Editor's PiCK

[Today's Global Interest Coins] Bitcoin, Fartcoin, Lens Protocol, etc.

Summary

- Bitcoin is reported to be maintaining a steady trend, with analysis suggesting it is breaking away from its correlation with the stock market and regaining its original role.

- Fartcoin is noted for its volatility, having surged more than 30% in the past 24 hours before plummeting again, drawing attention due to its short-term surge.

- The social graph-based Web3 protocol Lens Protocol gained attention with the news of the mainnet 'Lens Chain' operation, featuring virtually zero gas fees for users.

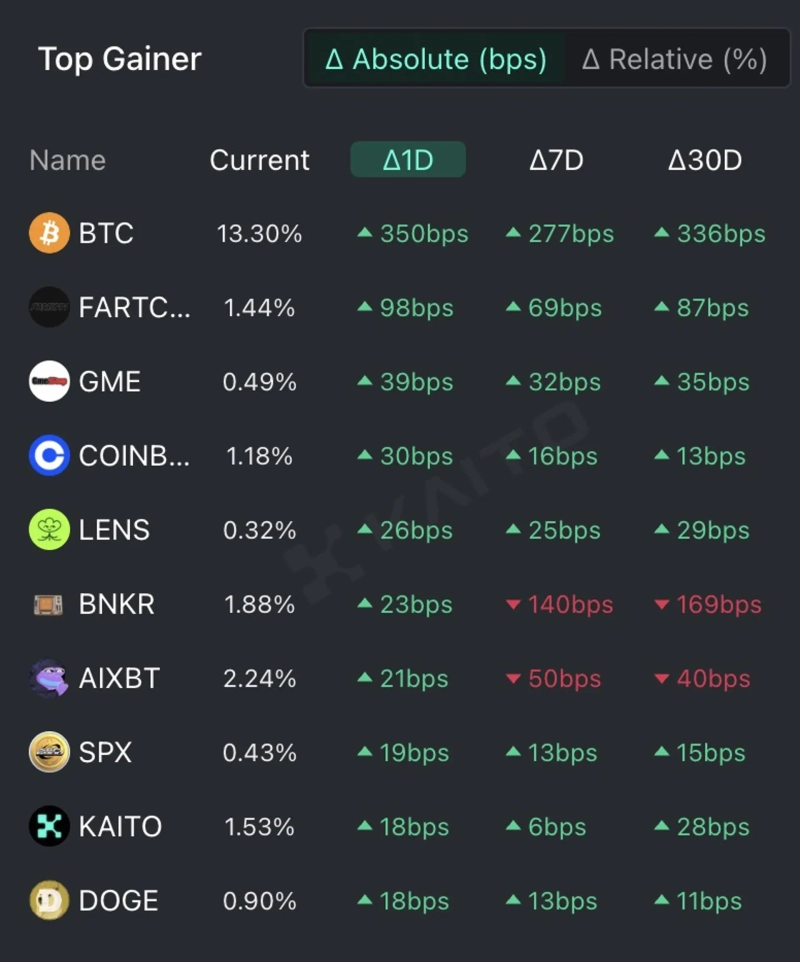

According to the top gainers of Token Mindshare (a metric quantifying the influence of specific tokens in the virtual asset market) on the AI-based Web3 search platform Kaito, the top 5 keywords related to virtual assets that people are most interested in as of the 5th are Bitcoin (BTC), Fartcoin (FARTCOIN), GameStop (GME), Coinbase (Coinbase), and Lens Protocol (LENS).

Bitcoin, which ranked first in interest, is maintaining a steady trend despite the sharp decline in the US stock market. The previous day, the US stock market showed a sharp decline due to the announcement of mutual tariffs by US President Donald Trump and China's countermeasures, as well as inflation concerns revealed in the March Federal Open Market Committee (FOMC) minutes of the US Federal Reserve (Fed). It is evaluated that the weakening of interest rate cut expectations had a negative impact on the overall market.

Nevertheless, Bitcoin is trading at $83,660 on the Binance Tether (USDT) market, up 1.13% from the previous day. Some interpret this as Bitcoin breaking away from its correlation with the stock market and regaining its original role.

Fartcoin, which ranked second in interest, gained attention due to its short-term surge. Over the past 24 hours, its price surged more than 30% and then plummeted again, highlighting its volatility as a speculative issue. Currently, Fartcoin is trading at around $0.49 on the Bitget USDT market, up about 11% from the previous day.

GameStop (GME) attracted attention from both the stock market and the virtual asset community. It recently completed the issuance of $1.3 billion worth of convertible bonds and announced plans to purchase Bitcoin with the proceeds. According to blockchain-specialized media SolidIntel, GameStop plans to use $1.48 billion of the convertible bond proceeds for Bitcoin investment.

Coinbase was listed as a keyword due to a significant stock price drop following the Nasdaq decline amid the Trump administration's tariff policy impact. Over the past three trading days, the stock price has fallen by about 12%. Along with tech stocks, stocks related to virtual asset exchanges are also showing vulnerability to market uncertainty.

The social graph-based Web3 protocol Lens Protocol gained attention with the news of the mainnet 'Lens Chain' operation. The Lens development team announced on the 5th through official channels that "the mainnet has been officially launched with the deployment of Lens V3." This chain, based on zkSync L2 blockchain, features providing users with virtually zero gas fees and storing all content on-chain.

Additionally, investors are also showing interest in Bankercoin (BNKR), AIXBT (AIXBT), SPX6900 (SPX), Kaito (KAITO), and Dogecoin (DOGE).

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)