Summary

- The Hang Seng Tech Index rose 25% in a month, with DeepSeek's technological innovation being analyzed as the background.

- As China's AI technology is reevaluated, foreign investor funds are flocking to the Hong Kong stock market.

- Everdeen's China investment manager mentioned that the R&D capabilities of Chinese tech companies are similar to those of the US.

Hang Seng Tech Index Soars 25% in a Month

US M7 Rises Only 0.5% in the Same Period

The Hang Seng Tech Index in Hong Kong has surged 25% in a month, driven by the rally in Chinese tech stocks. This is attributed to the renewed interest from global investors as investment sentiment improved, highlighting the technological innovations of the AI startup DeepSeek.

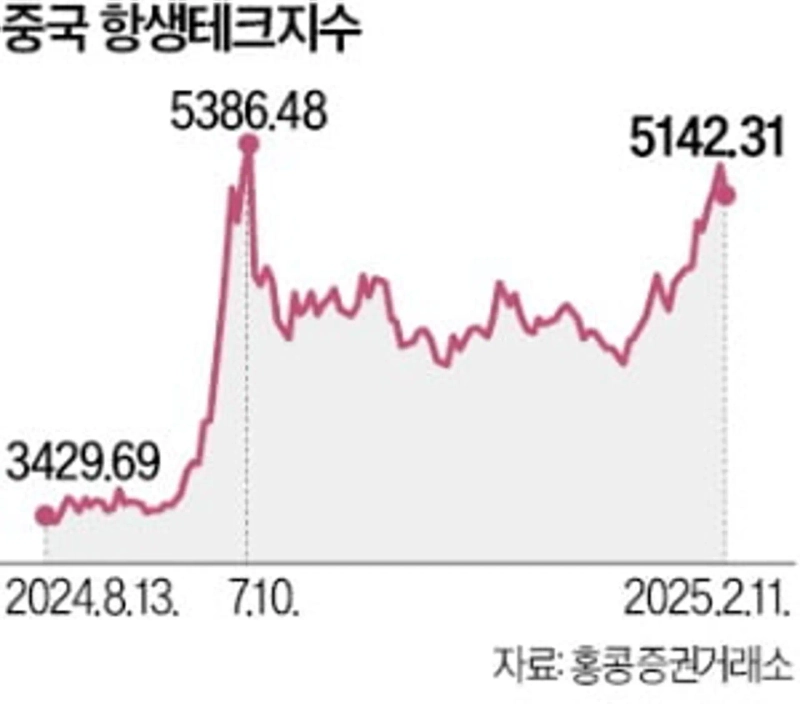

According to the Hong Kong Stock Exchange (HKEX) on the 12th, the Hang Seng Tech Index stood at 5142.32, up 25% from its low on the 13th of last month. This contrasts with the Nasdaq 100 Index's 4.4% rise and the average increase of less than 0.5% in the US 'Magnificent 7' (the top 7 large US tech stocks) during the same period.

The sharp rise in Chinese tech stocks is analyzed as a reevaluation of China's AI competitiveness, led by DeepSeek. The Financial Times (FT) explained, "DeepSeek's AI model has demonstrated technology comparable to US models, despite being developed with much less capital and computing resources, which has been a boon for Chinese tech stocks." According to Bloomberg, DeepSeek's corporate value reaches up to $150 billion (about 218 trillion won).

The success of DeepSeek has led to a reevaluation of the R&D capabilities of Chinese tech companies, drawing foreign investor funds to the Hong Kong stock market. Bush Chu, China investment manager at the UK's largest asset management firm Everdeen, analyzed, "The technological prowess of Chinese tech companies is on par with US big tech in the global market," adding, "As positive perceptions of Chinese AI technology spread, investment funds are flowing back into the Chinese market."

The stock prices of Chinese tech companies, which show strengths in AI and cloud computing, also rose collectively. Alibaba's stock price surged 6% in a single day after announcing the application of AI features co-developed with Apple to the iPhone. E-commerce companies JD.com (24%) and Meituan (11%) also showed significant upward trends.

The buying spree of Hong Kong stocks by mainland Chinese investors is also accelerating. According to HKEX, the trading volume through the 'Stock Connect' system, which allows mainland investors to purchase Hong Kong stocks, surged 66% compared to the previous month.

Citigroup stated, "DeepSeek is known to possess unique hardware technology," adding, "The AI investment and large language model (LLM) levels of Chinese internet giants are undervalued."

Reporter Lee So-hyun y2eonlee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.