Editor's PiCK

'Trump's Pick' Atkins Likely to Become SEC Chair... Big Change Coming to the Crypto Market

Summary

- Atkins, nominated by President Trump as the SEC chair candidate, is expected to drive the easing of crypto regulations.

- Atkins is likely to assume office early next month, and the review for altcoin ETF approval is expected to accelerate.

- With the Republican majority in both houses, Atkins' approval is considered highly likely.

'Trump Nominee' Atkins SEC Chair Candidate

Confirmation Hearing Underway... Likely to Assume Office Early Next Month

U.S. Crypto Regulation Expected to Ease

"Will Accelerate Altcoin ETF Approval Review"

The 'leadership vacuum' at the U.S. Securities and Exchange Commission (SEC), a key agency for the crypto policy of the Trump administration's second term, has continued for over two months. With the recent confirmation hearing for Paul Atkins, nominated as the next SEC chair, attention is focused on the timing of the new leader's inauguration.

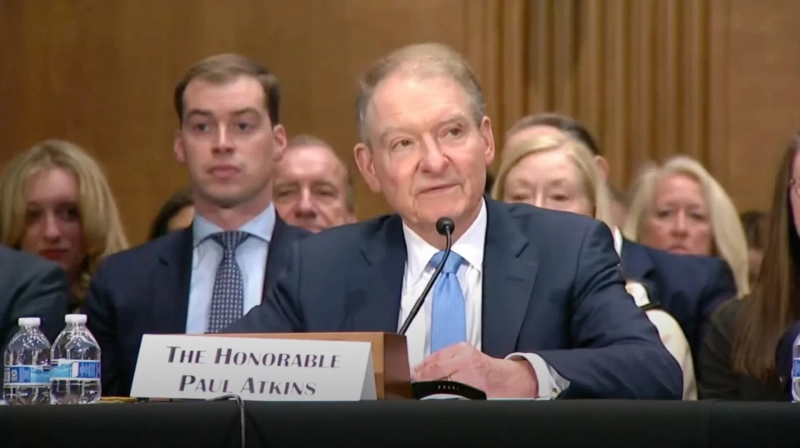

According to industry sources on the 2nd, the confirmation hearing for Atkins, the SEC chair candidate, was held on the 27th of last month (local time) by the U.S. Senate Banking Committee. Atkins is considered one of the representative 'pro-crypto' figures among the major personnel of the Trump administration's second term. During the confirmation hearing, Atkins expressed his intention to prioritize establishing a clear regulatory framework for digital assets if confirmed as chair.

The SEC is expected to accelerate the easing of crypto regulations once Atkins takes office. The analysis is that President Donald Trump nominated Atkins as the next SEC leader to drive the growth of the crypto industry. The SEC also formed an 'Crypto Task Force (TF)' internally right after the launch of the Trump administration's second term.

Likely to Assume Office Early Next Month

The SEC is crucial to the Trump administration's crypto policy because it oversees related regulations. The SEC is a presidential agency that manages and supervises all assets classified as 'securities.' It has the power to create securities-related regulations and possesses quasi-judicial authority, such as investigation and prosecution, which significantly impacts the market. This is why the crypto industry is keenly watching the timing of Atkins' inauguration.

Considering precedents like former SEC Chair Gary Gensler, it is expected that Atkins will likely assume office early next month. In relatively recent cases, such as the Trump administration's first term and the Biden administration, it typically took about 4 to 5 weeks from the SEC chair confirmation hearing to approval, and about 1 week from approval to inauguration.

Specifically, in the case of former Chair Gensler, the confirmation hearing was held on March 2, 2021, followed by approval on April 14 of the same year, and inauguration on April 17. Former Chair Jay Clayton, who led the SEC during the Trump administration's first term, had his confirmation hearing on March 23, 2017, followed by approval on May 2 of the same year, and inauguration on May 4. Unless there are significant variables, Atkins is also likely to assume office early next month, about 5 to 6 weeks after the confirmation hearing date.

"Advisory to FTX" Criticism

Of course, there are variables such as conflict of interest concerns. Atkins is known to have provided advisory services to several crypto companies through 'Patomak Global Partners,' a consulting firm he founded in 2009. Senator Elizabeth Warren pointed out that Atkins also provided advisory services to the bankrupt crypto exchange FTX in 2022.

Personal assets related to crypto could also heighten conflict of interest concerns. According to materials recently submitted by Atkins to the U.S. Office of Government Ethics, his crypto-related assets are valued at $6 million (approximately 8.8 billion won). Bloomberg reported that Atkins and his wife's personal assets amount to at least $327 million (approximately 480 billion won). Atkins has stated that he will dispose of his crypto-related assets if confirmed as chair.

"High Likelihood of Approval"

However, given that the Republican Party holds the majority in both the House and Senate, it is widely expected that there will be no significant obstacles to his approval. The concerns about Atkins' crypto-related assets and potential conflicts of interest are unlikely to be decisive enough to block the approval itself. U.S. political media outlet Politico reported, "Atkins is evaluated as a sufficiently qualified chair candidate across the political spectrum," and "the likelihood of Senate approval is also high."

Meanwhile, the SEC has been canceling or withdrawing lawsuits and investigations against crypto companies following the launch of the Trump administration's second term. The recent withdrawal of the lawsuit against Ripple, the issuer of XRP, is a representative example.

The market is also growing optimistic that the SEC will speed up the approval review of spot Exchange-Traded Funds (ETFs) for altcoins such as Solana (SOL), XRP, and Litecoin (LTC) once Atkins assumes office, filling the leadership vacuum. James Seyffart, a Bloomberg Intelligence ETF analyst, stated, "(The SEC) will likely delay all matters that can be postponed until Atkins takes office."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)