Editor's PiCK

[Exclusive] 'Blockchain Giant' DSRV Eyes Japan Entry... Considering Stablecoins and More

Summary

- Korean blockchain company DSRV is planning to enter the Japanese market, recognizing its growth potential.

- DSRV is considering expanding its stablecoin and validator businesses in line with the Japanese government's commitment to fostering stablecoins and institutional changes.

- Aiming for a KOSDAQ listing in the first half of next year, DSRV targets 30 billion won in revenue this year through revenue diversification.

Japan Actively Promotes Stablecoins

Legal Framework Established in 2023

Considering Exporting Validator Business

Aiming for KOSDAQ Listing in First Half of Next Year

Korean blockchain company DSRV is planning to enter the Japanese market, recognizing the high growth potential of Japan's virtual asset industry. Among the business areas being considered are stablecoins, which the Japanese government is actively working to institutionalize.

According to industry sources on the 1st, DSRV is seriously considering expanding its business into Japan. To this end, DSRV CEO Kim Ji-yoon has been staying in Japan since last month to explore business opportunities. It is also known that CEO Kim met with officials from Japan's Financial Services Agency (FSA) early last month.

Specifically, DSRV is exploring the possibility of a stablecoin business in Japan. Stablecoins are virtual assets whose prices are linked to fiat currencies like the US dollar. They are more stable than general virtual assets like Bitcoin (BTC) due to their lower price volatility. CEO Kim was appointed as the inaugural chairman of the 'Stablecoin Council' under the Korea Fintech Industry Association, which was launched in February this year.

Japan Pushes for Institutionalization Since 2022

The background to DSRV's consideration of entering Japan is the Japanese government's commitment to fostering stablecoins. Japan has identified stablecoins as a future growth engine early on and began institutional preparations in 2022. In 2023, Japan amended the Payment Services Act to classify stablecoins as 'electronic payment instruments,' establishing a legal foundation.

Japan is accelerating institutionalization by further amending stablecoin-related laws following the inauguration of the Trump administration's second term. Stablecoins are a key part of U.S. President Donald Trump's pro-virtual asset policy. President Trump recently reiterated his commitment to fostering stablecoins, stating in a speech that "dollar-based stablecoins will contribute to strengthening dollar dominance."

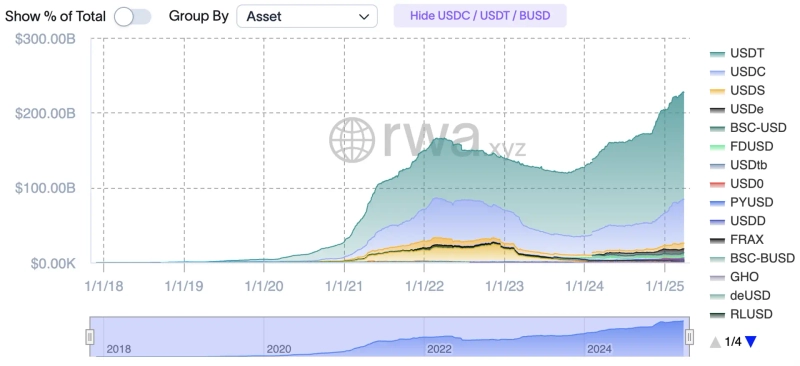

The recent surpassing of the $200 billion (approximately 294 trillion won) stablecoin market cap is also in this context. According to real-world asset (RWA) data analysis platform rwa.xyz, the total market cap of stablecoins as of today is $227.32 billion, up 3.18% from a month ago.

U.S. asset management firm Bernstein predicts that the global stablecoin market could grow to $500 billion this year. Coinbase, the largest virtual asset exchange in the U.S., stated in its '2025 Virtual Asset Market Outlook' report that "the next substantial wave of virtual asset adoption will center around stablecoins."

Targeting 30 Billion Won Revenue This Year

DSRV is also considering exporting its main revenue source, the validator business, to Japan. Validators are systems that verify the proper functioning of blockchain networks and are considered a core technology in the virtual asset industry. DSRV is already the number one validator business in the Ethereum (ETH) staking sector in Korea. DSRV aims to expand its validator business and more than double its related revenue within the year.

DSRV is also accelerating new businesses such as payments and custody. The reason DSRV obtained a Virtual Asset Service Provider (VASP) license from the financial authorities last year is also for this purpose. It is interpreted that DSRV is diversifying its revenue structure in preparation for a KOSDAQ listing, which is being pursued with the goal of the first half of next year. Earlier this year, DSRV announced that it aims to nearly triple its annual revenue from 10 billion won last year to 30 billion won this year.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)