Summary

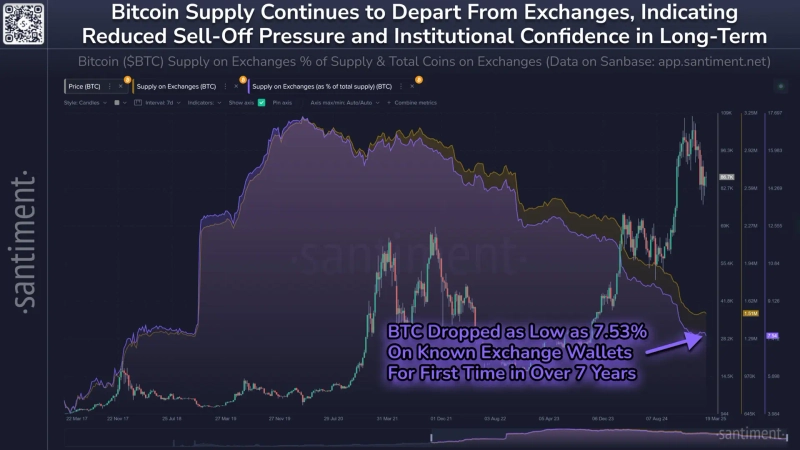

- "It was stated that the share of Bitcoin's supply within exchanges falling to 7.53% is the lowest in 7 years."

- "The decrease in exchange supply suggests a reduction in short-term selling pressure and the possibility of a price rebound."

- "The trend of Bitcoin being recognized as a store of value has been strengthened due to the increase in institutional investors' demand."

It has been found that the Bitcoin (BTC) circulating on virtual asset exchanges has fallen to the 7% range of the total supply.

On-chain analysis platform Santiment announced on its official X account on the 27th that "the share of Bitcoin's supply within exchanges has fallen to 7.53%." This means that the Bitcoin traded on exchanges accounts for 7.53% of the total circulation. Santiment stated, "This is the lowest level since February 20, 2018," adding, "The decrease in Bitcoin's exchange supply generally suggests that short-term selling pressure is decreasing."

Santiment predicted that the decrease in Bitcoin's exchange supply could lead to a price rebound. Santiment analyzed, "(The decrease in exchange supply) means that Bitcoin investors have less immediate intent to trade or liquidate," and added, "This trend acts as a buffer to reduce spot selling supply and prevent sharp price declines in a volatile market." Furthermore, "Historically, lower exchange holdings tend to coincide with bull markets," it added.

The increase in institutional demand was also mentioned. Santiment stated, "The decrease in (Bitcoin's) exchange supply shows that institutional investors' interest is growing," and added, "More and more Bitcoin is moving to more secure institutional storage, and market participants are recognizing Bitcoin as a store of value (SOV) rather than a short-term speculative asset."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)