KDI Calls for Rate Cuts... Bank of Korea Criticizes "Lack of Analytical Capability"

Summary

- The Korea Development Institute (KDI) suggested cutting the base rate two to three times to recover domestic demand amid slowing economic growth in Korea.

- In response to KDI's call for rate cuts, the Bank of Korea expressed concerns about the risk of exchange rate increases and the potential outflow of foreign capital.

- The differing policy directions have highlighted the conflict between KDI and the Bank of Korea.

Tensions Over Monetary Policy

KDI Lowers Growth Forecast to 1.6%

Concerns Over Sluggish Domestic Demand and Export Slowdown

"Need to Cut Rates 2-3 Times Instead of Supplementary Budget"

Bank of Korea "Not Concerned with Opinions of Specific Institutions"

"Hasty Rate Cut Remarks Could Push Up Won-Dollar Exchange Rate"

The Korea Development Institute (KDI), a national research institute, has lowered its economic growth forecast for this year from 2.0% to 1.6%, arguing that "considering the economic situation, the Bank of Korea should cut the base rate at least two to three times this year." The Bank of Korea expressed displeasure with KDI's comments on monetary policy, stating it was "just the opinion of one institution." The tension between the Bank of Korea, which prioritizes price stability, and KDI, which focuses on growth, has resurfaced.

◇KDI "Base Rate Should Be Cut Two to Three Times"

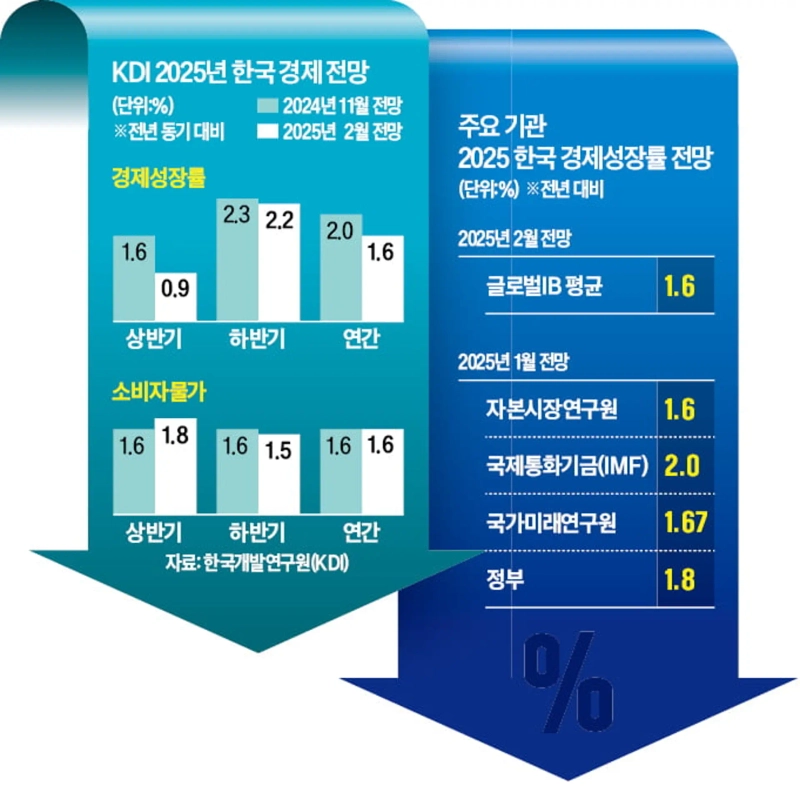

On the 11th, KDI presented an economic growth forecast of 1.6% in its 'KDI Economic Outlook Revision.' This is 0.4 percentage points lower than the 2.0% forecast released last November. It is lower than the 2.0% and 1.8% forecasts presented by the International Monetary Fund (IMF) and the government, respectively, and similar to the 1.6-1.7% forecast released by the Bank of Korea last month.

KDI cited sluggish domestic demand recovery, including consumption and construction investment, as the reason for lowering the forecast. Concerns that the export growth rate would slow due to U.S. President Donald Trump's tariff increase policy were also reflected. By sector, the private consumption growth rate was revised down from 1.8% to 1.6%. Construction investment was presented at -1.2% from -0.7%. The export growth rate was lowered from 1.8% to 1.6%.

KDI analyzed that the base rate should be cut to boost domestic demand. Jeong Gyucheol, head of KDI's Economic Outlook Office, said, "The base rate is high compared to the economic situation, so it should be further lowered," adding, "Considering the neutral interest rate (long-term equilibrium rate in a state of price stability and full employment) is roughly in the mid-2% range, the base rate, which is 3.0% per annum, should be cut two to three times."

While KDI emphasized the need for fiscal policy, it clearly opposed the formulation of a supplementary budget. Jeong said, "According to the National Finance Act, a supplementary budget can be formulated when there is an economic recession or mass unemployment," adding, "It is difficult to see the current situation, with a growth rate in the mid-to-late 1% range, as an economic recession, so it is hard to say that the conditions for a supplementary budget have been met."

◇Bank of Korea "KDI's Analytical Capability Differs from Bank of Korea"

The Bank of Korea showed displeasure at KDI's comments on monetary policy. A senior official at the Bank of Korea said in a call, "We are not concerned with the opinions of specific institutions," but added, "KDI's economic outlook and monetary policy analytical capability differ significantly from the Bank of Korea."

There was also an evaluation within the Bank of Korea that it is premature for a national research institute to advocate for a base rate cut. This is because it could inadvertently push up the won-dollar exchange rate. If only Korea lowers the base rate while the U.S. Federal Reserve's rate cut pace is slowing, it could prompt global funds to exit the domestic market. Bank of Korea Governor Lee Chang-yong also said in an interview with Bloomberg on the 6th, "It is not confirmed that the base rate will be cut this month" for this reason.

There was also skepticism within the Bank of Korea regarding the neutral interest rate, which KDI used as a basis for advocating a base rate cut. A former Bank of Korea monetary policy director said, "The Bank of Korea calculates the neutral interest rate by averaging five neutral interest rates derived from five economic models," adding, "If KDI is confident, they should disclose their neutral interest rate model."

The two institutions have frequently clashed over monetary policy in the past. The central bank, which emphasizes price stability, is generally closer to the 'hawkish' (preference for monetary tightening) stance. In contrast, KDI, as a national research institute representing the government, which emphasizes growth, has a 'dovish' (preference for monetary easing) perspective. This is why tensions arise whenever KDI releases an economic outlook report and mentions monetary policy.

The fact that KDI has produced many Bank of Korea governors and monetary policy committee members has also been a background for the tension. Since 1997, when the monetary policy committee members changed from non-standing to standing positions, six KDI-affiliated figures, including former Governor Kim Joong-soo, former committee members Lee Deok-hoon, Kang Moon-soo, Ham Joon-ho, Cho Dong-chul (current KDI president), and Shin In-seok, have held high positions at the Bank of Korea.

Kim Ik-hwan/Lee Kwang-sik reporters lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.