Editor's PiCK

Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]

Summary

- Experts said Bitcoin is in a precarious phase in which additional downside pressure could grow if it fails to hold key support and resistance levels such as $60,000 and $70,000–$74,000.

- According to on-chain analysis, about 44% of Bitcoin supply is in unrealized loss territory, and under a scenario similar to the 2022 bear market, it could fall an additional roughly 20% to $60,000.

- Multiple analysts were cited as saying Bitcoin may have entered a structural bear-market cycle, citing the break of $70,000, a drop below the long-term support line at $89,000, and the possibility of a pullback to $60,000–$65,000.

As investor sentiment has sharply deteriorated amid AI skepticism and signs of cooling in the labor market—extending the correction in tech stocks—Bitcoin (BTC) has also moved in lockstep with the risk-off mood, continuing to trade weakly around the $64,000 level.

In the market, as losses among institutional investors deepen and large-scale leveraged liquidations in the futures market unfold simultaneously, analysis is emerging that this decline has moved beyond a simple pullback and entered a phase of “structural reset.” Attention is shifting to whether the $60,000 level can hold. Experts warn that unless the key near-term threshold at $74,000 is reclaimed quickly, additional downside pressure could persist.

As of 13:28 on the 6th, Bitcoin is trading at $64,855 on Binance’s USDT market, down 8.85% from the previous day. On Upbit’s KRW market, it is priced at 96.20 million won. Bitcoin has fallen more than 20% so far this year and is down about 48% from its all-time high recorded in October last year. At the same time, the “kimchi premium” (the price gap between overseas and domestic exchanges) stands at 0.96%.

Tech stocks swept by an AI headwind and a “Bessent shock”…Plus Japan’s fiscal risks, a ‘triple whammy’

Global equities and cryptoasset (cryptocurrency) markets are sliding in tandem as moves to reassess the profit model of the AI industry intersect with uncertainty over the direction of U.S. policy. As the recent decline in crypto prices intensifies, remarks by U.S. Treasury Secretary Scott Bessent have also weighed on market sentiment.

At a Senate hearing on the 5th (local time), Secretary Bessent said, “The U.S. government has neither the authority nor the will to prop up Bitcoin with a bailout,” dismissing the possibility of government intervention. He went on to stress that the Bitcoin held by the U.S. government is limited to assets seized through legal procedures, making clear there are no plans for additional purchases. The market assessed the remarks as a signal that dampens expectations for a policy backstop during a downturn. Bitcoin subsequently gave up the $68,000 level, extending its losses.

With the “Lummis bill,” aimed at building up Bitcoin as a strategic asset of the U.S. federal government, still pending in Congress for 11 months, and now compounded by the Treasury’s negative stance on new purchases, policy-driven optimism appears to be fading. Investor Michael Burry, who predicted the 2008 global financial crisis, warned that further declines in Bitcoin could trigger a “death spiral” of cascading sell-offs across broader financial markets.

In particular, on Wall Street, following the unveiling of Anthropic’s new enterprise AI tool “Claude Cowork,” a reassessment of profit structures has spread across the software sector, bringing the tech-stock correction into full swing. The market capitalization of related companies fell by about 440 trillion won ($300 billion) in just one day, while risk-off sentiment is also spreading across risk assets.

In addition, ahead of Japan’s general election scheduled for the 8th, concerns are growing that Japanese Prime Minister Sanae Takaichi’s fiscal expansion policies could translate into a medium- to long-term fiscal burden. With Japanese government bond yields under upward pressure, the potential unwinding of yen carry trades is also emerging as a market risk. Some also expect that if yen funding raised at low interest rates is pulled back, outflow pressure could intensify in crypto markets as well.

