Summary

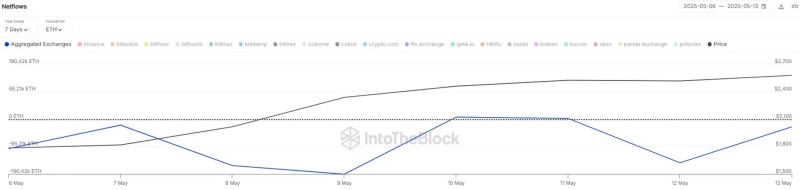

- It was reported that over $1.2 billion worth of Ethereum has been withdrawn from centralized exchanges over the past week.

- Since May, investors have been accumulating Ethereum for the long term rather than selling it.

- The withdrawal of cryptocurrencies from exchanges is considered a positive signal for price increases, with Ethereum rising 7.13% in 24 hours.

Over the past week, a large amount of Ethereum (ETH) has been withdrawn from centralized exchanges (CEX).

On the 14th (local time), Centora (formerly IntoTheBlock) stated on X (formerly Twitter) that "$1.2 billion worth of Ethereum has been withdrawn from exchanges over the past 7 days," adding that "since May, investors have been accumulating Ethereum for the long term rather than selling it." They also noted that "selling pressure is also decreasing."

Typically, the withdrawal of cryptocurrencies from exchanges is considered a positive signal for price increases as it reduces the supply of tradable cryptocurrencies.

As of 5:22 PM, Ethereum is trading at $2,630 on the Binance USDT market, up 7.13% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit