Hayes: "Trump Tariffs Will Break Bitcoin's Correlation with Nasdaq"

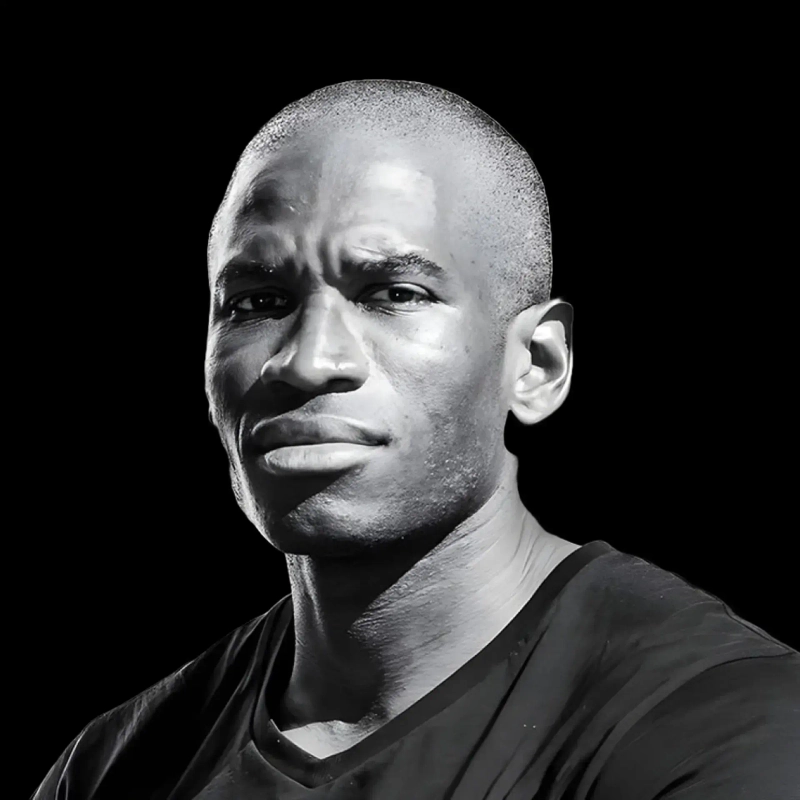

Doohyun Hwang

Summary

- Arthur Hayes stated that tariffs will break the correlation between Bitcoin and Nasdaq.

- He expressed hope that Bitcoin will fulfill its original role as a 'fiat liquidity alarm.'

- Bitcoin is predicted to be positively impacted in the medium term by macroeconomic changes due to tariff policies.

Arthur Hayes, Chief Investment Officer (CIO) of Maelstrom, recently commented on the changing correlation between Bitcoin (BTC) and the macroeconomy.

On the 4th (local time), he stated on his X, "Bitcoin holders must now learn to love tariffs," adding, "This time, I hope Bitcoin will break its correlation with Nasdaq and function in its original role as a 'fiat liquidity alarm.'"

Previously, Hayes predicted that the macroeconomic flow (such as expectations of interest rate cuts) due to tariff policies would have a positive impact on Bitcoin in the medium term. Meanwhile, Bitcoin is trading at over $84,000, up 1.35% from the previous day, in the Binance Tether (USDT) market.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)