Editor's PiCK

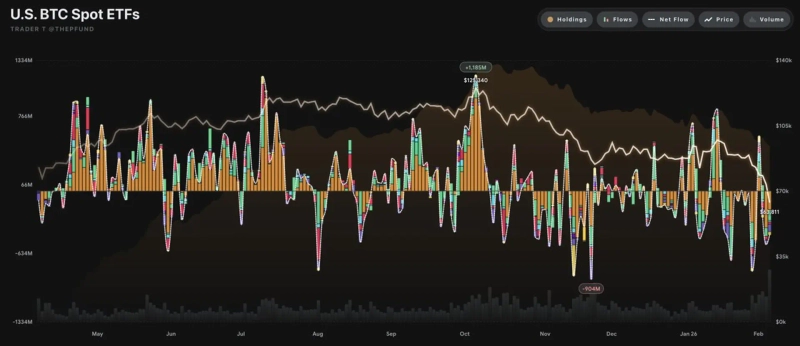

US Bitcoin ETFs See $400 Million ‘Ebb’ in a Day...No Products Posted Net Inflows

Summary

- A total of $434.29 million in net outflows was reported across 11 US spot Bitcoin ETFs.

- Heavy outflows continued from major products including BlackRock’s IBIT, Fidelity’s FBTC and Grayscale’s GBTC.

- Mid- and small-sized ETFs such as Invesco’s BTCO were reported to be flat with no inflows or outflows.

More than $400 million flowed out of the spot Bitcoin ETF market.

According to data from Trader T on the 5th, the combined net outflows across 11 US spot Bitcoin ETFs totaled $434.29 million. As Bitcoin prices plunged, what appears to have been a wave of panic selling by investors seems to have spilled over into the ETF market.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded outflows of $175.48 million. Fidelity’s Wise Origin Bitcoin Fund (FBTC) also saw $110.48 million leave, while Grayscale’s GBTC (-$75.42 million) and its mini ETF BTC (-$35.17 million) likewise joined the outflow trend. ARK Invest (ARKB) and Bitwise (BITB) posted net outflows of $23.12 million and $15.62 million, respectively.

By contrast, mid- and small-sized ETFs such as Invesco (BTCO), Franklin (EZBC), Valkyrie (BRRR), VanEck (HODL) and WisdomTree (BTCW) were flat, with no inflows or outflows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)