Editor's PiCK

[Today's Global Interest Coins] Bitcoin, AIXBT, FTT Token, and Others

Summary

- Bitcoin regained its upward price trend, attracting investors' interest, and is reported to be trading at the $104,000 range.

- AIXBT drew attention due to increased price volatility, and the focus on the AI agent theme influenced the increase in mentions.

- FTT Token gained attention ahead of the second debt repayment, which may result in some small creditors receiving 120% of their principal.

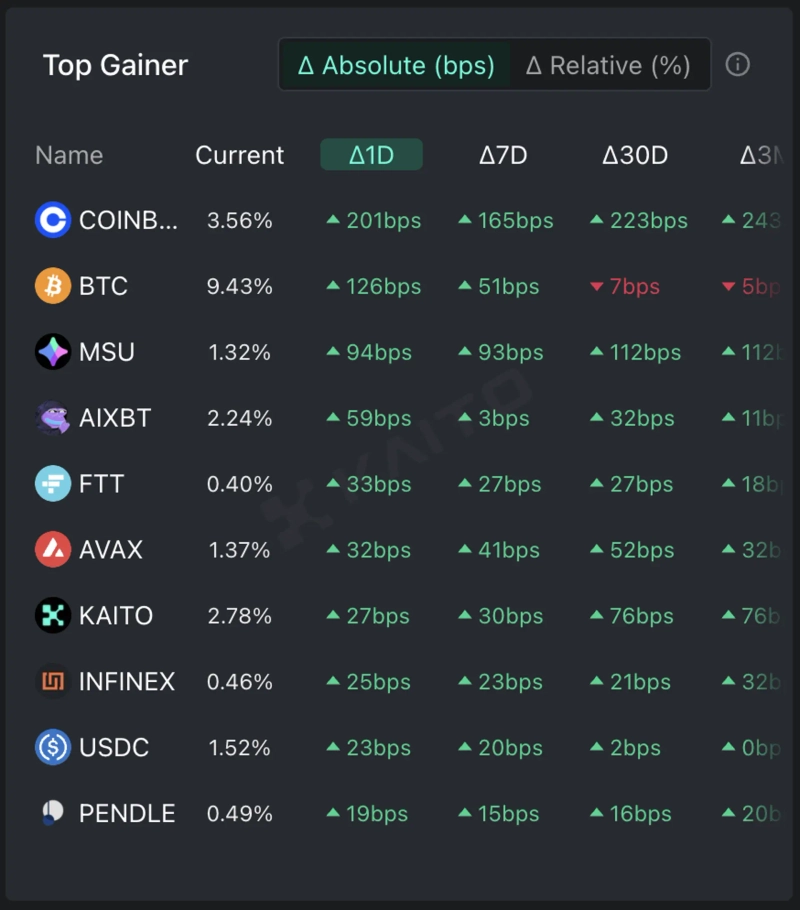

According to the Token Mindshare (a metric quantifying the influence of specific tokens in the virtual asset market) top gainer of the AI-based Web3 search platform Kaito, the top 5 virtual assets currently attracting the most attention as of the 16th are Bitcoin (BTC), AIXBT, FTT Token (FTT), Avalanche (AVAX), and Kaito (KAITO).

Bitcoin regained its upward price trend, catching the eyes of investors. Bitcoin, buoyed by the upward trend, even recovered to the $104,000 range. On CoinMarketCap, Bitcoin is trading at around $104,000, up approximately 1.2% from the previous day. The U.S. Bitcoin spot ETF recorded net inflows for two consecutive trading days from the 14th to the 15th.

AIXBT drew attention due to its increased price volatility. As of today, AIXBT is trading at around $0.18 on CoinMarketCap, down approximately 7.4% from the previous day. The heightened focus on the AI agent theme since the end of last month is presumed to have influenced the increase in online mentions of AIXBT.

FTT Token gained attention ahead of the second debt repayment of the virtual asset exchange FTX, which went bankrupt in 2022. FTT Token is the utility token of FTX, and FTX will begin the second debt repayment of $5 billion from the 30th of this month. The repayment targets users who held exchange accounts and general unsecured creditors at the time of FTX's bankruptcy in 2022. Some small creditors may receive 120% of their principal through this repayment.

Avalanche attracted investors' attention by integrating with the Avalanche-based DeFi protocol Euler and the global asset management firm BlackRock's tokenized fund BUIDL. The Block reported today that Euler and BUIDL are integrating. As a result, users can deposit BUIDL's token, sBUIDL, as collateral in Euler to borrow USD Coin (USDC), etc.

Kaito's online mentions are presumed to have increased as the foundation clarified suspicions related to market making (MM). The Kaito Foundation announced on its official X account on the 15th that it signed a contract with the MM company Web3Port on February 17th but voluntarily terminated the contract on the 27th of the same month. Web3Port, a Chinese virtual asset market maker, was embroiled in controversy over misconduct during the listing process of Movement (MOVE). The Kaito Foundation claimed, "We have not sold a single Kaito since the Token Generation Event (TGE) and are instead buying back through buybacks."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)