Summary

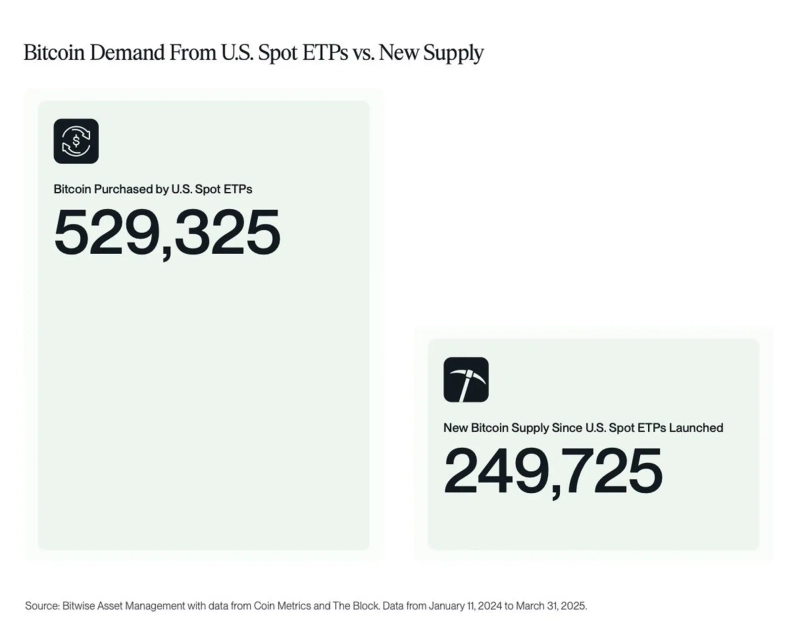

- It was reported that the US Bitcoin spot ETF purchased about 2.1 times the amount of newly mined Bitcoin.

- The active purchases by the Bitcoin spot ETF are interpreted as a supply shortage effect, acting as a catalyst for price increases.

- Bitcoin is currently experiencing fluctuations due to President Donald Trump's tariff policies.

It has been revealed that the US Bitcoin (BTC) spot Exchange-Traded Fund (ETF) has absorbed more than twice the amount of newly mined Bitcoin since its launch.

According to Cointelegraph on the 19th (local time), the Bitcoin spot ETF traded in the US has purchased a total of 529,325 Bitcoins since its launch. This is approximately 2.1 times the 249,725 Bitcoins newly mined during the same period.

This phenomenon is interpreted as a catalyst for the rise in Bitcoin prices. This is because the rapidly absorbed volume in the market leads to a 'supply shortage' effect, reducing the number of Bitcoins available for circulation.

However, currently, Bitcoin is experiencing fluctuations due to US President Donald Trump's tariff policies. On this day, Bitcoin is trading at around $84,860, up about 0.1% compared to the previous day in the Binance Tether (USDT) market.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)