Steel, Cars, and Other Key Korean Export Items Still Face 25% Tariffs…Semiconductors Also in the Crosshairs

Summary

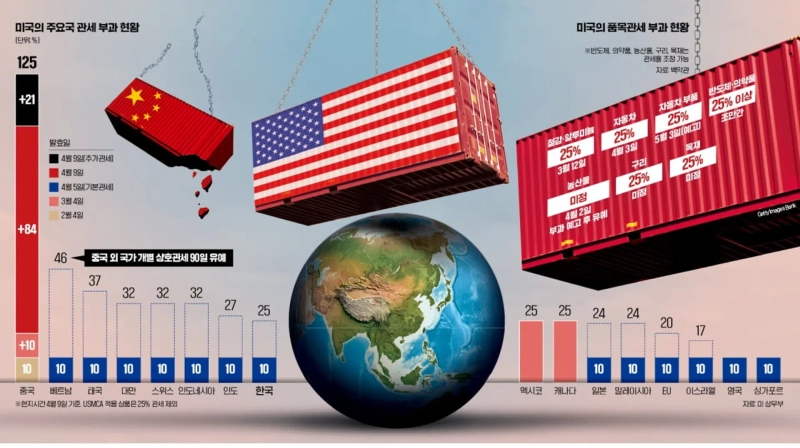

- The United States has reported that it still imposes a 25% tariff on key Korean export items such as steel and automobiles.

- With the deferral of Vietnam's tariffs, it is expected that Samsung Electronics will be able to maintain profitability through advance production at its factories.

- It has been analyzed that if the ultra-high tariffs on China continue, Korea is likely to be affected by the US-China trade conflict.

Trump Tariffs Currently in Effect

Vietnam Also Exempted…Samsung Breathes a Sigh of Relief

The United States has deferred imposing individual reciprocal tariffs on over 70 countries excluding China, resulting in only a 10% basic reciprocal tariff and previously implemented tariffs on steel, aluminum, and automotive items (25%) being applied to Korean exports. Particularly, the same measure has been applied to Southeast Asian countries, where high tariffs of around 40% were anticipated, allowing domestic conglomerates with manufacturing plants in Vietnam to breathe a sigh of relief.

According to the Ministry of Trade, Industry and Energy on the 10th, the basic tariff rate for Korean products exported to the United States is currently 10%. Previously, the reciprocal tariff rate imposed by the United States on Korea due to its trade surplus was 25%, which included a basic tariff of 10% plus an additional 15%, but the 15% has been deferred.

The United States has announced ultra-high tariffs of 48% on Cambodia, 36% on Laos, 46% on Vietnam, and 36% on Thailand. These countries' tariff rates have also been lowered to 10%, allowing Korean semiconductors and smartphones, which are mainly produced in these countries, to narrowly avoid impact. Samsung Electronics has mobile factories in Thai Nguyen and Bac Ninh, Vietnam, producing about half of its smartphones. With the deferral of Vietnam's tariffs, there is speculation that Samsung Electronics may actually benefit. Kim Dong-won, a researcher at KB Securities, analyzed, "Samsung Electronics can increase supply through advance production during the 90-day grace period and secure time to adjust production volumes at its eight production bases." On the other hand, Apple, which produces iPhones at its Foxconn factory in China, must pay the ultra-high tariff of 125% imposed on China.

However, there are considerable concerns that if the US-China tariff war intensifies, Korean exports will inevitably be affected. A government official said, "If exports and imports between the US and China shrink, China may use Korea as a bypass export route, and the US may take issue with this, creating a sandwich situation."

Lee Jun-yeop, a professor of international trade at Inha University, said, "Although exports to China have decreased, China is still a major export destination for Korea, and if Chinese trade shrinks, the impact on Korea will inevitably be significant," adding, "As China devalues the yuan, the pressure to devalue the won will also increase." If China's 'product dumping' intensifies with the devaluation of the yuan, the impact on the domestic market could also grow.

The 25% tariff on automobiles, Korea's top export item last year, is still being imposed, and there is no sign of the automotive parts tariff scheduled for the 3rd of next month being canceled. Some in the government are concerned that if the semiconductor tariff, which President Trump has pressured to impose at over 25%, becomes a reality, it would be no different from applying a 25% reciprocal tariff to Korea.

Reporters: Kim Dae-hoon/Kim Ri-an daepun@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Today’s key economic and crypto calendar] Remarks by Fed Governor Christopher Waller, among others](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] AI tech shares draw bargain hunting, lifting markets together… Dow sets another record high](https://media.bloomingbit.io/PROD/news/c018a2f0-2ff5-4aa8-90d9-b88b287fd926.webp?w=250)