Summary

- The Swiss National Bank has officially rejected the idea of incorporating Bitcoin into its foreign exchange reserves.

- Due to issues of volatility and liquidity, virtual assets do not meet Switzerland's currency reserve requirements, according to President Schlegel.

- In this context, the Bitcoin Initiative argued that including Bitcoin would bring significant returns, but both Swiss authorities and the European Central Bank remain skeptical.

The Swiss National Bank (SNB) has officially rejected the idea of incorporating Bitcoin (BTC) into its foreign exchange reserves. The main reasons are the liquidity and volatility issues of the virtual asset (cryptocurrency) market.

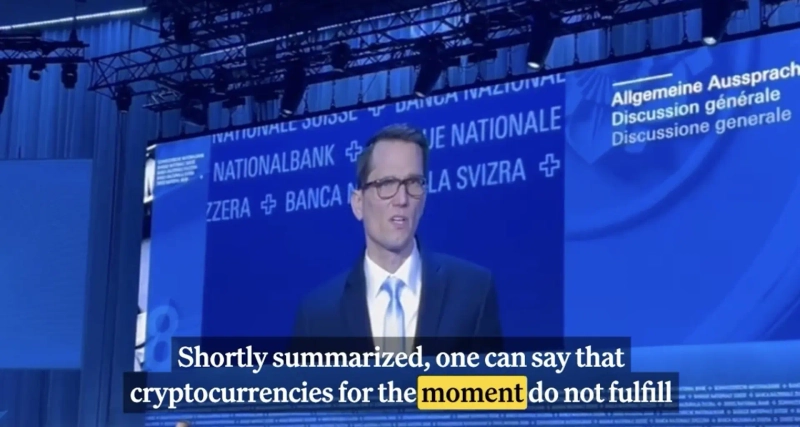

According to CoinDesk on the 26th (local time), SNB President Martin Schlegel stated in a speech at the general meeting, "The virtual asset market may seem to have good liquidity under normal circumstances, but naturally raises questions in times of crisis," and "Furthermore, virtual assets are well-known for their high price volatility, posing risks from the perspective of long-term value preservation." He added, "In other words, at this point in time, virtual assets do not meet Switzerland's currency reserve requirements."

President Schlegel's remarks came in response to a question about the research results from the Bitcoin Initiative, which has advocated for the inclusion of Bitcoin. The Bitcoin Initiative claimed through research that "if Bitcoin were included in the Swiss sovereign wealth fund at a 1% ratio, the returns since 2015 would have nearly doubled."

Meanwhile, the European Central Bank (ECB) also maintains a negative stance on Bitcoin. ECB President Christine Lagarde has repeatedly criticized Bitcoin as a 'worthless asset' and a 'means associated with money laundering.' Earlier this year, she stated, "Bitcoin will never be included in the foreign exchange reserves of any central bank under the ECB."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)