PiCK

Dollar weakens even with U.S. Treasury yields in the 4% range… the real risk markets fear [Global Money X-File]

Summary

- It argued that a “Sell America” dynamic is spreading across dollar assets, driven by a weaker U.S. dollar index and an expanding “political risk premium.”

- It noted that a combination of rising dollar volatility, surging hedging costs, and an overstretched gold price environment is driving foreign outflows from U.S. assets and tightening in funding markets.

- It warned that if the dollar plunges, it could trigger dumping of U.S. Treasuries, a sharp tightening of U.S. financial conditions, and the won–dollar exchange rate’s entry into a “new normal,” posing structural risks to small open economies such as South Korea.

In recent global financial markets, the dollar’s value has been holding at an unusually low level. Normally, when U.S. Treasury yields stay higher than those of other advanced economies, demand for dollars increases and the U.S. dollar strengthens. Recently, however, the move has been in the opposite direction. Analysts say geopolitical risks are at work.

An unusual “Sell America”?

According to Investing.com on the 11th, the yield on the U.S. 10-year Treasury hit the 4.18% range the previous day—higher than in some other advanced economies. Germany’s 10-year yield (in the 2.8% range) and Japan’s 10-year yield (in the 2.2% range) are holding in the 2% range. In such circumstances, demand typically rises for U.S. bonds, viewed as safe-haven assets and offering higher yields, pushing the dollar higher. Capital generally flows from lower-yielding markets to higher-yielding ones.

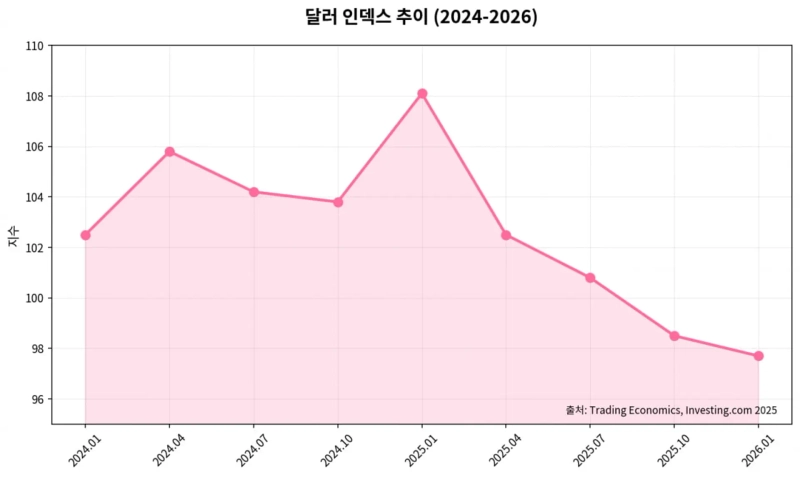

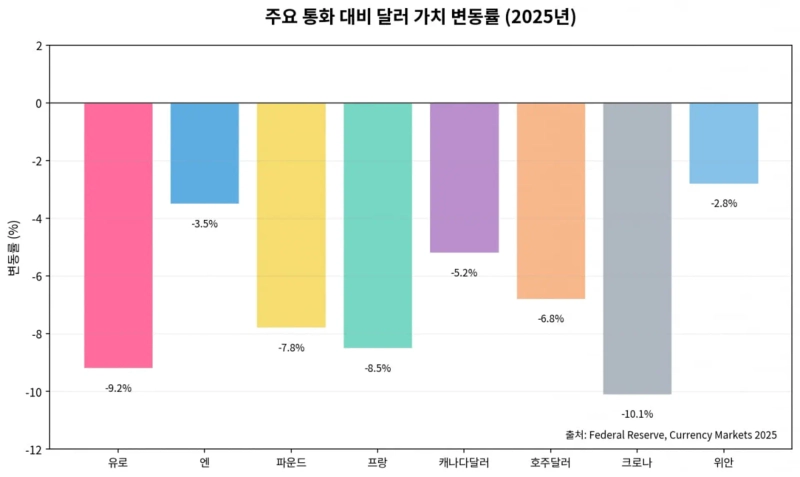

In cases like this, the dollar tends to strengthen. But it was the exact opposite. The dollar index, which tracks the dollar’s value against the currencies of six major economies including the European Union (EU), stood in the 96 range that day, hovering near its lowest level in the past four years. This is why some have argued that the long-dominant global market rule of “interest-rate differentials” has broken down.

According to recent reports from Morgan Stanley and Barclays, the dollar is currently about 4–5% undervalued versus its theoretical fair value implied by the U.S.–Germany rate gap and growth differential. In academia, one interpretation is that the dollar is undervalued due to a so-called “political risk premium” being priced into the U.S. national system. Some also note that investors are reacting more sensitively to fears that they “could lose principal” than to higher yields.

Analysts say the reasons the dollar has shifted from a “risk-free asset” to a “politically risky asset” are multifaceted. They also point to the incident on the 20th of last month, when President Donald Trump threatened European allies with tariffs in connection with the issue of purchasing Greenland, an autonomous territory of Denmark.

In a typical financial crisis, falling stock prices lead safe-haven Treasuries and the dollar to rise. But that day was different. The S&P 500 fell 2.06%, and prices of U.S. 10-year Treasuries also declined. The dollar index fell 0.5% that day. A “Sell America” dynamic appeared across stocks, bonds, and the dollar.

Tony Sycamore, chief market analyst at IG, said, “Investors dumped U.S. assets across the board due to worries over prolonged uncertainty, tensions in alliances, and accelerating de-dollarization.”

Another factor cited is controversy over interference with the independence of the U.S. central bank (Fed), which has weighed on the dollar. The U.S. Department of Justice (DOJ) has been speeding up an investigation, since the second half of last year, related to renovation costs tied to Fed Chair Jerome Powell. On the 30th of last month, Kevin Warsh, a former Fed governor known for a hawkish stance, was named as the next chair.

