Summary

- The US April Consumer Price Index (CPI) growth rate was lower than expected, positively impacting the market.

- Despite the Trump administration's tariff war, the core CPI growth rate excluding energy and food matched expectations.

- It is anticipated that the price impact from tariffs will start to appear significantly from the May CPI.

Lowest in 4 Years Since February 2021

Core Inflation Also Rises 0.2% from Previous Month

Food Prices Fall for the First Time in a Year

"Tariff Impact Not Yet Reflected"

The US April Consumer Price Index (CPI) growth rate fell below market expectations. It was anticipated that the tariff war by the Donald Trump administration would spur inflation, but it recorded the smallest increase since February 2021.

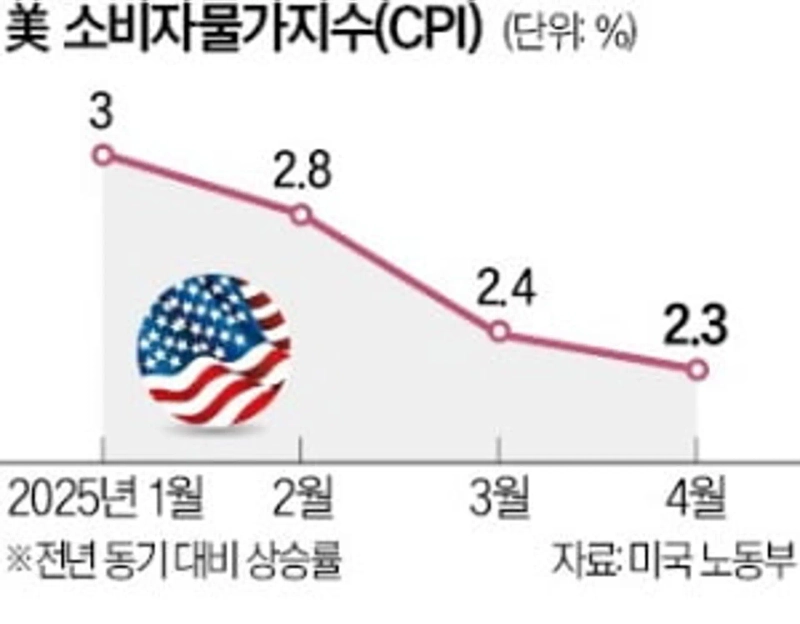

According to the US Department of Labor on the 13th, the April CPI rose 2.3% compared to the same month last year. This figure slightly falls short of the expert forecast (2.4%) compiled by Dow Jones. Not only did the increase slow compared to March (2.4%), but it also marked the lowest growth rate in 4 years since February 2021 (1.7%). The month-on-month CPI growth rate was also 0.2%, lower than the expected 0.3%. Excluding the volatile energy and food sectors, the core CPI rose 2.8% year-on-year and 0.2% month-on-month, matching market expectations (2.8%, 0.3%).

The April CPI figures were expected to reflect the inflation impact of the Trump administration's tariff war. However, according to the CPI report, airfare, hotel rates, used car and truck prices, and clothing costs generally declined. Food prices showed a downward trend for the first time in a year. New car prices remained flat. However, prices for imported furniture and appliances surged.

Experts analyzed that companies stockpiled inventory in large quantities before raising prices, resulting in a modest inflation increase. They expected the price impact from tariffs to start showing significantly from the May CPI. Bank of America (BoA) assessed it as an indicator showing "calm before the tariff storm."

Economists predicted that the risk of a US recession has somewhat decreased due to tariff reductions between the US and China, but the uncertainty of tariff policies continues, and inflation is expected to rise this year. However, with the US and China entering a 90-day tariff truce, the increase rate is not as steep as expected, and the US Federal Reserve (Fed) is also expected to maintain a wait-and-see approach.

Reporter Sangmi Ahn saramin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)