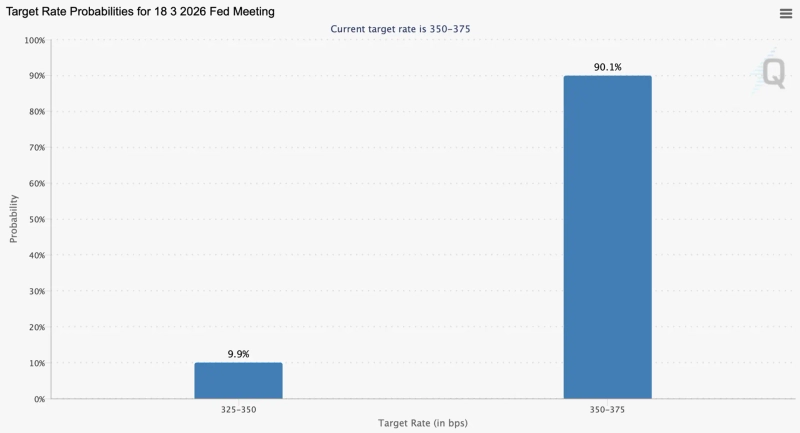

As of 13:00 that day, CME FedWatch showed that the interest-rate futures market is pricing a 90.1% probability that the Federal Reserve (Fed) will keep the policy rate unchanged in March, and a 9.9% probability of a cut. Fed Chair Jerome Powell, after the January FOMC, noted upside risks to inflation, signaling a cautious stance on rate cuts.

ETF investors take heavy losses…Signals of an exit by “Wall Street whales”

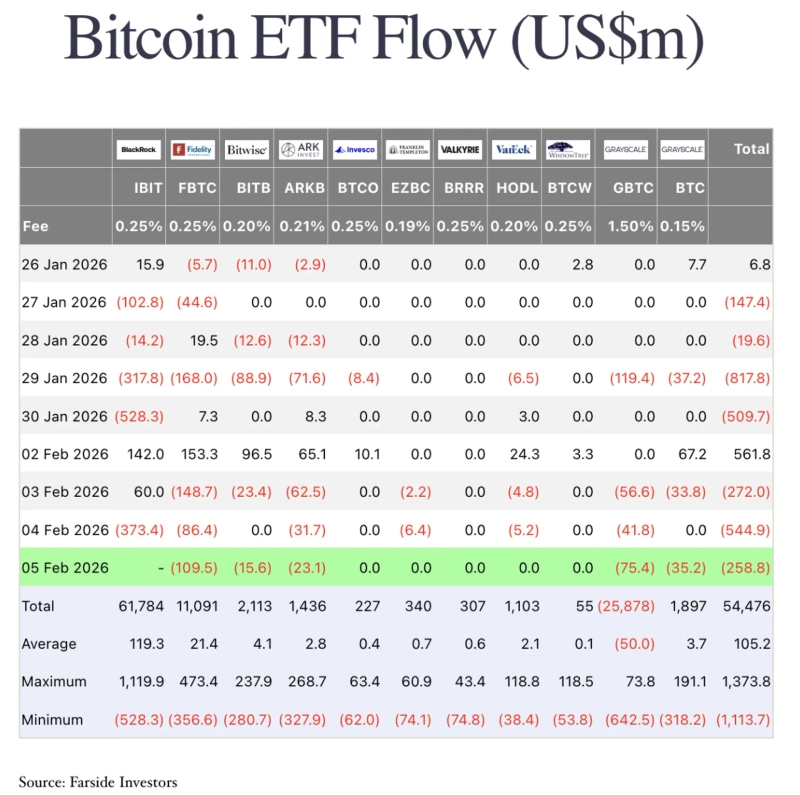

Last week, spot Bitcoin exchange-traded funds (ETFs) saw total net outflows of $1.4877 billion (about 2.1878 trillion won), adding to downside pressure. Net outflows have continued into this week. The market is focusing on the fact that Bitcoin’s price has fallen below the ETF investors’ average entry price ($87,830). Typically, breaking below the average entry level can worsen investor sentiment.

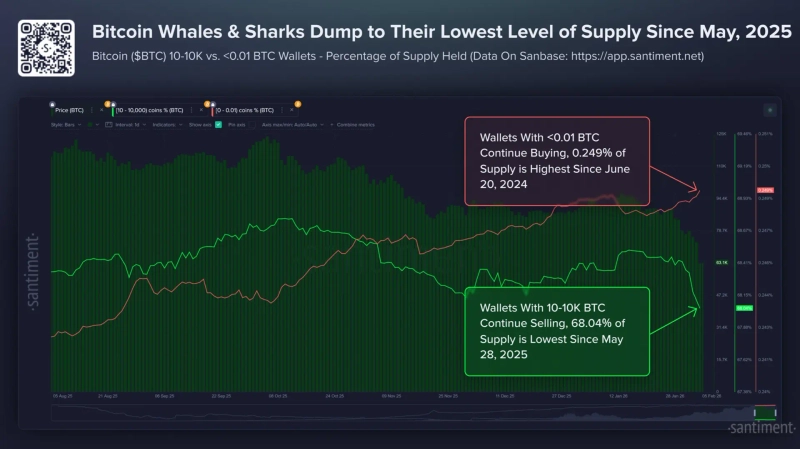

On-chain flow indicators likewise point to weakening investor sentiment. Crypto data analytics firm Santiment said in a research note on the 5th, “Over the past week, the crypto market has drawn a steep downward curve, leaving sentiment toward Bitcoin and Ethereum extremely deteriorated.” It added, “Over the past two weeks, whale wallets holding 10–10,000 BTC sold more than 50,000 Bitcoin into the market, while retail investors have been quickly accumulating,” noting, “This is a typical negative supply-demand signal that appears during periods of falling market value.”

Uncertainty surrounding U.S. policy also remains a headwind. Crypto trading firm QCP Capital said in a report that day, “(On the 4th) the passage of a budget bill in the U.S. House temporarily eased the risk of a partial federal government shutdown, but the market remains in a phase of reacting immediately to headlines rather than conviction.” It added, “With Department of Homeland Security funding limited through the 13th, renewed tensions over fiscal negotiations could pressure markets again.”

Some interpret this pullback as part of an over-leveraging washout. Global crypto exchange Bitfinex said in its weekly research note, “The decline began as worsening macro conditions—such as the possibility of a hawkish Fed chair succession and geopolitical risks—combined,” adding, “The market is passing through a painful ‘structural reset’ phase as leverage is unwound.” After Kevin Warsh’s possible appointment gained attention, about $2.5 billion in long positions were forced liquidated in crypto futures markets.

Crypto analytics firm Swissblock said in a report on the 5th, “The impact of the corrective phase that followed the large-scale liquidations in October last year remains strong,” and assessed that “an attempted shift back to an uptrend in mid-month also failed after being blocked by strong selling pressure.” It added, “As a result, the structure in which downside momentum dominates is becoming more entrenched.”

A fateful $60,000…A watershed between “further downside” and a “technical rebound”

Market experts say that whether Bitcoin can defend the $60,000 level will be a key inflection point for easing short-term downside pressure and reversing the trend.

Ayush Jindal, an analyst at NewsBTC, said, “After extending losses to the $60,000 level, Bitcoin has struggled to stage a technical rebound, with the area around $70,600 acting as strong resistance.” He added, “If it fails to break above the $67,200–$68,500 zone in the short term, additional downside pressure could persist,” and predicted, “In that case, it is highly likely to be pushed back down toward the psychological line at $60,000.”

Alex Kuptsikevich, a senior analyst at FxPro, said, “With Bitcoin making a new low versus last year and retreating to around the November 2024 level, the pattern of progressively lower highs suggests sellers are in control.” He added, “For now, this is a precarious phase in which further declines could continue if the $74,000 level fails to hold.” Some also say that, after the early-year rebound lost momentum, broader market fragility is again coming to the fore.

On-chain analytics firm Glassnode said, “About 44% of Bitcoin supply remains in unrealized loss territory, and after falling more than 30% from the recent peak of $108,000, the share of coins in profit has shrunk from 78% to below 56%,” adding, “If a scenario similar to the 2022 bear market unfolds, Bitcoin could fall by an additional roughly 20%, sliding to the $60,000 line.”

James Butterfill, head of research at CoinShares, said, “With the key support at $70,000 breaking, short-term downside pressure has intensified further,” adding, “It’s necessary to keep the possibility of a pullback to the $60,000–$65,000 range open.”

Rakesh Upadhyay, an analyst at Cointelegraph, also said, “Bitcoin is sliding to its lowest level in about 15 months, further strengthening bearish pressure.” He added, “If Bitcoin falls below $72,945, the downward move could accelerate and extend losses toward the $60,000 level,” while noting, “Conversely, if it recovers $79,500, there is room for a short-term technical relief rally.”

Cautionary voices about the medium- to long-term trend are also emerging. Katie Stockton, founder of Fairlead Strategies, said, “With Bitcoin falling below the key support line of the long-term uptrend ($89,000), it suggests it may have entered a more structural retrenchment phase.” She added, “In that case, Bitcoin may have entered a bear-market cycle, and future rebound attempts could also be blocked by selling pressure, showing a typical down-market pattern.”

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)