Editor's PiCK

"The Bitcoin Bull Market is Over"... Ju Ki-young Shouted Twice, Why?

Summary

- The price of Bitcoin has fallen below $75,000, signaling to investors the end of the Bitcoin bull market.

- Ju Ki-young, CEO of CryptoQuant, assessed that Bitcoin has entered a bear market based on indicators such as the realized market cap, and evaluated the possibility of a short-term rebound as low.

- Some analyses suggest that the U.S. tariff policy could increase the preference for alternative assets, potentially having a positive impact on Bitcoin in the medium to long term.

Intensifying Bitcoin Downtrend

Falls Below $75,000 in 5 Months

'Bear Market' Analysis Gains Traction

"Further Adjustment Expected When U.S. Market Opens"

The decline in the prices of virtual assets such as Bitcoin (BTC) is intensifying. Analyses suggesting that the Bitcoin bull market, which has continued since last year, has ended are also emerging.

According to CoinMarketCap, a virtual asset market tracking site, the price of Bitcoin fell below the $75,000 mark at one point on the 7th. This is a sharp drop of about 10% compared to the previous day, marking the first time Bitcoin has fallen below $75,000 since November last year. Major altcoins such as Ethereum (ETH) and Solana (SOL) recorded a decline of 19-20% in just one day. XRP also showed a decline close to 22%.

The main cause of the sharp decline is attributed to the 'tariff bomb' triggered by Trump. U.S. President Donald Trump announced a large-scale reciprocal tariff policy on the 2nd (local time) of this month. As a result, nearly $6.6 trillion (about 9,670 trillion won) in market capitalization evaporated from the U.S. stock market alone last week. This week, major stock markets such as Japan's Nikkei and Hong Kong's Hang Seng Index have also plummeted. On this day, due to the sharp decline in the KOSPI, a sidecar (temporary suspension of trading) was triggered for the first time in 8 months since last August.

Initially, the price of Bitcoin maintained the $82,000 support line until last weekend. It showed a movement contrary to the U.S. stock market, where the coupling (synchronization) phenomenon has recently strengthened. Rather, Bitcoin temporarily rose and held its ground on the 4th and 5th, when the U.S. stock market's sharp decline began, buoyed by analyses that it could be a 'tariff safe haven'. Michael Saylor, chairman of Strategy, also raised investors' expectations by stating, "Bitcoin is not subject to tariffs" immediately after the U.S. government's announcement of the reciprocal tariff policy.

"Entering Bear Market According to Data"

However, as the decline in Bitcoin prices increases, the analysis that the bull market has ended is gaining traction in the market. The signal was fired by Ju Ki-young, CEO of CryptoQuant. Just before the Bitcoin downtrend began in earnest, CEO Ju claimed on the 6th via X that "the Bitcoin bull market is over" and "the possibility of a short-term rebound seems low." CEO Ju said, "In a bull market, prices rise even with small funds, but in a bear market, prices do not rise even with large funds," and "the current data clearly points to the latter (bear market)."

This is not the first time CEO Ju has made such an analysis. On the 18th of last month, CEO Ju declared the end of the bull market, stating, "A bear market or sideways market will continue for the next 6 to 12 months." At that time, CEO Ju said, "All on-chain indicators point to a bear market," and "even when indicators were ambiguous over the past two years, I have argued for a bull market, but now it seems clear that we are entering a bear market."

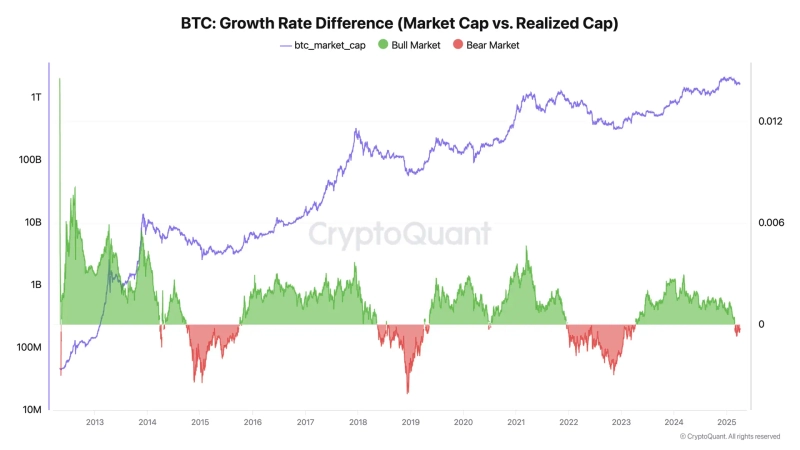

What CEO Ju focused on is the 'Realized Cap'. The realized market cap is a figure measured based on the purchase price and quantity of each Bitcoin holder recorded on the blockchain, and is an indicator that can more accurately grasp the flow of funds in the market than the 'Market Cap'.

CEO Ju explained, "The realized market cap shows how much actual funds are flowing into the market," and "if the realized market cap is increasing but the market cap is stagnant or declining, it means funds are coming in but prices are not rising." He added, "(Currently) funds are flowing into the market, but prices are not responding," and "this is a phenomenon commonly seen in bear markets."

"Possibility of Falling to $70,000"

Given the situation, concerns are growing that the price decline could steepen. Julia Zhou, Chief Operating Officer (COO) of virtual asset market maker (MM) Caladan, told Bloomberg, "Cryptocurrencies generally serve as a leading indicator of risk assets," and "a more drastic adjustment is expected when the U.S. market opens today (7th)." Virtual asset analyst Michaël van de Poppe also stated on X that "a rollercoaster-like trend will continue over the next 1-2 weeks, testing the bottom of Bitcoin," and "(at the current rate of decline) it could fall to $70,000."

However, there are also quite a few experts maintaining a bullish stance. They believe that the U.S. tariff policy could increase the preference for alternative assets, potentially benefiting Bitcoin in the medium to long term. Arthur Hayes, former CEO of BitMEX, said, "(U.S. tariffs) may have severed the correlation between Bitcoin and Nasdaq," and "Bitcoin is becoming a 'fiat liquidity alarm'." Former CEO Hayes recently analyzed that if the U.S. Federal Reserve (Fed) engages in quantitative easing (QE) to supply liquidity to the market, the price of Bitcoin could reach $250,000 within the year.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)