Summary

- It was reported that funds have been flowing out of the US Ethereum spot ETF for 13 consecutive trading days.

- It was stated that $11.8 million and $6.69 million were withdrawn from BlackRock's ETHA and Grayscale's ETH, respectively.

- Ethereum was reported to be trading at $1,985, up 0.5% on Binance.

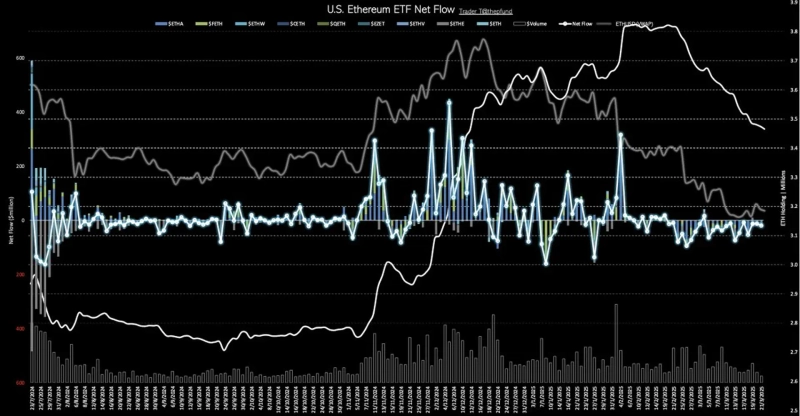

Funds have been flowing out of the Ethereum (ETH) spot exchange-traded funds (ETFs) in the United States for 13 consecutive trading days.

According to data from TraderT on the 21st (local time), a total of $18.49 million was net outflowed from the Ethereum spot ETFs listed in the United States on that day. This fund outflow has been continuing since the 6th and there are no signs of reversal yet.

The product that recorded the largest outflow on this day was BlackRock's ETHA, with $11.8 million withdrawn. Grayscale's ETH also saw an outflow of $6.69 million. Meanwhile, no net inflows or outflows occurred in other ETF products.

Meanwhile, Ethereum was trading at $1,985, up 0.5% from the previous day, in the Tether (USDT) market on Binance as of 2:37 PM on the same day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)