Editor's PiCK

[Today's Global Trending Coins] Ethereum, Bitcoin, Banker Coin, Avalanche, etc.

Summary

- The sharp decline of Ethereum and Bitcoin in the virtual asset market was attributed to the dampened investor sentiment following the PCE index announcement.

- There was a recent Avalanche ETF application, but the market reaction was limited, and a price decline was observed.

- Banker Coin showed a significant decline despite the attention on the AI-based platform.

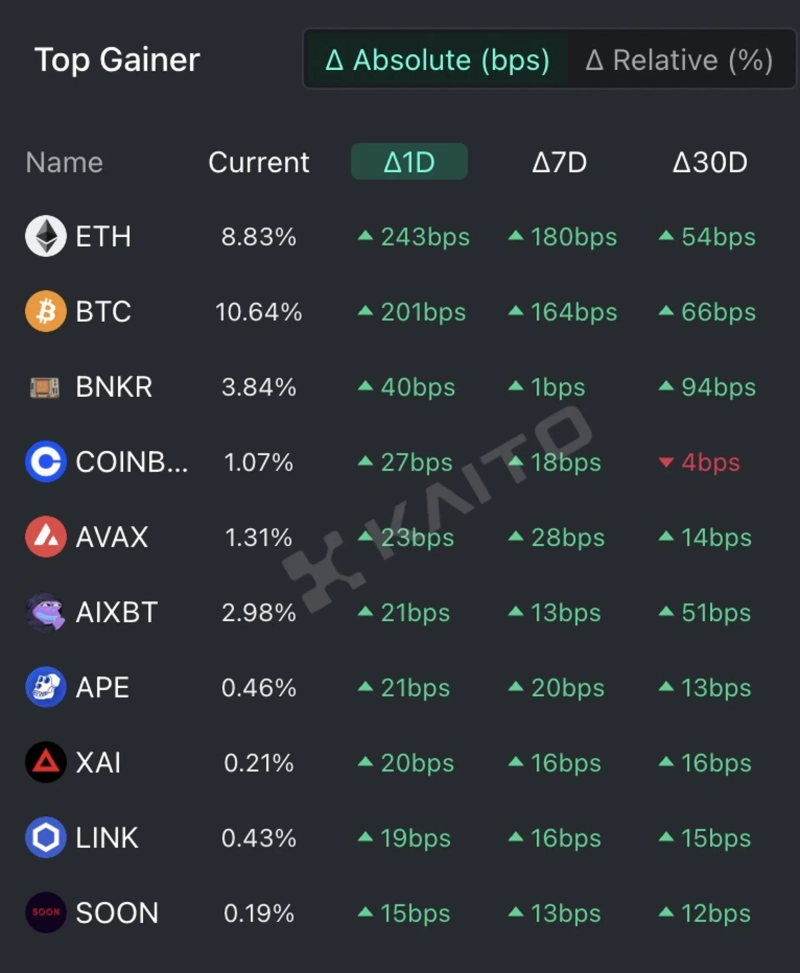

According to the top gainers of Token Mindshare (a metric quantifying the influence of specific tokens in the virtual asset market) by the AI-based Web3 search platform Kaito, the top 5 keywords related to virtual assets that people are most interested in as of the 29th are Ethereum (ETH), Bitcoin (BTC), Banker Coin (BNKR), Coinbase, and Avalanche (AVAX).

On the 29th (local time), the U.S. Department of Commerce announced that the February Personal Consumption Expenditure (PCE) price index suggested increased inflationary pressures, causing the virtual asset (cryptocurrency) market to turn downward. Particularly, Ethereum (ETH) and Bitcoin (BTC), which ranked first and second in interest, fell sharply overnight, dampening investor sentiment.

The February PCE index rose 2.5% year-on-year, matching the market expectations compiled by Dow Jones. However, the core PCE inflation rate, excluding volatile energy and food, slightly exceeded expectations at 2.8% compared to the expected 2.7%. Recent policy uncertainties, such as the possibility of tariffs imposed by former U.S. President Donald Trump, are interpreted as adding pressure to risk assets amid rising inflation forecasts.

After the announcement, Ethereum and Bitcoin plunged nearly 5% and 4%, respectively, based on the Binance Tether (USDT) market. As the selling trend spread across the market, the decline in major virtual assets also widened.

Meanwhile, the AI-based virtual asset trading platform Banker, which recently introduced a token distribution feature through X (formerly Twitter), attracted market attention, but Banker Coin (BNKR) failed to defend its price. As of the 29th, Banker Coin traded at around $0.00022, down 28% from the previous week.

News also emerged that Grayscale, a major U.S. virtual asset management firm, submitted an application for an Avalanche (AVAX) spot exchange-traded fund (ETF). On the 28th (local time), Grayscale reportedly filed a 19b-4 form related to the Avalanche ETF with the U.S. Securities and Exchange Commission (SEC) through Nasdaq. However, the market reaction was limited. Avalanche traded at $20, down 4.8% from the previous day in the Binance USDT market.

Additionally, investors are also interested in AIXBT, ApeCoin (APE), Xai (XAI), and Chainlink (LINK).

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)