Summary

- Solana's weekly fees revenue has hit its lowest since last September.

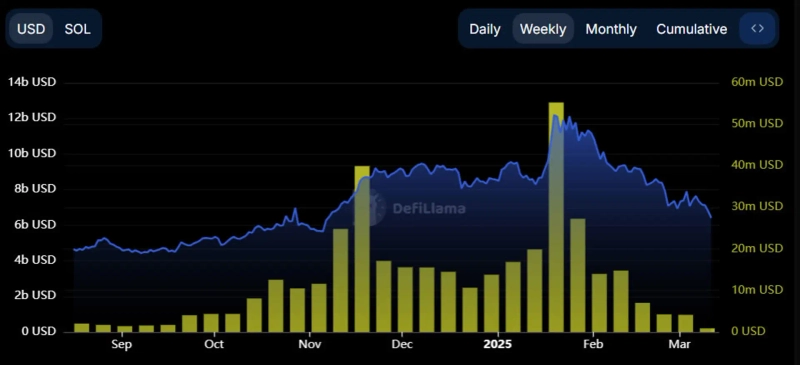

- Solana's on-chain metrics have declined, with DeFi Total Value Locked decreasing by about 50% compared to mid-January.

- The media reported that the collapse of meme coin trading is the main cause of Solana's revenue decline.

Solana (SOL)'s weekly fee revenue has reached its lowest level since September last year.

According to CoinTelegraph on the 10th (local time), Solana's weekly fees recorded $4 million, marking the lowest since September last year. This represents a 93% decrease compared to the all-time high ($55.3 million) recorded in mid-January.

Other on-chain metrics have also significantly decreased. According to DeFiLlama data, Solana DApp revenue last week was $32 million, down about 86% compared to mid-January ($238 million). Additionally, the DeFi Total Value Locked (TVL) recorded $6.4 billion, down about 50% compared to mid-January.

The media stated, "The decline in Solana's on-chain metrics is due to the collapse of the meme coin bubble," adding that "meme coin trading accounts for about 80% of Solana blockchain revenue."

Meanwhile, according to CoinMarketCap data, the market capitalization of meme coins is approximately $44 billion. This is about a 68% decrease compared to December's peak ($137 billion).

As of 3:48 PM, Solana is trading at $123.14 on Binance's USDT market, down 3.16% compared to 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit