PiCK

"Not just a ghost coin 'fat-finger'"…Lawmakers lash out at Bithumb and regulators alike

Summary

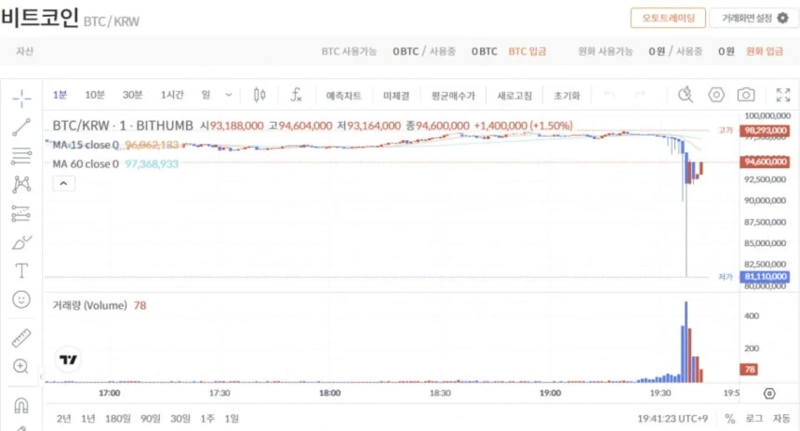

- Bithumb said it mistakenly credited 620,000 bitcoins during an event and has failed to recover part of them.

- The National Assembly said the incident was due to system shortcomings, not a simple fat-finger, criticizing it as a failure of internal controls such as real-time balance-to-ledger reconciliation.

- Lawmakers from both parties said responsibility also lies with financial authorities for oversight of cryptoasset trading systems and a regulatory vacuum, alongside the damage to trust in exchanges.

National Assembly’s Political Affairs Committee diagnoses the ‘Bithumb incident’

Shock from erroneous crediting of 620,000 ‘ghost bitcoins’

“System failures, not a simple fat-finger”

Questions over regulators’ responsibility as well…“a regulatory vacuum”

A wave of strong criticism erupted in the National Assembly over the erroneous Bitcoin (BTC) crediting incident that occurred last week at cryptoasset (cryptocurrency) exchange Bithumb. Still, lawmakers also raised questions of “responsibility” for financial authorities that failed to speed up institutional reforms and follow-up legislation.

On the 11th, the National Assembly’s Political Affairs Committee held a plenary meeting at the National Assembly building in Yeouido, Seoul, and received a work report from financial authorities regarding the “Bithumb incident.” Attendees included committee members as well as Bithumb CEO Lee Jae-won, Financial Supervisory Service Governor Lee Chan-jin, and Financial Services Commission Vice Chairman Kwon Dae-young.

The Bithumb incident refers to a case in which Bithumb mistakenly credited users with 620,000 bitcoins while distributing rewards for an in-house promotional event. According to authorities, 618,000 of the 620,000 credited have been recovered, but 1,788 bitcoins that were already sold have reportedly not yet been recovered.

Appearing at the meeting, CEO Lee said, “I sincerely apologize to the public for the concern caused by our erroneous event payout,” adding, “I apologize for causing great concern to customers who trusted Korea’s cryptoasset market and to those who have worked for the sound development of the industry.” He continued, “As the ultimate person responsible for this incident, I deeply acknowledge my responsibility,” and said, “We will comprehensively re-examine internal controls and systems and prepare measures to prevent a recurrence.”

System shortcomings under the spotlight

Committee members agreed that the incident was not a simple “fat finger” (Fat Finger—an order input error), but an accident stemming from vulnerabilities in Bithumb’s internal systems.

Rep. Kim Nam-geun of the Democratic Party of Korea said, “I understand Bithumb actually holds 42,000 bitcoins, yet 620,000 were issued on the books—this is tantamount to creating ghost coins,” adding, “It means Bithumb’s real-time balance-to-ledger reconciliation system, segregation of event accounts, and verification procedures for large-scale payouts also failed to function properly.”

In particular, lawmakers pointed out that Bithumb’s real-time balance-to-ledger reconciliation system is weaker than those of other exchanges. Kim said, “In Upbit’s case, I understand it operates a system that automatically matches the actual wallet holdings and the ledger amount every five minutes,” and asked, “By contrast, doesn’t Bithumb lack a properly established real-time reconciliation system, which led to bitcoins being paid out beyond actual holdings?”

CEO Lee responded, “We check information on the digital assets we hold in real time,” but acknowledged that “for this event payout, the real-time reconciliation system did not function properly.”

Vice Chairman Kwon said, “I agree there must be an integrated system in which actual holdings and ledger quantities match in real time,” adding, “We will reflect this in the second phase of legislation.”

Rep. Kim Sang-hoon of the People Power Party, who chairs the party’s special committee on stock and digital-asset value-up, also expressed disappointment. He said the incident could undermine trust in crypto exchanges, which have recently been mentioned as one of the potential issuers of stablecoins (cryptoassets whose value is pegged to fiat currency).

Kim said, “Do you know what stance the Bank of Korea has been taking on crypto exchanges lately?” and added, “If incidents like this occur amid concerns that crypto exchanges themselves are not being operated stably, market trust is bound to be shaken significantly.” He continued, “It made me think it is premature to expand stablecoin issuers to crypto exchanges.”

“The Bithumb incident—financial authorities also bear responsibility”

Some also argued that the incident could have been prevented at the level of financial authorities.

Rep. Min Byung-deok of the Democratic Party of Korea said during questions on pending issues, “The primary responsibility for this incident clearly lies with Bithumb,” but added, “At the same time, the authorities also made mistakes.”

The argument is that even though internal-control and payout-management standards related to the Bithumb incident could have been codified in advance, a regulatory vacuum emerged due to contentious issues such as limits on major shareholders’ ownership stakes in exchanges and the question of who can issue stablecoins.

Specifically, Min said, “When the National Assembly enacted the User Protection Act in July 2023, it requested as an accompanying opinion that follow-up legislation be prepared within one year, but it still has not been implemented,” adding, “Even though bills containing recurrence-prevention measures such as strengthened internal controls had already been submitted in the National Assembly, the authorities failed to move at an adequate pace, and as a result this incident could not be prevented,” he said.

Lawmakers from the People Power Party also pressed the financial authorities on responsibility. Rep. Kang Myung-gu said, “The Bithumb erroneous-crediting incident should not be linked to limits on major shareholders’ stakes,” adding, “Did anyone talk about ownership-stake regulation in the 2018 Samsung Securities ‘ghost shares’ incident?”

Kang continued, “Cryptoasset trading systems are not fundamentally different from stock trading systems; if inspections had been carried out thoroughly after the Samsung Securities incident, this could have been prevented in advance,” adding, “The financial authorities must fully assume responsibility for the parts where they were negligent in management and supervision.”

FSS Governor Lee responded, “We will properly examine the operational status.”

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.