Recently, Treasury Secretary Scott Bessent, asked by Senator Elizabeth Warren whether “the Warsh nominee could be prosecuted if he doesn’t cut rates as the president wants,” replied, “That depends on the president,” further fueling debate over the Fed’s independence. Critics said the remark underscored uncertainty that central bank independence may not be legally protected.

Spillover to the real economy

As the dollar wobbled, the impact began to spread across the real economy and industry. According to Reuters, one-month implied volatility in EUR/USD surged to 10% in late January—about double the usual level. That means options-market participants see the exchange rate potentially swinging by more than 10% over the next month.

Ben Pearson, a senior trader at UBS, noted, “Clients’ demand for dollar hedges is flooding in to the point of testing banks’ processing capacity,” adding that “surging hedging costs are ultimately eating into returns for foreign investors in U.S. assets, creating a vicious cycle that accelerates outflows.”

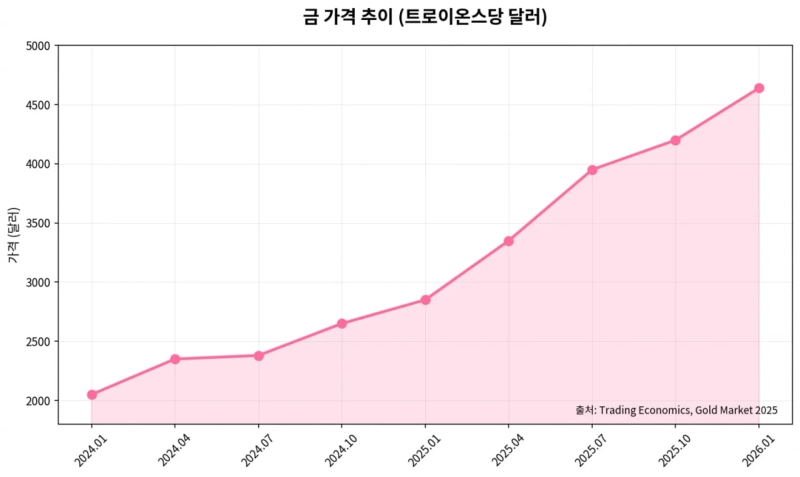

Gold, an alternative to the dollar, has seen heightened volatility recently. In early February, right after Warsh’s nomination, gold prices plunged more than 5% in a single day, threatening the $5,000-per-ounce level. That reflected fears the nominee would favor tighter policy, combined with margin calls driven by market panic.

However, as dollar unease persisted, gold rebounded. As of the 10th, spot gold traded around $5,029 per troy ounce. It remains below the all-time high set two weeks earlier on Jan. 29. Still, it is historically elevated. Société Générale said “money betting on currency depreciation is flowing into the metals market at the ‘speed of light.’”

The “still only the U.S.” view

A strong counterargument is that the dollar’s status cannot collapse overnight—often framed as the “no alternative” thesis. Chris Hyzy, Chief Investment Officer (CIO) at Bank of America (BofA), said, “Some worry about ‘Sell America,’ but global capital still has nowhere else to go but the United States,” adding that “the current dollar weakness may be a temporary correction reflecting excessive political concerns.”

In fact, the eurozone faces pressure to cut rates amid recession fears. Japan also has little room to raise rates due to its massive debt burden. According to Goldman Sachs, Japanese investors hold about $1 trillion in U.S. equities and $1.5 trillion in U.S. bonds. A rapid selloff could also backfire on Japan’s financial institutions, analysts say.

But some dollar bears argue this time is different. Kenneth Rogoff, a professor at Harvard University, warned, “What truly threatens the dollar is not tariffs, but erosion of the rule of law and loss of institutional credibility,” adding that “the Trump administration’s attempt to neutralize the Fed’s independence is like imposing a permanent ‘uncertainty tax’ on dollar assets.”

Analysts say the worst-case scenario for how a dollar risk premium could hit the macroeconomy is “disorderly depreciation” and “forced tightening.” Typically, a weaker dollar loosens global liquidity. But now, even as the dollar weakens, funding markets are instead showing signs of strain. Analysts point to the widening negative “cross-currency basis” as evidence.

It is a situation where the spot dollar falls, yet the cost (premium) of borrowing dollars rises. While markets fear dollar depreciation, they still have to obtain dollars for settlement, creating a “bottleneck.”

If the dollar’s value plunges, foreign investors may be prone to dumping U.S. Treasuries to avoid FX losses. BofA warned that “a monthly dollar drop of more than 5% is considered a disorderly decline, which could trigger a U.S. Treasury selloff and sharply tighten U.S. financial conditions.” This is also why France’s Finance Minister Roland Lescure voiced concern that “if exchange-rate volatility is not put on the G7 agenda, it could spread into an economic crisis.”

Moves in the U.S. dollar have a major impact on South Korea, a small open economy. The won–dollar exchange rate, analysts say, has now entered a “new normal,” where the old formula (1,100–1,200 won) no longer applies. Many experts argue the 1,400-won range should be accepted as a constant rather than a crisis.

Reporter Juwan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Tethered by consumer-slowdown fears… Financials slide in tandem on ‘AI onslaught’ [New York market briefing]](https://media.bloomingbit.io/PROD/news/b203e033-1844-4138-83af-b5b084dd9a6d.webp?w=250)

![Dollar weakens even with U.S. Treasury yields in the 4% range… the real risk markets fear [Global Money X-File]](https://media.bloomingbit.io/PROD/news/7359c31a-2f59-4bd3-81b0-542f21060875.webp?w=250)