Editor's PiCK

BlackRock: "Bitcoin at a Critical Turning Point... Institutional Investment Expected to Expand" [Virtual Asset Investment Insight Forum 2025]

Summary

- Mitchnick stated that "Bitcoin still accounts for over 60% of the total cryptocurrency market capitalization, emerging as the central asset of the market."

- The approval of a spot Bitcoin ETF provided mainstream investors with new investment opportunities, leading to an explosion of new demand.

- Mitchnick said, "The discussion of holding Bitcoin as a reserve asset is spreading to several countries worldwide, and this will be an important issue in terms of macroeconomic and foreign exchange policy."

Virtual Asset Investment Insight Forum 2025

Robert Mitchnick, Head of Digital Assets at BlackRock

Institutional Participation Expected to Expand Due to Political Environment Changes

Banks' Custody and Trading Entry to Be Accelerated... Enhancing Credibility

Bitcoin as a Strategic Asset Discussion Spreads to Foreign Governments

Speed of Institutional Portfolio Inclusion Likely to Influence Market Trends

"The digital asset sector is currently at a critical turning point. Institutional investors' interest in cryptocurrencies, including Bitcoin, is unprecedentedly high."

Robbie Mitchnick, Head of Digital Assets at BlackRock, stated at the 'Virtual Asset Investment Insight Forum 2025' held at Conrad Hotel in Yeouido, Seoul on the 25th, "The structural growth of digital assets is becoming full-fledged. Korea, as one of the early adopters of cryptocurrencies, is also forming a vibrant market," he said.

Mitchnick explained that BlackRock approaches digital assets by dividing them into three pillars: ▲ traditional cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) ▲ stablecoins ▲ asset tokenization. He emphasized, "All three areas are receiving high interest from global clients," and "Digital assets hold the technological potential to fundamentally transform the existing financial infrastructure beyond being mere investment targets."

"Bitcoin Still at the Center of the Market... Accounts for 60% of Total Market Cap"

Mitchnick stated, "Since the emergence of Bitcoin, over a million cryptocurrencies have been created, yet Bitcoin still accounts for over 60% of the total cryptocurrency market capitalization," adding, "This is not a mere coincidence."

He defined Bitcoin's core value within the history of human currency. According to Mitchnick, Bitcoin is the first asset to simultaneously solve three issues that currencies historically failed to address: ▲ arbitrary expansion of supply ▲ inefficiency in cross-border remittances ▲ risk of censorship and seizure.

He continued, "Bitcoin's supply is fixed at 21 million, enabling real-time cross-border remittances, and its decentralized structure provides censorship resistance and openness," emphasizing, "Thanks to these characteristics, anyone in the world can access the Bitcoin ecosystem with just a smartphone and the internet."

Institutional Influx Accelerated... Focus on Portfolio Diversification Effects

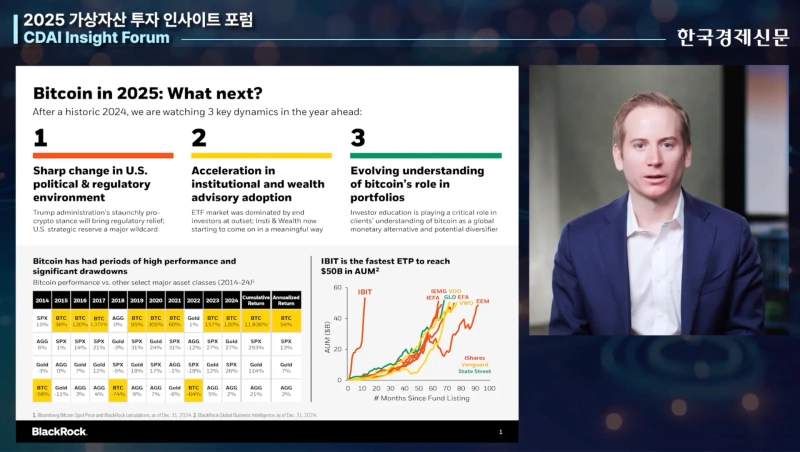

Mitchnick further diagnosed that 2024 was a year when a structural inflection point occurred in the Bitcoin market. He reported, "With the approval of a spot Bitcoin ETF in the United States, a new investment vehicle accessible to mainstream investors was established, leading to an explosion of new demand."

However, he cited the release of large bankruptcy liquidation sales as the background for the Bitcoin price not soaring at the time. Mitchnick analyzed, "Approximately $3 billion worth of Bitcoin was released into the market during the bankruptcy liquidation processes of entities like Genesis and Mt.Gox, including the German government, balancing new demand and supply and temporarily suppressing the price rise."

He added, "However, as the liquidation sales concluded and a pro-Bitcoin administration was inaugurated in the United States, the market surged," noting, "Ultimately, the Bitcoin price surpassed $100,000 for the first time in history."

What Are the Key Agendas for Digital Assets This Year?

Mitchnick identified the key agendas for the digital asset market in 2025 as ▲ expansion of institutional financial participation due to political changes in the United States ▲ spread of strategic Bitcoin holding discussions ▲ speed of institutional investors' portfolio inclusion.

He stated, "Now, institutional conditions are opening up for U.S. banks to fully participate in areas like Bitcoin custody, trading, and prime brokerage," predicting, "This will play a decisive role in enhancing the maturity and credibility of the cryptocurrency market."

He also mentioned, "The discussion of holding Bitcoin as a reserve asset is spreading beyond some U.S. state governments to several countries worldwide," adding, "This will be an important issue in terms of macroeconomic and foreign exchange policy."

Regarding the timing of institutional asset inclusion, he explained, "Since 2024, a full-fledged analysis of Bitcoin's risk-reward ratio and appropriate proportion in portfolios has begun," noting, "This is not a problem that can be concluded in a short period, and BlackRock is jointly exploring this complex process with many global clients."

In conclusion, he added, "Bitcoin is now fundamentally changing the way global financial markets are restructured and investment portfolios are composed, beyond being a mere technological trend," emphasizing, "BlackRock will continue to lead this massive paradigm shift with our clients."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)