if Trump dismisses it, the continuity of Trump Meme Coin is also questionable from an ethics standpoint for public officials. Government watchdogs immediately criticized it as a violation of presidential ethics norms, while industry insiders condemned it as an act of cashing in on the presidency.

From Trump's personal perspective, minting meme coins is a lucrative cash grab. The market value of his $Trump Coin soared to $15 billion (22 trillion won) after its debut on January 18. This indicates a windfall for Trump-related companies that own most of the tokens. Two days later, Melania, named after the First Lady, was launched and also surged within hours.

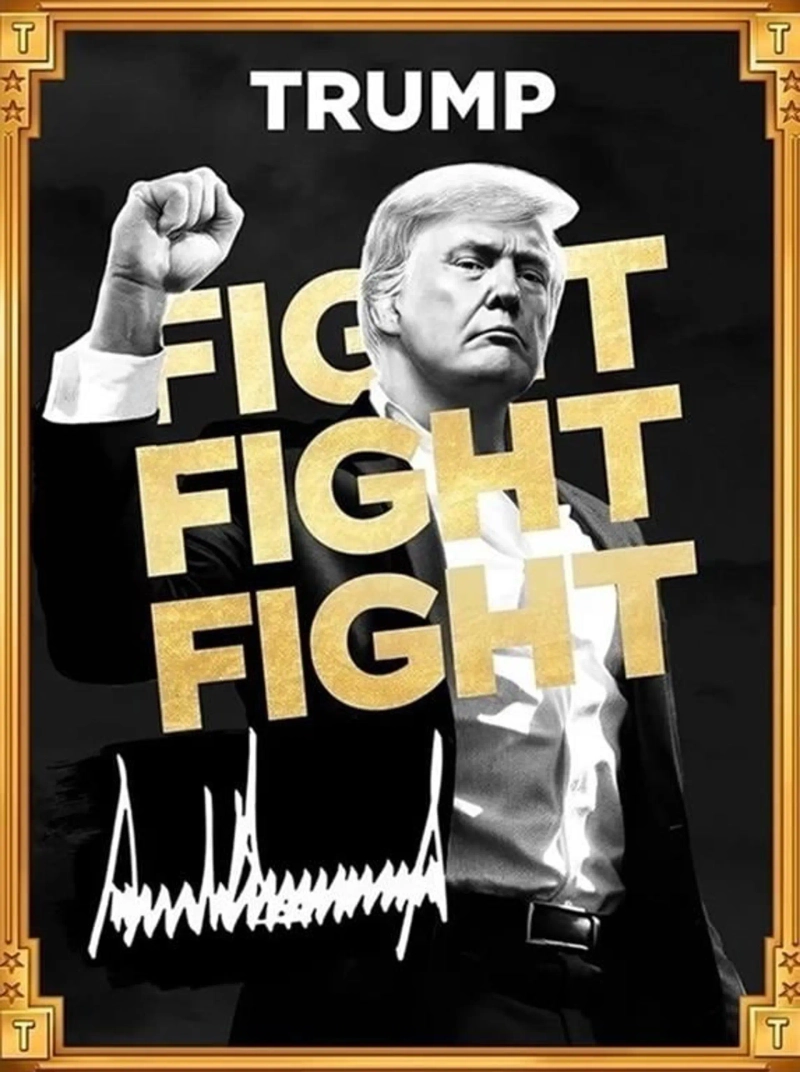

Trump Meme Coin is 80% owned by CIC Digital, an affiliate of the Trump Organization, and a related company, Fight Fight Fight.

The art of Trump's meme coin depicts him with his fist raised in the air. It is based on a widely circulated photo of Trump after an assassination attempt during a campaign rally.

The first and most valuable meme coin, Dogecoin, started from a photo of a Japanese Shiba Inu dog that became famous as a meme on the internet. Meme coins like Dogewithhat and Pepe also reference images of a dog with a hat and an anthropomorphized green frog.

Despite this, meme coins currently have a total market value of over $100 billion. It's a costly joke. Currently, Dogecoin is the largest meme coin with a market value of over $50 billion. Other coins with high market value include Shiba Inu, Pepe, and Bonk.

The underlying blockchains of meme coins vary. Dogecoin is built on its own blockchain, where ownership and transaction activity ledgers are public. Other meme coins are based on blockchains like Ethereum or Solana.

The people who make money from meme coins are developers and early investors. They can reap the most significant profits through sales when prices rise. Cryptocurrency exchanges and brokers, which see increased trading volume and fee income when interest in meme coins explodes, are also beneficiaries.

Guest reporter Kim Jung-ah kja@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Despite Trump’s pledge to ‘cut’… “U.S. debt ratio set to hit post-WWII high” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/8c7809d5-0bc5-4094-8563-4dbd8393af0f.webp?w=250)

![Selling pressure despite a 'surprise jobs report'… the three major indexes end slightly lower [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/71d04eea-1cc0-4ced-a1e2-c695c8d95cac.webp?w=250)