Summary

- It was reported that there is an increase in cases where foreign workers in Korea receive wages using stablecoins.

- Blockchain-related startups are considering providing incentives in virtual assets to attract top talent.

- It was explained that due to legal regulations, it is difficult to pay wages in virtual assets, and stablecoins are unlikely to be recognized as legal currency.

Hankyung CHO Insight

Attorney Koo Ja-hyung's 'Issue Plus'

According to recent media reports, there is an increasing number of cases where foreign workers residing illegally in Korea are receiving wages in stablecoins. The main reasons cited are that wages can be received with just a digital wallet without a bank account, and remittances can be made to their home countries immediately with low fees. It is also considered a way to bypass regulations that may arise during the payment or remittance process, and it seems to be becoming a practice in some industries.

However, if a domestic company officially pays wages to its employees in virtual assets, it becomes a completely different issue. Especially among startups related to blockchain technology, companies have been discussing for years the method of paying their workforce in coins as if they were stock options. This is considered because companies can secure excellent talent at a relatively low cost, and employees can potentially earn high returns. Furthermore, companies engaged in blockchain-related business have a demand to issue their own coins and pay employees with them as wages to gain promotional effects and share the results of growth with employees.

However, these attempts have not been properly realized mainly due to the strict regulations of the Labor Standards Act regarding the method of wage payment. Article 43 of the Labor Standards Act stipulates that "wages must be paid in full directly to the worker in currency," and only exceptions are recognized if there are special provisions in laws or collective agreements. Here, 'currency' means the legal tender in Korea, namely the Korean won. Such regulations are commonly confirmed in many countries, and the International Labour Organization (ILO) Wage Protection Convention explicitly stipulates payment in currency, stating that "wages paid in money must be paid in legal tender, and payment in the form of promissory notes, receipts, or vouchers or any other form claimed to replace legal tender must be prohibited" (Article 3).

In Korea, cases where exceptions to the currency payment principle are recognized by law are very rare, and one can find a provision in the Seafarers Act that allows part of the wages to be paid in the currency circulating at the port of call (Article 52 of the Seafarers Act). In addition, there is a provision in the Minimum Wage Act regarding the inclusion of 'wages paid in forms other than currency' in the minimum wage, but it is difficult to see it as directly stipulating an exception to the currency payment principle. In the past, some local governments stipulated by ordinance that part of the wages could be paid in local currency, but the Ministry of Government Legislation interpreted that an ordinance with effect limited to the jurisdiction of a local government cannot serve as a basis for recognizing exceptions to the currency payment principle.

There was also a review to formalize the method of payment in virtual assets through collective agreements. As mentioned earlier, Article 43 of the Labor Standards Act allows exceptions to payment methods other than currency through collective agreements. However, in reality, it was difficult to obtain the consent of labor unions to secure special compensation means for some talents, and in many companies, there is no union itself, making it difficult to be a practical alternative.

Then, is it possible to pay virtual assets as a bonus rather than 'wages'? Some companies are known to have actually considered this method. Since the currency payment principle under the Labor Standards Act applies only to 'wages', if a bonus is not considered wages, it is possible to pay bonuses in virtual assets. However, there is still a hurdle as the argument continues that if bonuses are paid continuously and regularly to workers based on collective agreements or employment rules, they are considered wages, making it not completely free from the controversy over the wage nature of bonuses. In particular, in the case of general virtual assets, the high volatility of value means that if the value plummets after payment, workers are likely to raise issues, and once an issue is raised, disputes may spread over the wage nature of bonuses.

It is also possible to consider paying virtual assets in the form of welfare points. Welfare points paid as part of a selective welfare system are not considered wages under the Labor Standards Act (Supreme Court en banc decision 2016Da48785 on August 22, 2019), so payment in the form of virtual assets is considered possible. However, welfare points are relatively small in amount, making it difficult to achieve the promotional or talent attraction purposes intended by companies, and the procedural complexity such as internal regulation adjustments is cited as a difficulty.

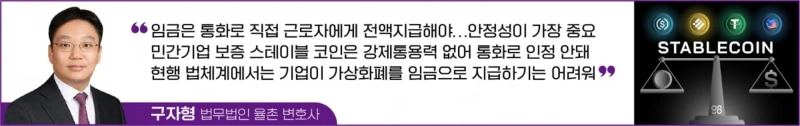

If stablecoins are officially allowed, could this solve these problems? Stablecoins are virtual assets designed to have stable prices by being linked to specific legal tender (e.g., US dollars). Some presidential candidates and political circles have mentioned the possibility of won-based stablecoins along with discussions on central bank digital currency (CBDC), and the Bank of Korea is also conducting research on stablecoins. However, since stablecoins guaranteed by private companies do not have legal tender status like state-issued legal tender, even if the issuance of stablecoins based on the won is allowed, it is still likely not to be recognized as 'currency' under the Labor Standards Act.

In conclusion, under the current legal system, it is fundamentally difficult for companies to pay wages in cryptocurrency. Although technology is evolving and industries are rapidly changing, wage payment is a core right of labor and a matter directly related to survival, so the law still emphasizes stability. However, now is the time for institutional discussions that can harmoniously connect technological advancement and legal stability rather than simple prohibition. The ILO Wage Protection Convention also strictly prohibits wage payment in forms other than currency, but states that "where payment in kind is customary or desirable due to the nature of the industry or occupation," such payment is allowed. It is considered a time to explore 'desirable' payment methods, limited to some bonuses or selective salaries, in industries or companies closely related to virtual assets, with the company or parent company guaranteeing the payment.

Attorney Koo Ja-hyung, Yulchon LLC

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)