PiCK

China 'Staggering' Under US Tariff Bombardment... Export Growth Rate Lowest in 10 Months

Summary

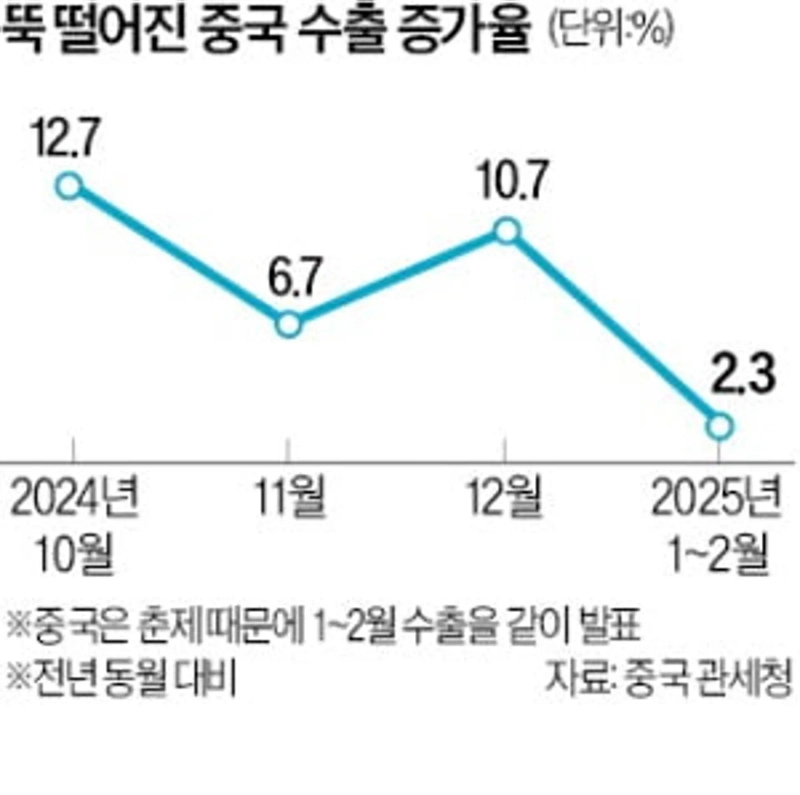

- China's export growth rate for January-February was 2.3%, falling far short of expectations and recording the lowest in 10 months.

- Chinese export companies are expected to struggle with performance improvement due to additional US tariffs.

- China plans to establish a fund worth 200 trillion won to strengthen its leadership in advanced technology fields such as AI.

January-February 2.3% increase... Half of expected forecast

"Chinese companies likely to struggle with performance improvement"

Accelerating 'AI rise' to counter US offensive

Wang Yi: "Establishing investment fund worth 200 trillion won"

Chinese exports are taking a direct hit from the US tariff bombardment. China's export growth rate for January-February this year was only 2.3% year-on-year, recording the lowest in 10 months. Many Chinese export companies are struggling in the US market, and their export performance is not expected to improve easily in the future. The Chinese government has decided to create a fund worth 200 trillion won to foster industries while strongly countering the US offensive and seeking to take the lead in advanced technology fields such as artificial intelligence (AI).

According to China's Customs Office on the 7th, China's export value in January-February increased by 2.3% compared to the same period last year, falling far short of market expectations (5%). This is the lowest growth rate since April last year (1.5%). China's import value for January-February also decreased by 8.4% year-on-year, showing the largest drop since July 2023. It showed a significant difference from market expectations (1% increase).

Analysts say that China's export performance is deteriorating due to additional tariffs imposed by President Trump. The United States applied a 10% additional tariff to China from the 4th of last month, followed by another 10% increase a month later, bringing the cumulative tariff rate to 20%. Chinese export companies proactively expanded their export volume from the end of last year in anticipation of Trump's possible re-election, but it was insufficient to prevent the shock of tariff increases.

Chinese export companies are also facing direct pressure from additional tariffs. According to Bloomberg, Walmart, the largest US retailer, recently demanded that Chinese export companies reduce their supply prices by up to 10%. This is seen as an attempt to transfer the burden of President Trump's additional tariffs. Chinese companies are resisting, citing insufficient margins. Some companies are reportedly considering sourcing parts from Vietnam as it becomes difficult to lower raw material procurement prices.

Meanwhile, China's strategy against the US offensive is to secure a definite advantage in the advanced technology industry competition. Wang Yi, China's diplomatic commander (concurrently serving as Foreign Minister) and director of the Central Foreign Affairs Office of the Chinese Communist Party, said at a press conference held at the Beijing Media Center on the occasion of the annual largest political event, the Two Sessions (National People's Congress and Chinese People's Political Consultative Conference), "The Chinese government plans to establish and operate a fund worth 200 trillion won." The intention is to create a government-led long-term fund with a long investment period to help startups overcome initial funding difficulties and grow into national-level AI companies like DeepSeek.

China Central Television (CCTV) referred to this new fund as an 'aircraft carrier-class fund in the startup field' and explained, "It is mainly for financial capital's early investment, small business investment, long-term investment, and hardcore technology (high-barrier advanced technology) investment," adding that "local and social capital of 1 trillion yuan (about 200 trillion won) will be required." The fund's duration is 20 years. The central bank, the People's Bank of China, is also participating. The People's Bank plans to soon launch the so-called 'Science and Technology Board (科技板),' a dedicated market for science and technology innovation bonds within the bond market, to strengthen financial support in the fields of science, technology, and innovation.

Beijing=Kim Eun-jung Special Correspondent/Lee Hye-in Reporter kej@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.