PiCK

Trump Signs 'Bitcoin Strategic Reserve' But... "No Additional Purchases"

Summary

- President Trump announced that he would stockpile Bitcoin as a strategic asset, but stated there would be no new purchases.

- This measure caused Bitcoin prices to drop by 5.7% at one point, failing to meet market expectations.

- The U.S. government's Bitcoin stockpiling is analyzed as a strategy to counter the digital yuan.

Ban on Selling 200,000+ Confiscated Coins

Market Disappointed, Price Drops 5% at One Point

U.S. President Donald Trump signed an executive order on the 6th (local time) to stockpile Bitcoin as a strategic asset. This comes just 4 days after he announced his intention to establish a strategic asset reserve. However, Bitcoin prices actually fell after he ruled out the possibility of additional purchases.

The President announced an executive order directing the Treasury Department to establish an office to manage the 'Bitcoin Strategic Asset Reserve.' The Treasury will manage all Bitcoin acquired through civil and criminal asset forfeitures as strategic asset reserves. Once added to the reserve, these Bitcoin cannot be sold. The U.S. government is known to currently hold approximately 200,000 Bitcoin.

President Trump emphasized, "Bitcoin is called 'digital gold' because of its scarcity and security," adding that "being the first country to create a strategic Bitcoin reserve offers strategic advantages since the supply is fixed." He further pointed out that "while the U.S. government holds a significant amount of Bitcoin, it has not implemented policies that maximize Bitcoin's strategic position as a unique store of value in the global financial system."

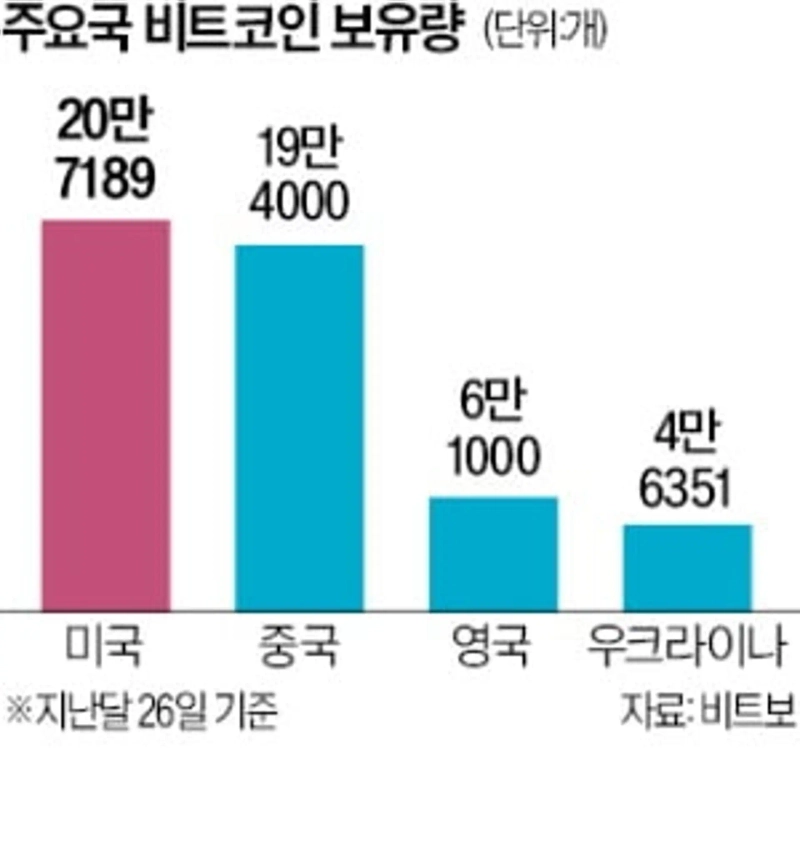

Analysts suggest that the U.S. is stockpiling Bitcoin as a strategic asset to counter China's central bank digital currency (CDBC), the 'digital yuan.' China is encouraging the use of the digital yuan, issued by the People's Bank of China, for payments in 26 cities. Unlike CBDCs issued by central banks, cryptocurrencies are valued as decentralized payment methods.

However, contrary to market expectations, the Trump administration made it clear there would be 'no new Bitcoin purchases.' The executive order stated that "the U.S. government shall not acquire additional reserve assets except through civil or criminal asset forfeitures or fines." The Secretaries of Treasury and Commerce must develop strategies for acquiring Bitcoin without imposing additional costs on taxpayers. Earlier reports suggesting that the Trump administration would purchase new Bitcoin proved incorrect.

Steven Lubka, head of Swan Bitcoin Family Office, assessed that "it's good news, but not what the market wanted, which was expecting short-term buying pressure." Ripple, Ethereum, Solana, and Cardano, which President Trump had previously mentioned would be stockpiled as strategic assets, were also omitted from this executive order.

After the announcement, Bitcoin prices fell by as much as 5.7% during trading. Ethereum (-3.8%), Ripple (-7.4%), Solana (-4.9%), and Cardano (-9.2%) also plunged before recovering some losses.

President Trump is expected to announce additional plans regarding the strategic asset reserve at the first-ever cryptocurrency summit at the White House on the 7th. The summit will reportedly be attended by officials including David Sacks, the Trump administration's Bitcoin czar, and Mark Uyeda, Acting Chairman of the Securities and Exchange Commission (SEC), as well as CEOs from Bitcoin-related companies such as Coinbase, Robinhood, and MicroStrategy.

Reporter Kim In-yeop inside@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.