"Bitcoin Inflow Fund Flow Recovery... Institutional Proportion Rapidly Increasing" [Token 2049 Dubai]

Summary

- It was reported that the recent fund flow into Bitcoin ETFs is changing to be institution-centered.

- Robert Michnick emphasized that it can take a long time for asset management companies to introduce ETFs, and this is a continuing change.

- Jan van Eck stated that Bitcoin, along with gold, is being recognized as an alternative to traditional assets, and some investors are classifying it as a safe asset.

There is an opinion that the nature of the fund flow into Bitcoin (BTC) Exchange Traded Funds (ETFs) is changing to be institution-centered.

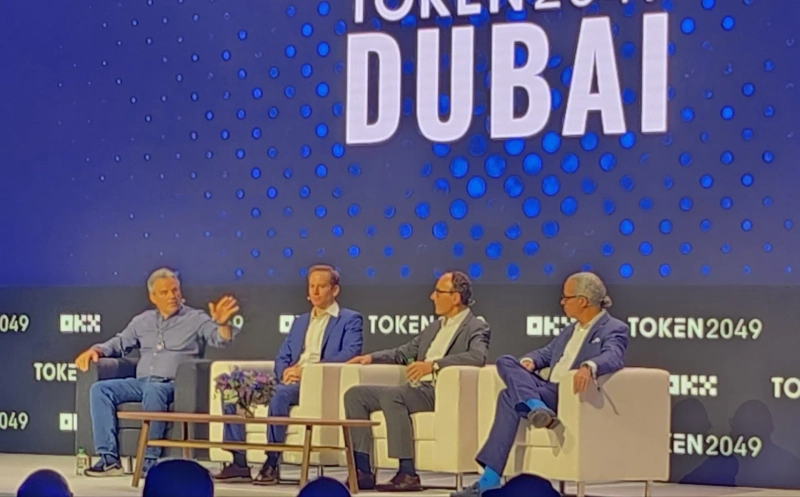

On the 30th (local time), Robert Michnick, BlackRock Digital Asset Head, said in a panel discussion at the Token 2049 Dubai conference held at Madinat Jumeirah, Dubai, "At the time of the ETF launch, the initial fund inflow was mainly from individual investors, including large asset holders. However, as recent adjustments have been made, the proportion of institutions and asset management companies is increasing."

He added, "In the case of asset management companies, it can take a long time to verify before introducing ETF products, so it can take a long time. This is not a temporary phenomenon but a continuing change."

Jan van Eck, VanEck CEO, also predicted that the upward trend due to continuous institutional fund inflow will continue. VanEck said, "Gold and Bitcoin have both reached all-time highs this year. However, investors are not properly recognizing this due to uncertainties. Bitcoin is being recognized as an alternative to traditional assets along with gold by institutional investors."

He also mentioned that some investors are diversifying their assets by recognizing Bitcoin as a safe asset. He said, "Some investors are classifying Bitcoin as a safe asset and diversifying their assets from gold to Bitcoin," adding, "The market was stabilized as ETFs and MicroStrategy absorbed the dumping volume."

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)