KDI Lowers This Year's Growth Rate from 1.6% to 0.8%... "Next Year Also in the 1% Range"

Summary

- The Korea Development Institute (KDI) announced that it has lowered this year's growth rate forecast from 1.6% to 0.8%.

- It explained that U.S. tariff policies and domestic demand slump hinder growth, and it is expected to remain in the 1% range next year.

- KDI emphasized the need for an additional base rate cut to stimulate the economy.

Significantly Below Potential Growth Rate of 1.8%

Continued Domestic Demand Slump and Sharp Decline in Exports

Construction Investment -4.2%·Private Consumption 1.1%

"Need for Additional Base Rate Cut This Year"

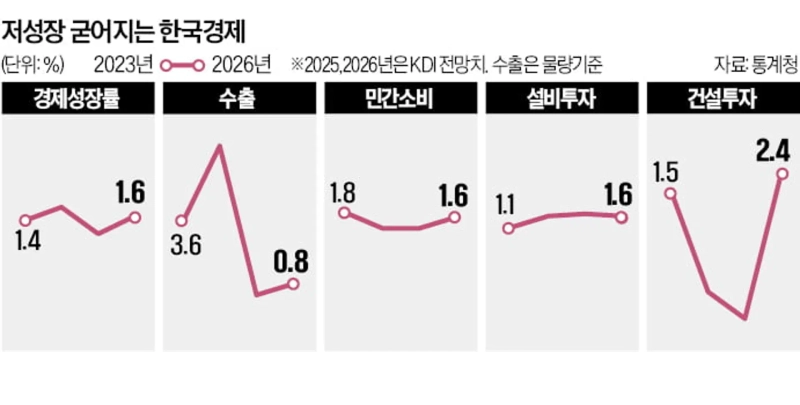

The Korea Development Institute (KDI) has significantly lowered this year's growth rate forecast for South Korea from the previous 1.6% to 0.8%. This is due to the continued slump in domestic demand, including the construction industry, and the expectation that exports will also deteriorate due to U.S. tariff policies. KDI also predicts that next year's growth rate will remain in the 1% range.

In the '2025 First Half Economic Outlook' released on the 14th, KDI presented this year's growth rate at 0.8%. This is half of the February forecast (1.6%). KDI explained that "external variables, including U.S. tariff impositions, reduced the growth rate forecast by 0.5 percentage points, and domestic demand slump variables reduced it by 0.3 percentage points."

Jeong Gyuchul, head of KDI's Economic Outlook Office, explained, "We did not expect the U.S. tariff policy to be implemented so quickly," and "the recovery of consumer sentiment has been slower than expected, and the slump in the construction sector has continued."

KDI expects this year's total export growth rate (in volume terms) to be 0.3%, significantly below last year's growth rate (7.0%). It forecasts that goods exports will decrease by 0.4% compared to the previous year. This is based on the observation that trade between countries will decrease significantly due to the U.S.-initiated trade war.

This year's domestic construction investment is expected to decrease by 4.2% compared to last year. Last year, it also decreased by 3% compared to the previous year, and this year the decrease is expected to be larger. The private consumption growth rate is expected to maintain the same level as last year at 1.1%. The facility investment growth rate is expected to rise to 1.7% from last year's 1.6%.

KDI also believes that if the U.S. maintains high tariff rates while countries respond with retaliatory tariffs, the growth rate could fall further. It analyzed that if the housing market continues to deteriorate, further damaging the financial structure of construction companies, it could act as a downward pressure on the economy.

KDI's growth rate forecast for this year is lower than that of the Bank of Korea (1.5%) and the International Monetary Fund (IMF·1.0%) but higher than that of Hyundai Research Institute (0.7%), JP Morgan (0.5%), and Citi (0.6%).

On the 5th, KDI presented South Korea's potential growth rate for this year at 1.8%. It sees the actual growth rate as being 1 percentage point below the potential growth rate. If this year's growth rate falls below the potential growth rate, next year's growth rate usually rises based on the base effect. However, KDI presented next year's growth rate forecast at 1.6%, the same as the potential growth rate. It seems to believe that the aftereffects of the U.S. tariff policy will continue next year, and the recovery will not be significant.

KDI suggested that the Bank of Korea should lower the base rate to stimulate the economy. Jeong said, "To maintain fiscal soundness, additional supplementary budgets should be approached cautiously," and "an additional rate cut is needed this year."

Kim Ikhwan Reporter lovepen@hankyung.com

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit