Editor's PiCK

"Korea should lift capital controls and issue a KRW stablecoin"

Summary

- Seokmoon Jeong, Director of Presto Research Center, stated that Korea must lift capital controls and issue a KRW stablecoin to achieve economic effectiveness.

- Blockchain can eliminate friction in the flow of capital between countries, and a KRW-based stablecoin can contribute to the internationalization and stability of the KRW.

- He criticized the closed nature of the existing financial system and argued that financial openness and amendment of the Foreign Exchange Transactions Act are necessary to enjoy the benefits of blockchain.

"The true value of blockchain lies in eliminating friction in the flow of capital between countries. However, Korea's current financial system is excessively closed. To gain substantial benefits, capital controls must be lifted first."

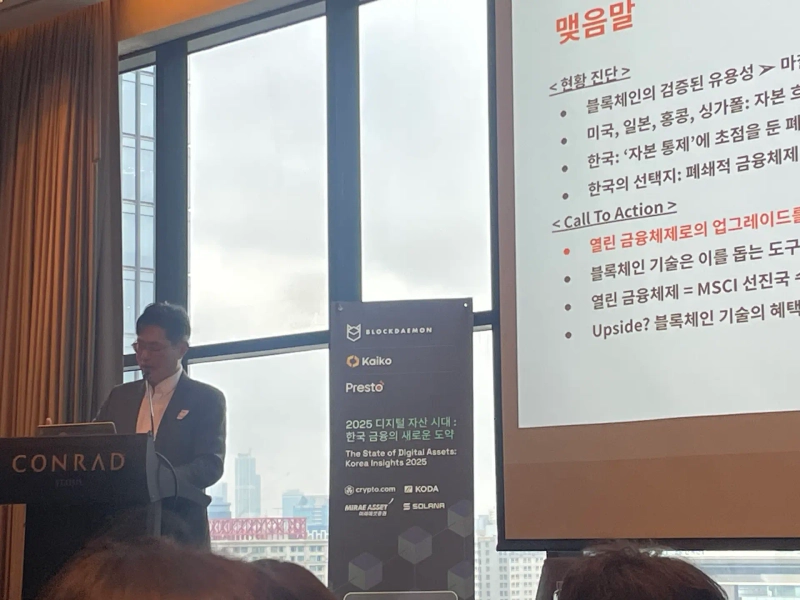

Seokmoon Jeong, Director of Presto Research Center, stated at the '2025 Digital Asset Era: A New Leap for Korean Finance' forum held at the Glad Hotel in Yeouido, Seoul on the 27th, "It is difficult to gain practical benefits by simply adopting U.S. policies. Rather than blind acceptance, a fundamental understanding and strategic planning of the Korean financial market structure is necessary," he said.

Director Jeong said, "The dollar is used as a global exchange medium, but various frictions such as fees, payment delays, and exchange rate risks occur due to intermediaries whenever it crosses borders," and "The U.S. is trying to solve this through blockchain. It is no coincidence that 99% of stablecoins are dollar-based," he said.

He added, "The core of blockchain is the frictionless movement of code assets," and "While traditional financial networks are intermediary-centered, blockchain is a technology that can streamline value movement."

Director Jeong pointed out that countries that value the freedom of capital flow are incorporating blockchain into the institutional framework more quickly, criticizing the closed nature of the Korean financial market.

He said, "According to the MSCI index, Korea has not yet been included in the advanced markets," and "This is because regulations that hinder the free inflow of capital, such as the foreign investor registration system, document submission burden, and the absence of an offshore KRW foreign exchange market, still exist."

He continued, "We should also move towards issuing a KRW-based stablecoin. However, to achieve substantial economic effects, the Foreign Exchange Transactions Act must be amended first," and "Issuing it as a 'showcase' within a closed financial system like now has no practical benefit," he asserted.

He further predicted, "If a KRW-based stablecoin becomes a global distribution medium, the internationalization of the KRW will be strengthened," and "This will have a chain effect of increasing the stability and credibility of the KRW in the long term."

Director Jeong provided a specific example of utilization, saying, "If a KRW stablecoin issued with government bonds as collateral is used as a payment method for foreign tourists, a market capitalization level of $1.7 billion is possible," and emphasized, "To fully enjoy the benefits of blockchain, capital controls must be abolished and an open financial system must be adopted."

Finally, he added, "Now is the opportunity. To activate capital transactions and improve the economic structure, blockchain must be proactively embraced," and "For Korean finance to make a new leap, a paradigm shift from 'closed to open' is necessary."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)