Summary

- HyperLiquid announced a compensation plan for users who suffered losses following the delisting of JELLY.

- They stated that users, except those with suspicious addresses, will be compensated by the Hyper Foundation.

- Criticism continues regarding various issues such as HyperLiquid's centralization.

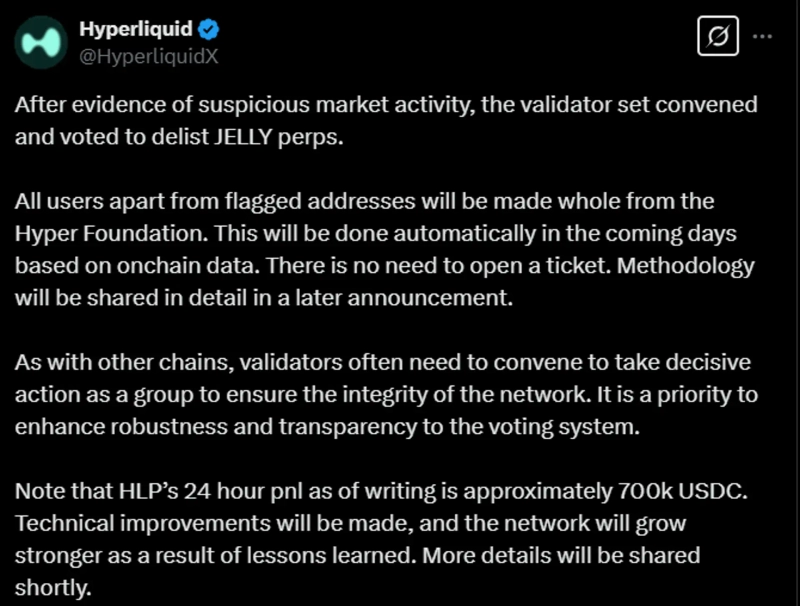

HyperLiquid, which proceeded with the delisting of JELLY, announced on the 26th (local time) via X (formerly Twitter) that "after discovering evidence of suspicious market activity, we delisted JELLY perpetual futures following a validator vote," and "users (who suffered losses) except for those with suspicious addresses will be compensated by the Hyper Foundation."

They added, "Details on the compensation method will be announced later."

Previously, a trader at HyperLiquid opened a short position of 430 million JELLY, settled a position of 30 million JELLY, and withdrew the remaining margin of 2.76 million USDC, resulting in the liquidation of 398 million JELLY.

As a result, the amount was taken on by the Hyper Liquidity Provider (HLP) liquidation address.

Meanwhile, there is growing criticism regarding HyperLiquid's centralization issues, governance, credibility, and risk management.

JH Kim

reporter1@bloomingbit.ioHi, I'm a Bloomingbit reporter, bringing you the latest cryptocurrency news.