Editor's PiCK

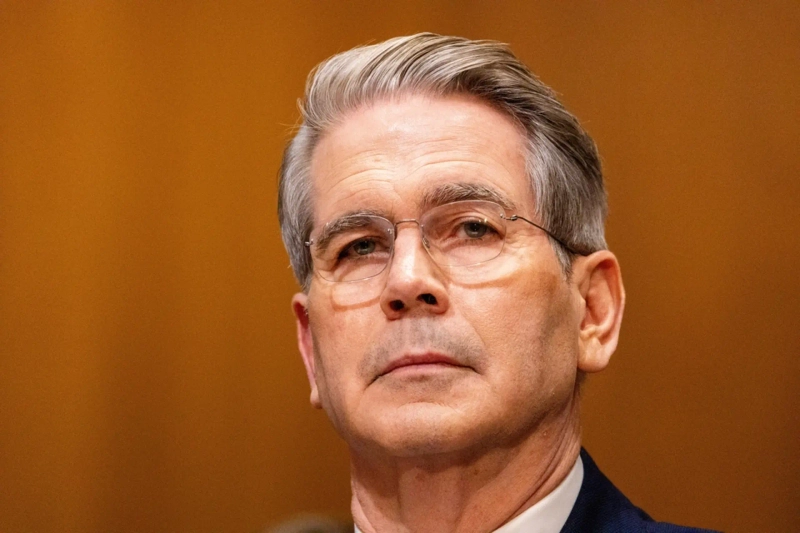

"If you don't like regulation, leave"…U.S. Treasury Secretary aims pointed remarks at the crypto industry

Summary

- Secretary Bessent urged strict regulatory compliance from the virtual asset industry, saying that if they dislike regulation they should go to El Salvador.

- He said the convergence of traditional banks and virtual-asset services will accelerate and stressed that the Clarity Act must be passed.

- He reaffirmed the view that stablecoins should not lure bank deposits with high yields and cause instability in the financial system.

U.S. Treasury Secretary Scott Bessent urged the virtual asset (cryptocurrency) industry to comply strictly with regulations, delivering pointed remarks that "if you don't like regulation, go to El Salvador." He also said the convergence of traditional banks and virtual-asset services will accelerate, and called for swift passage of the pending virtual-asset market structure bill in Congress (the Clarity Act).

On the 5th (local time), appearing at a hearing of the U.S. Senate Banking Committee, Secretary Bessent made the comments in response to questions from Republican Sen. Cynthia Lummis. When Lummis asked whether a time would come when traditional banks and virtual-asset firms offer the same products, he replied affirmatively, saying, "Over time, that will happen naturally."

"We are already discussing how small community banks can participate in the digital asset revolution," Bessent said, suggesting that the integration of finance and virtual assets is an inevitable trend.

However, he made clear that the industry cannot develop without clear rules. Citing the Clarity Act currently under discussion in Congress, he stressed that "this bill must be passed."

He added that "if there are market participants who don't want this bill, they should leave for El Salvador"—which has adopted bitcoin as legal tender—and emphasized that "we need to strike a balance between government oversight and the freedom of virtual assets." The message was that establishing safe and sound practices under U.S. government oversight should take priority.

The Clarity Act, currently pending before the Senate Banking Committee, is deadlocked due to disagreements between the parties and within the industry over whether to allow interest on stablecoins. On this issue, Bessent sided with the banking sector.

"If banks are to supply loans to local communities, deposit stability is essential," he said, adding that "actions that cause deposit volatility are highly undesirable." It was effectively a reaffirmation of the view that stablecoins should not lure bank deposits with high yields and destabilize the financial system.

Meanwhile, there are signs the industry may be stepping back to help get the bill passed. Some virtual-asset firms have recently been reported to have offered concessions that would expand the role of community banks within the stablecoin system to facilitate passage of the legislation.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)