Summary

- Korea's gold market 'Kimchi Premium' is reported to be about 20% higher than international prices.

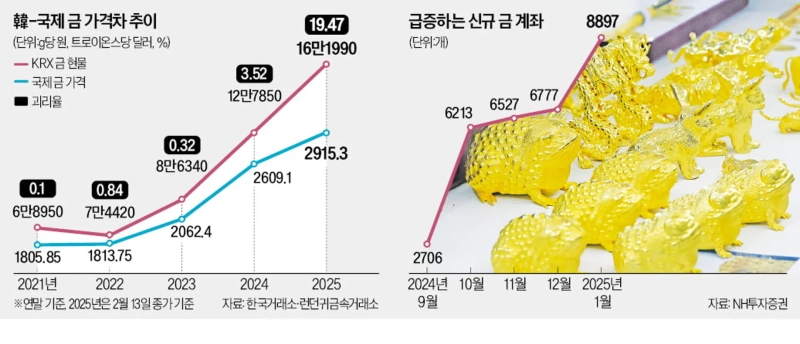

- The price gap, which averaged 0.46% since the KRX Gold Market's launch in 2014, has surged to 19.47%.

- Warned of possible short-term price adjustments due to won weakness and spreading gold investment 'FOMO'.

Record High Premium Amid Gold Shortage

Physical gold in Korea is trading at nearly 20% higher than international prices. This excessive 'Kimchi Premium', similar to the Bitcoin market, is raising concerns.

According to the Korea Exchange and London Bullion Market Association (LBMA) on the 14th, the price gap between the KRX Gold Market and LBMA spot prices reached a record high of 19.47%. While the Korean gold market closed at 161,990 won per gram, the London market price converted to Korean won was only 135,588 won.

The average daily price gap between Korean and international prices had been just 0.46% since the KRX Gold Market's launch in 2014 until last month. This unprecedented divergence is attributed to the recent gold price surge and FOMO (Fear Of Missing Out) spreading among investors, while domestic physical gold remains in short supply. The accelerating Korean won weakness this year is also a significant factor. When the won-dollar exchange rate rises (closing at 1,443.50 won in today's weekly trading), gold prices in won terms are valued higher.

Lee Young-hoon, a Samsung Securities analyst, warned, "Gold is a representative asset that typically follows the law of one price, with universal value worldwide," adding that "short-term price adjustments may occur in the Korean market."

Reporter Lee Si-eun see@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.