Editor's PiCK

Bitcoin Breaks Through $80,000, What's Next?…Expectations Rise with U.S. State Governments' Reserve Moves

Summary

- It was stated that if the U.S. state governments' Bitcoin reserve moves expand, it could increase market trust and act as an additional driving force for further rise.

- Several states, including Arizona and Texas, are promoting Bitcoin-related bills, which are expected to expand the long-term demand for Bitcoin.

- The state governments' Bitcoin reserves could induce buying forces from global countries and companies, potentially promoting a price rebound for Bitcoin.

Bitcoin Rebounds on Tariff Policy Deferral

Expansion of U.S. State Governments' Bitcoin Reserve Moves

Institutional Demand Basis 'Further Rise' Expectations

The global virtual asset (cryptocurrency) market rebounded sharply on the 9th (local time) following U.S. President Donald Trump's announcement of a mutual tariff deferral. Bitcoin, which had plummeted due to tariff strengthening, regained the $80,000 level thanks to the easing measures. In addition, there is growing expectation that the U.S. state governments' push for a 'strategic reserve' of Bitcoin could act as an additional driving force for the rise.

President Trump announced on the 2nd (local time) that a minimum tariff of 10% would be imposed on most goods imported into the U.S., and separate mutual tariffs would be applied to 57 countries. On the 5th, he decided to impose mutual tariffs of up to 50% on over 80 countries, including South Korea, which took effect on the 9th. However, on the same day, President Trump announced via Truth Social that mutual tariffs would be deferred to 10% for 90 days for 75 countries excluding China.

The New York Stock Exchange, which had plummeted immediately after the tariff policy took effect, turned into a surge. On this day, the S&P 500 index rose 9.52% to close at 5456.90, recording the largest single-day gain since 2008. The Dow Jones index soared 2962.86 points (7.87%) to 40608.45, and the Nasdaq Composite index rose 12.16% to close at 17124.97. These are the largest gains since 2020 and 2001, respectively. According to CNBC, 30 billion shares were traded on this day, marking the highest daily trading volume in Wall Street history.

Bitcoin also showed a rebound trend. Bitcoin, which had fallen to the $74,000 level on the 8th, recovered to the $83,000 level on the 9th based on the Binance Tether (USDT) market, rising about 8% from the previous day. Ethereum (ETH) surged 13.7% to surpass $1,670, while XRP and Solana (SOL) also rose 14% and 12.4% to $2 and $119, respectively.

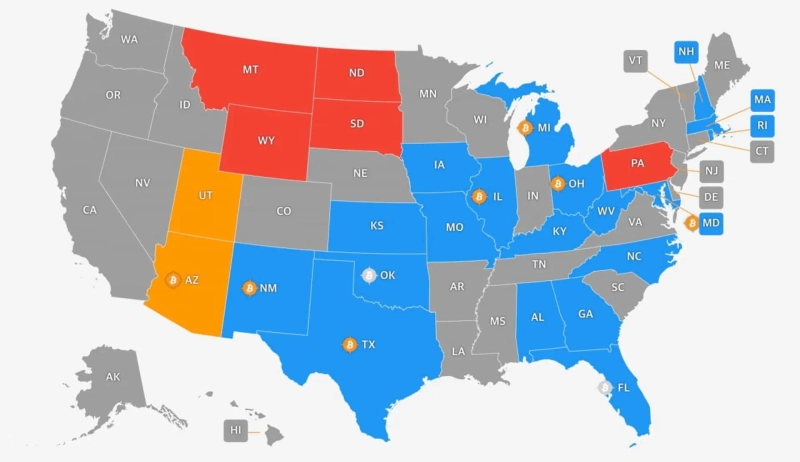

Amidst this short-term rebound trend, there is analysis that the U.S. state governments' move to strategically assetize Bitcoin could add institutional trust to the market. Currently, 26 states in the U.S. have proposed Bitcoin and digital asset reserve bills. Among them, related bills were rejected in five states: Montana, Wyoming, North Dakota, South Dakota, and Pennsylvania.

The region where the virtual asset reserve bill is being promoted most quickly is Arizona. Arizona is simultaneously promoting the 'Digital Asset Strategic Preparedness Fund Establishment Bill (SB 1373)' and the 'Bitcoin Reserve Fund Creation Bill (SB 1025)', both of which passed the full House committee on the 3rd. Only the third plenary session and the final House vote remain before the bills are enacted, after which they are expected to be formally legislated with the governor's signature.

Texas also passed the 'Strategic Bitcoin Reserve and Investment Act (SB 21)' in the Senate on the 8th of last month, and Florida is pursuing a bill to use Bitcoin as an inflation hedge for state government funds. Michigan has proposed a bill allowing up to 10% of total funds to be invested in virtual assets.

In South Carolina, the Bitcoin Reserve Bill (H4256) has also been proposed. This bill allows the state treasurer to invest up to 10% of the total funds in Bitcoin and sets a maximum holding limit of 1 million Bitcoins (approximately $77 billion).

If such strategic assetization moves at the state government level spread, it is expected to increase market trust in terms of expanding the demand base for Bitcoin and institutional inclusion. Global asset management firm VanEck analyzed in a report last February that if U.S. state governments introduce Bitcoin reserve bills, new demand of up to 247,000 BTC, or about $19 billion, could arise.

Seokmoon Jeong, director of Presto Research Center, analyzed, "The passage of state governments' Bitcoin reserve bills is like the influx of new long-term buyers," adding, "This could positively impact Bitcoin's image improvement and general investors' accessibility."

Seungsik Yoon, senior researcher at Tiger Research, also predicted, "If state governments start to reserve through market purchases, unlike the federal government's use of confiscated assets, it could trigger buying movements by global countries and companies," adding, "This could affect the price rebound of Bitcoin."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)