[Analysis] "Institutions Reduce Bitcoin Positions... Indicating Late Bull Market"

Summary

- Institutions are reportedly significantly reducing their net buying positions in Bitcoin.

- The net buying positions of non-institutional investors in Bitcoin are reportedly on the rise.

- It may indicate a shift in market structure, which could be a typical phenomenon observed in the late stages of a bull market.

It appears that institutions are reducing their net buying positions in Bitcoin (BTC).

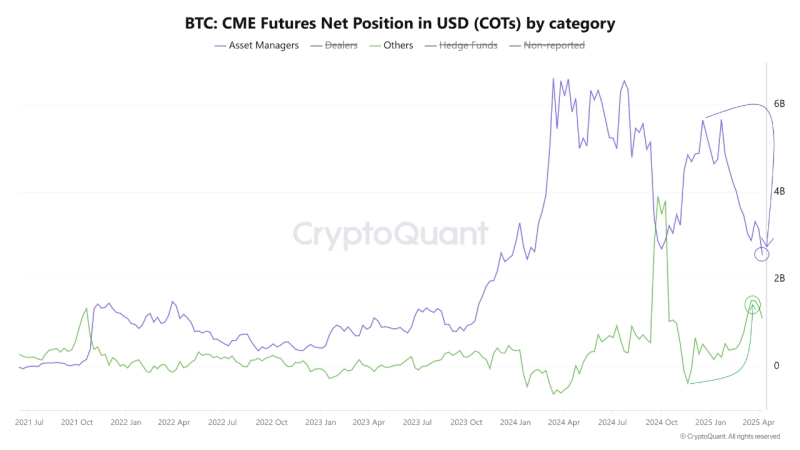

Amr Taha, a contributor to CryptoQuant, stated on the 17th, "(Asset managers) have significantly reduced their net buying positions in Bitcoin," adding that "the positions are currently around $2.5 billion." He noted, "The net buying positions of asset managers peaked at around $6 billion at the end of last year," and explained that "reducing positions is clearly interpreted as profit-taking or deleveraging."

On the other hand, the net buying positions of non-institutional investors in Bitcoin are on the rise. Amr Taha mentioned, "Recently, the net buying positions of (non-institutional investors) have surged, reaching approximately $1.5 billion," and noted that "this is the highest level in the past year." He further added, "This trend may indicate a shift in market structure," and "(especially) it could be a typical phenomenon observed in the late stages of a bull market."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Exclusive] South Korea’s FSS to look into ZKsync coin after a 1,000% surge in just three hours](https://media.bloomingbit.io/PROD/news/073d8ae6-ffa0-4b8b-85dd-3f131d9eb908.webp?w=250)