"Tariff fears may peak next month... Increase US stock allocation if further decline occurs"

Summary

- NH Investment & Securities advised using additional declines in the US stock market as an opportunity to increase allocation.

- Analysis suggests that tariff uncertainties under the Trump administration may be resolved after April.

- They reported that short-term tariff uncertainties are expected to continue due to retaliatory tariff policies from major countries.

NH Investment & Securities Analysis

Overnight, all three major New York stock indices plunged as economic pessimism expanded due to uncertainty in Trump's tariff policies. Meanwhile, securities firms advised that as US companies' earnings remain solid, investors should use any additional market decline as an opportunity to increase their allocation to US stocks.

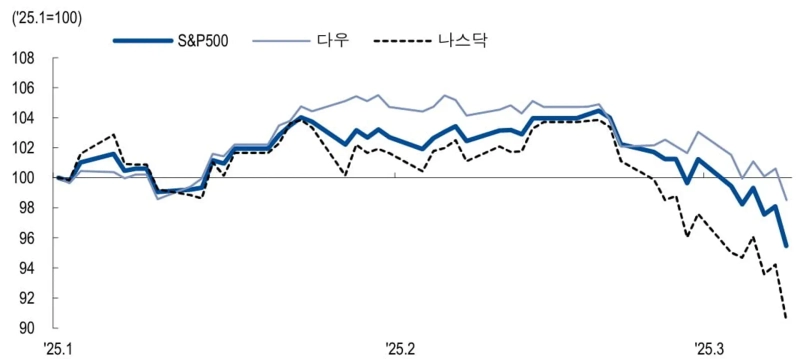

Kim Hwan, an analyst at NH Investment & Securities, explained, "The tech-heavy Nasdaq index plunged 4%, while the Dow Jones and S&P 500 indices fell by over 2%," adding that this was "due to concerns about economic slowdown from tariff fears, weak economic indicators, and weakened expectations for fiscal expansion in Germany."

Over the weekend, US President Donald Trump stated that it would take time to bring wealth back to the United States and did not rule out the possibility of a short-term economic recession. Despite Kevin Hassett, chairman of the White House National Economic Council (NEC), mentioning that tariff uncertainties would be resolved after April, recession fears have not subsided.

Kim noted, "Additionally, Mark Carney, the newly elected Liberal Party leader who will become Canada's next prime minister, strongly suggested retaliatory tariffs against the US, and China's Two Sessions, which is nearing its close, is also expected to implement retaliatory tariffs against the US as before, further fueling fears of economic recession."

He predicted, "Short-term tariff uncertainty will continue as major countries' implementation of retaliatory tariff policies increases the likelihood of Trump enacting mutual tariffs and similar policies."

However, analysis suggests that tariff fears are likely to peak in April, as mentioned by NEC Chairman Hassett. Since tariff increases during Trump's first term reduced global trade volume, there is a high possibility of continued negotiations between countries.

Kim stated, "The current phase is a policy vacuum period for Trump, and we are waiting for favorable policies to materialize," adding, "As quarterly earnings forecasts are still expected to rise step by step, the possibility of a sustained downward trend in stock prices is low."

He continued, "If we apply the valuation decline seen during the peak of tariff fears in 2018 during Trump's first administration to the current situation, the S&P 500 index could fall further to the 5500 level," suggesting that "when valuation concerns ease, investors should use this as an opportunity to increase their allocation to the US stock market."

Shin Min-kyung, Hankyung.com reporter radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Tethered by consumer-slowdown fears… Financials slide in tandem on ‘AI onslaught’ [New York market briefing]](https://media.bloomingbit.io/PROD/news/b203e033-1844-4138-83af-b5b084dd9a6d.webp?w=250)

![Dollar weakens even with U.S. Treasury yields in the 4% range… the real risk markets fear [Global Money X-File]](https://media.bloomingbit.io/PROD/news/7359c31a-2f59-4bd3-81b0-542f21060875.webp?w=250)