Editor's PiCK

US Bitcoin Spot ETF sees net outflows for 5 consecutive trading days... Totaling $722.43 million

Summary

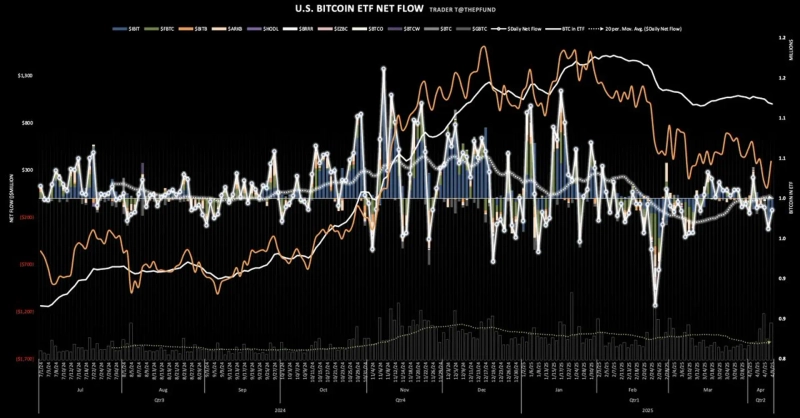

- The US Bitcoin Spot ETF reported consecutive net outflows, with cumulative outflows reaching $722.43 million.

- Among them, BlackRock's IBIT saw the largest outflow with $89.85 million withdrawn in a single day.

- The Bitcoin price surged due to the tariff suspension announcement, rising 7.8% from the previous day to trade at around $81,700.

The US Bitcoin (BTC) Spot Exchange-Traded Fund (ETF) recorded net outflows for four consecutive trading days. The cumulative outflow during this period amounts to $722.43 million.

According to data from TraderT, on the 9th (local time), a total of $127.26 million was net outflowed from Bitcoin spot ETFs trading in the US.

The product with the largest outflow was BlackRock's IBIT, with $89.85 million withdrawn in a single day. Grayscale's GBTC also saw a net outflow of $33.80 million. VanEck's HODL recorded a net outflow of $4.65 million, and WisdomTree's BTCW saw a net outflow of $5.67 million.

On the other hand, Bitwise's BITB recorded a net inflow of $6.71 million. Fidelity's FBTC, ARK Invest's ARKB, Franklin Templeton's EZBC, Valkyrie's BRRR, and Grayscale's mini ETF (BTC) saw no net inflows or outflows.

Contrary to the Bitcoin spot ETF fund flows, the price of Bitcoin rebounded on this day. Based on the Binance Tether (USDT) market, Bitcoin is trading at around $81,700, up 7.8% from the previous day. Previously, Bitcoin had retreated to the $74,000 level due to tariff policy impacts, but surged after US President Donald Trump's announcement of a mutual tariff suspension, breaking through the $83,500 level during the day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)