Korbit: "Virtual Asset Accounting Standard 'ASC 350-60' Still Has Limitations"

Summary

- Korbit Research Center announced that with the introduction of ASC 350-60, virtual assets are measured at fair value, allowing investors to evaluate company value more clearly.

- ASC 350-60 has enabled financial statements of companies holding large amounts of Bitcoin to reflect more accurate asset values.

- However, they emphasized that several limitations remain, such as the subjectivity and volatility of fair value assessment, requiring clearer guidance in the future.

Korbit Research Center, under the domestic virtual asset (cryptocurrency) exchange Korbit, announced on the 10th that it has published a report titled 'Introduction of ASC 350-60 and Virtual Asset Accounting Standards' covering virtual asset accounting standards.

According to Korbit Research Center, the existing virtual asset accounting method ASC 350-30 under US GAAP (United States Generally Accepted Accounting Principles) had an asymmetrical structure that evaluated virtual assets based on cost and only reflected impairment losses, which limited companies' financial statements from properly reflecting the actual value of their held assets.

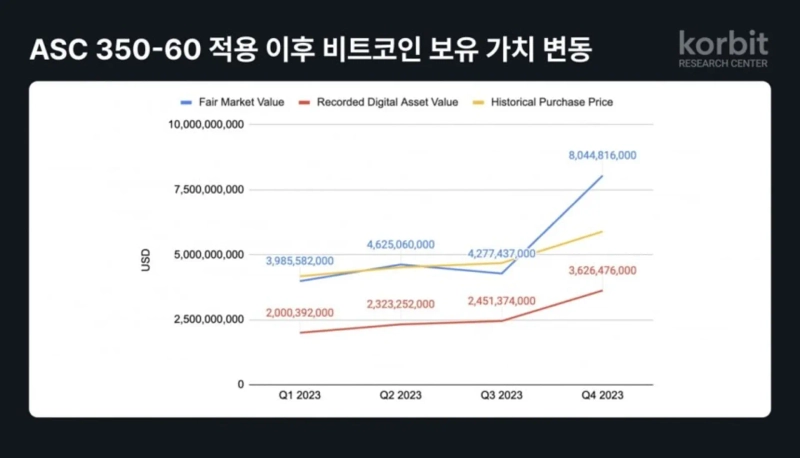

To address this issue, FASB (Financial Accounting Standards Board) introduced ASC 350-60 in 2023. ASC 350-60 measures virtual assets that meet certain requirements at fair value, distinguishes between virtual assets and other intangible assets in reporting, and clarifies cash flow and disclosure requirements. This allows investors to more clearly evaluate company value, and particularly enables financial statements of companies holding large amounts of Bitcoin to reflect the actual value of their held assets.

However, Korbit Research Center explained that limitations still exist even after the introduction of ASC 350-60. These include the subjectivity and volatility of fair value assessment, ambiguity in accounting classification by virtual asset type, issues with non-cash compensation evaluation standards, and the absence of criteria for initial recognition and derecognition.

The head of Korbit Research Center said, "Accounting standard-setting bodies and regulatory authorities need to provide clearer guidance in the future," adding, "Companies also need to actively respond by organizing internal accounting systems and establishing fair value assessment policies."

Hankyung.com Newsroom open@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.