Summary

- It was reported that President Donald Trump's policy changes and statements are directly affecting the price volatility of Bitcoin.

- Experts predict that as the Bitcoin market becomes more institutionalized and secure in the medium to long term, volatility will decrease and there is potential for price increases.

- The US government's move to legislate stablecoins could strengthen dollar hegemony and promote growth in the cryptocurrency industry.

Tariff War Fuels US Inflation

Risk Assets Avoided Due to Delayed Rate Cuts

Recovers to 140 Million KRW Range After 20% Crash

Skepticism Remains Due to High Price Volatility

Some Claim "Will Reach $200,000 This Year"

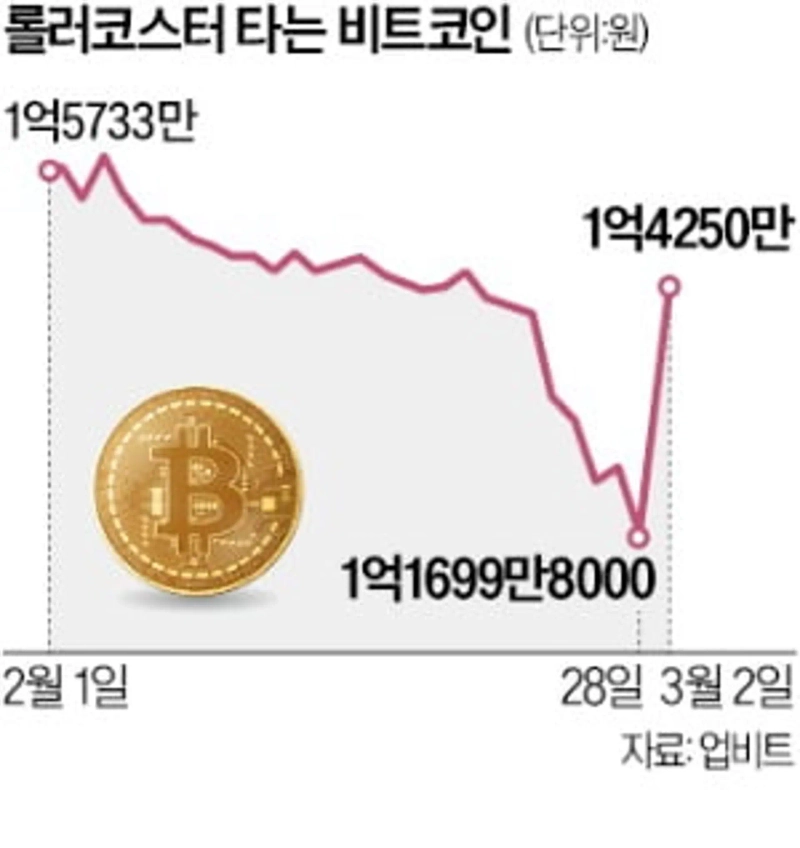

Bitcoin prices have been on a rollercoaster ride over the past month. The price of Bitcoin plummeted due to the tariff war initiated by US President Donald Trump, then surged rapidly after President Trump declared his intention to stockpile Bitcoin. Bitcoin, which had crashed to the 110 million KRW range at one point, recovered to the 140 million KRW range in just two days.

Bitcoin on a Rollercoaster

According to the domestic cryptocurrency exchange Upbit on the 4th, Bitcoin fell by 20.9% last month alone. It soared to 160,304,000 KRW on the 3rd of last month, but expanded its decline to 118,266,000 KRW on the 26th of last month. It has since barely recovered to the 120 million KRW range. In the global market, it was traded at $78,411.03 at one point. This was the first time Bitcoin traded in the $70,000 range since November last year, about three months ago.

Bitcoin rose steadily after the US presidential election last November, as President Trump, who proclaimed himself a pro-cryptocurrency advocate, was elected. However, investor sentiment weakened as President Trump did not introduce any notable cryptocurrency-related policies after his inauguration. Additionally, Bitcoin has been negatively affected as President Trump started tariff wars with not only China but also Canada and Mexico. On the 28th of last month, President Trump announced that he would impose the planned 25% tariff on Canada and Mexico from the 4th of next month if the issue of synthetic drugs such as fentanyl flowing into the US is not resolved. He also announced plans to impose an additional 10% tariff on China, which already faces a 10% tariff. He also expressed his intention to impose a 25% tariff on the European Union (EU).

If the US raises tariffs on trading partners, there are concerns that it could fuel inflation within the US. This gives the Federal Reserve (Fed) an incentive to delay cutting interest rates. When interest rate cuts are delayed, preference for risk assets like Bitcoin decreases, while preference for safe assets such as gold and the dollar increases.

However, in just two days since the beginning of this month, Bitcoin has recovered to the 140 million KRW range. This occurred after President Trump hinted again at his intention to stockpile Bitcoin on the 2nd (local time) on SNS, saying, "The stockpiling of virtual assets by the United States will boost this industry, which has fallen into crisis after years of corrupt attacks by the Biden administration." President Trump also stated, "I make it clear that I will make America the capital of virtual assets worldwide," and added, "We are making America great again."

Upon this news, Bitcoin in South Korea rapidly rose from the 120 million KRW range to the 140 million KRW range. In the global market, Bitcoin also recovered to $90,000. President Trump had previously signed an executive order for the development of the cryptocurrency industry right after his inauguration. The executive order included establishing a presidential working group on digital asset markets and reviewing national-level digital asset stockpiling.

Skepticism vs. Optimism Remains Tight

Skepticism about Bitcoin still persists. Martin Schlegel, Governor of the Swiss National Bank (SNB), stated in an interview with Swiss media that Bitcoin has various problems as an asset and is not suitable as a central bank reserve. First, Bitcoin shows extreme price volatility, making it difficult to maintain long-term investment value. Also, central bank reserves should be quickly utilized for monetary policy purposes when needed, but Bitcoin has limitations in terms of liquidity. He also pointed out that Bitcoin being a software-based asset exposes it to security vulnerabilities.

On the other hand, some are expressing optimism that Bitcoin will rise in the medium to long term. Jeffrey Kendrick, Head of Digital Asset Research at Standard Chartered (SC), predicted, "As the virtual asset industry becomes more institutionalized, the market will become safer, and as the adoption of virtual assets by institutions increases and regulatory clarity in the US combines, volatility will decrease over time." He claimed, "Bitcoin will rise to $200,000 this year and to $500,000 before President Trump leaves office."

Robert Kiyosaki, author of the bestseller 'Rich Dad Poor Dad' and a Bitcoin enthusiast, posted on SNS on the 28th of last month, "Bitcoin's crash means it's on sale," and "When it crashes, I laugh and buy more."

Growing Expectations for Stablecoins

Meanwhile, the US administration is initiating the legislation of stablecoins. David Sacks, Special Advisor on Virtual Assets and Artificial Intelligence (AI), known as the Crypto Czar in the White House, stated on the 13th of last month that "the legislation of stablecoins in the US is one of the top priorities." Stablecoins are cryptocurrencies pegged one-to-one with the dollar value. The market believes that the more stablecoins are activated, the more it helps strengthen dollar hegemony.

Bill Hagerty, a Republican senator from Tennessee, announced on the 4th of last month that bipartisan senators had introduced a bill to establish a regulatory framework for stablecoins. Senator Hagerty emphasized that this bill "will provide a safe and growth-oriented regulatory framework to promote innovation and support President Donald Trump's vision to make the US the world capital of cryptocurrency."

Reporter Jo Mi-hyun mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.