Editor's PiCK

Dominari Holdings, involving Trump family, invests $2 million in BlackRock Bitcoin ETF

Summary

- Dominari Holdings announced that it will invest $2 million in a Bitcoin spot ETF.

- The ETF in question is BlackRock's 'iShares Bitcoin Trust (IBIT),' currently the largest in the market.

- The strategy of indirectly holding Bitcoin is advantageous for regulatory compliance and can affect stock price volatility.

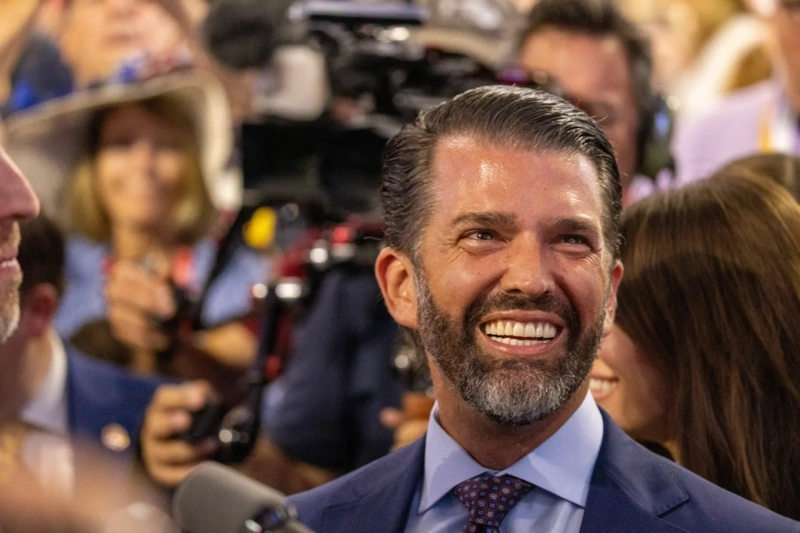

Dominari Holdings, an investment firm where Eric Trump and Donald Trump Jr., sons of former U.S. President Donald Trump, serve as advisors, has decided to invest some of its cash in a Bitcoin spot exchange-traded fund (ETF).

According to CoinDesk on the 28th (local time), Dominari announced in its earnings report released on the 22nd that it "adopted a strategy of holding Bitcoin as corporate reserves and will invest some cash in BlackRock's 'iShares Bitcoin Trust (IBIT).'" IBIT is currently the largest Bitcoin spot ETF in the market.

The report states that Dominari will initially invest $2 million to purchase shares in IBIT. Dominari's current market capitalization is approximately $70 million. Following the announcement last Friday, Dominari's stock price fell by more than 9% in one day.

Companies adopting Bitcoin as reserves typically purchase Bitcoin directly and store it themselves or use custodial services. However, Dominari chose a strategy of indirect exposure to Bitcoin through a regulated ETF, which offers advantages in accounting and regulatory compliance.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)