Summary

- President Donald Trump reportedly pressured the central bank blatantly with a message to lower interest rates further.

- Chairman Powell stated at the hearing that he would not be swayed by Trump's pressure and would make decisions based on economic conditions, declaring that now is not the time to lower rates.

- Recent inflation trends are concerning, and while the market does not see a high possibility of the Federal Reserve lowering rates this year, many believe it will only happen once or twice.

The conflict between the central bank, which aims to control inflation, and the administration, which seeks to stimulate the economy, is becoming more pronounced. U.S. President Donald Trump stated on Truth Social on the morning of the 12th (local time) that "rates need to be lowered further" and that this would proceed alongside the tariff policy.

Previously, Treasury Secretary Scott Besant mentioned that the focus is on the 10-year U.S. Treasury yield rather than the central bank's benchmark rate, indicating that there would be no direct pressure on the central bank. However, President Trump did not maintain a moderate stance like Besant and once again blatantly pressured the central bank. Today, Chairman Powell testified at the House hearing. He appeared in the Senate yesterday and the House today. It seems likely that he posted the message knowing the House hearing was about to start.

However, Chairman Powell appears unyielding. At today's hearing, when asked about Trump's remarks, he stated, "The public can be confident that the Federal Reserve will continue to carry out its duties quietly and make decisions based on economic conditions." He also mentioned the previous day that decisions would be made based on data, not political situations, indicating for two consecutive days that he would not be swayed by Trump's pressure.

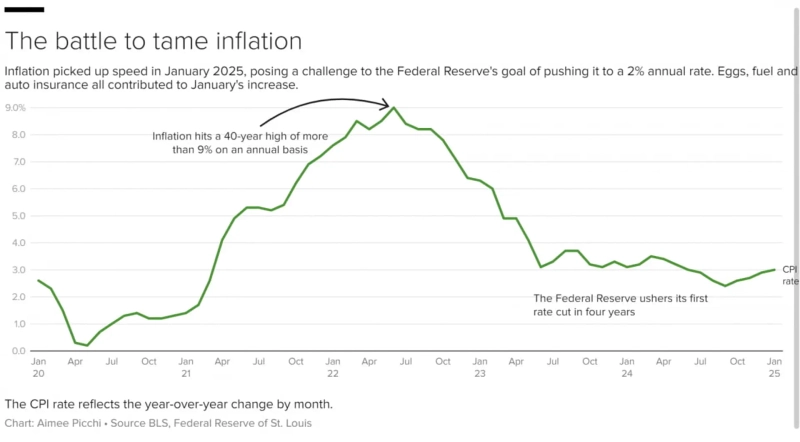

Chairman Powell made it clear that now is not the time to lower rates. Yesterday, he mentioned that the inflation rate still exceeds the target. He noted that "today's announced inflation indicators tell the same story," highlighting that the CPI index rose 3.0% year-over-year, exceeding expectations. The implication is that now is not the time to lower inflation but to prepare for the possibility of inflation rebounding.

In reality, the perceived inflation in the U.S. remains unstable. The significant rise in egg prices is cited as a major reason for the high CPI this time. Egg prices are not only high but also in very short supply. Many large retailers like Costco and Walmart have signs saying 'No Eggs.' The few remaining are expensive organic eggs that sell less.

However, even excluding volatile items like food and energy, the core CPI exceeded market expectations, indicating that overall inflationary pressures are significant. With the tariff policy announced, its impact cannot be ignored. Importers are considering price policy adjustments, and there is a sudden surge in demand to purchase necessary items in advance.

Market predictions about interest rates are also changing accordingly. Until two days ago, the opinion that the Federal Reserve would not lower rates further this year was about 20%. Now, this proportion has increased to about 30%. There is a strong belief that even if rates are lowered, it will only happen once or twice. The risk of inflation rebounding is perceived as more significant than the employment risk due to economic slowdown.

Washington = Lee Sang-eun, Special Correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.