Summary

- PayPal announced that it would offer an annual interest of 3.7% to holders of its stablecoin 'PayPal USD' to expand its market share.

- Experts stated that the high interest rates of stablecoins could pose a threat to traditional banking.

- It was reported that investors should carefully consider the guarantee of principal and interest as stablecoins lack legal protection.

"3.7% Annually When Deposited"... Dollar Coin Competes with Banks for Interest

The Onslaught of Stablecoins

(8) Stablecoins Threatening Traditional Banking

PayPal Aiming to Increase Market Share

High Interest for Coin Holders

Domestic Savings Accounts Offer 0.1% Annually

Overseas Exchanges Offer 4-6% Rewards

Clear Drawbacks... No Deposit Protection

Weak Security, Uncertain Recovery in Case of Hacking

Concerns of Sanctions if Considered Unauthorized by Authorities

Global digital payment platform company PayPal recently announced that it would offer an annual interest of 3.7% to holders of its stablecoin 'PayPal USD'. PayPal USD is a US dollar-pegged stablecoin introduced by PayPal in August 2023. It can be cashed out, transferred, and used for payments through the PayPal app. Minseung Kim, head of the Korbit Research Center, said, "It is interpreted as a strategy to increase dominance in the stablecoin market," and "Offering high interest rates could pose a threat to traditional banking."

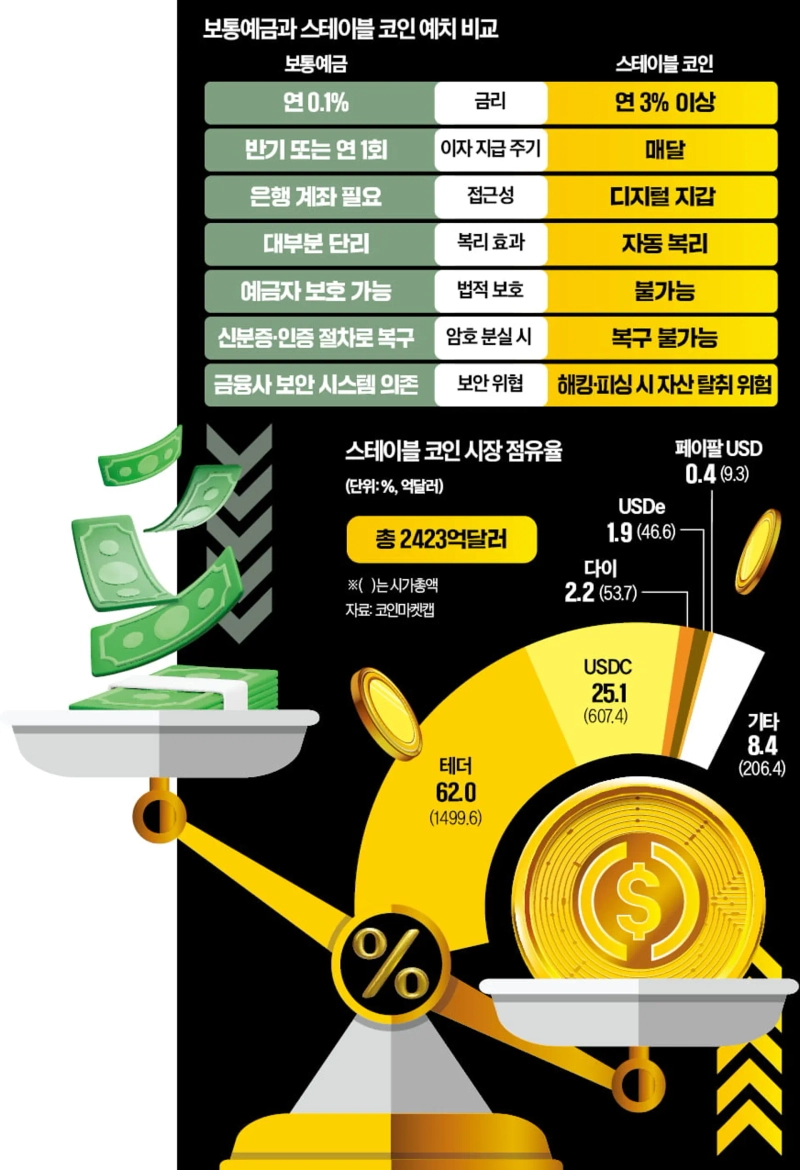

◇Higher Interest than Regular Savings

According to the cryptocurrency industry on the 12th, companies related to stablecoins are competing with commercial banks for 'interest'. PayPal decided to pay an annual interest of 3.7% in the form of PayPal USD to holders from this summer. PayPal's high-interest reward plan is to expand the market share of PayPal USD. The market capitalization of PayPal USD is 930 million dollars, approximately 1.3 trillion won. It falls far short compared to Tether (USDT, 149.9 billion dollars) and USD Coin (USDC, 60.7 billion dollars).

Overseas cryptocurrency exchanges like Binance also offer 4-6% rewards for depositing stablecoins. In the cryptocurrency market, this is called 'staking'. An industry official said, "The average interest on regular savings in the US is 0.41% annually," adding, "Depositing stablecoins can yield a real return that exceeds inflation."

In Korea, the interest rate for regular savings accounts, which allow free deposits and withdrawals, is around 0.1% annually. Since customers can withdraw at any time, banks find it difficult to use the deposited money for long-term loans or high-yield aggressive investments. This is why the interest rate is very low. However, stablecoins provide high interest (rewards) by operating the deposited assets with high returns or running a platform's own reward budget. PayPal plans to pay interest just for holding without any deposit period restrictions.

Stablecoins also differ from traditional finance in terms of interest payment methods. Generally, banks provide interest on regular savings every six months. Most term deposits pay interest at maturity. Most stablecoin platforms automatically pay interest daily or monthly. Bank deposits are mostly simple interest, but stablecoins consider the paid coins as deposited assets, resulting in a compound interest effect.

◇Uncertain Legal Status

Opening a bank account requires a complicated procedure. An ID such as a resident registration card, driver's license, or passport is needed. Real-name verification is required under the real-name financial system. Additionally, when opening a new account in Korea, the purpose must be clearly stated. If the purpose is unclear, account opening may be refused. In contrast, a digital wallet for storing stablecoins can be obtained by downloading an application that provides wallet services. It opens a way for financially marginalized groups to save and earn interest income.

There are also clear disadvantages to depositing stablecoins. Legally, the principal and interest are not guaranteed. In Korea, deposit protection is available up to 50 million won. In the US, it is guaranteed up to 250,000 dollars. If the issuer of a stablecoin goes bankrupt, it is difficult to recover assets. Additionally, they are vulnerable to security issues, and recovery responsibility is unclear in case of hacking. Managing the private key, a type of password assigned to the wallet, is also not easy. The private key is a very long password mixed with numbers and alphabets. If this information is lost, the wallet cannot be used permanently.

The uncertain legal status is also a risk factor. For example, if a country considers stablecoin deposit services as 'unauthorized banking', there is a possibility of sanctions.

Reporter Mihyun Cho mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)