Summary

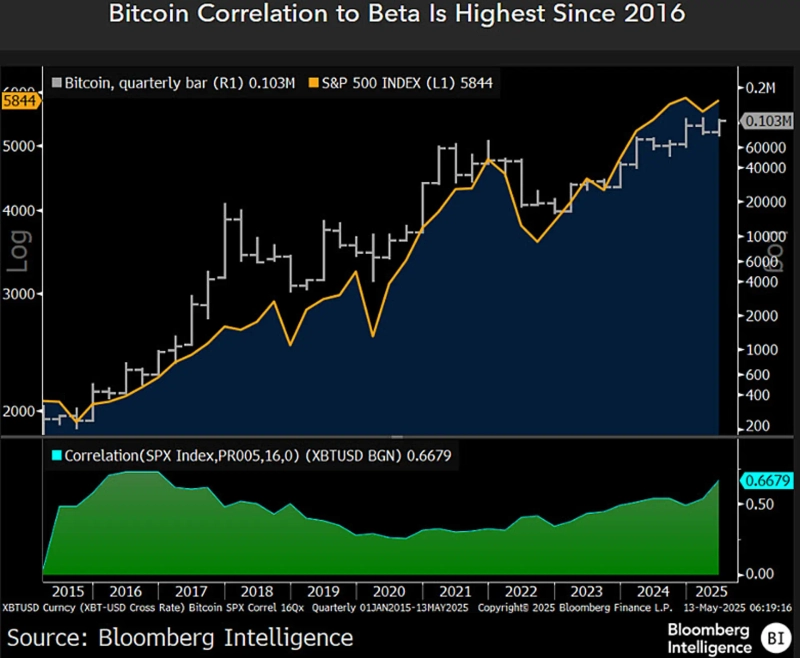

- Mike McGlone, Senior Macro Strategist at Bloomberg, analyzed that Bitcoin is more similar to a stock leverage asset than digital gold.

- Bitcoin has a high correlation with the S&P500, with a beta indicator of about 3 times compared to gold's about 1 time, indicating it is more influenced by the stock market.

- Due to the overheating of the S&P500, if stocks do not rise, Bitcoin is expected to weaken, while gold is said to show a stable trend.

An analysis has emerged that Bitcoin (BTC) is closer to a 'Leveraged Beta' asset linked to the stock market rather than holding the status of digital gold.

On the 13th (local time), Mike McGlone, Senior Macro Strategist at Bloomberg Intelligence, stated on X (formerly Twitter), "Bitcoin currently has a high correlation with the S&P500, and this figure continues to rise," adding, "It is closer to a leveraged beta asset than digital gold." He further explained, "The Bitcoin beta indicator for the S&P500 is about 3 times, while gold is about 1 time," and added, "The important factor for Bitcoin's rise is the stock market."

He also predicted that Bitcoin might underperform compared to gold. He said, "The S&P500 is currently overheated. A correction is expected in the future," and "If stocks do not rise, Bitcoin will show a weaker performance compared to gold." He continued, "Considering the past 4-year cycle, if Bitcoin does not maintain its upward trend, it could face higher risks," and "On the other hand, gold is likely to show relatively stable price movements."

Meanwhile, a leveraged beta asset refers to a high-risk asset whose returns fluctuate more significantly when the market moves.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit