Summary

- Amr Taha revealed that Binance's Ethereum holdings have decreased by about 300,000 in a month.

- He reported that large investors' over-the-counter trading and staking are the causes of the decrease in Ethereum supply.

- The decrease in Ethereum supply within the exchange can reduce selling pressure and form upward price momentum.

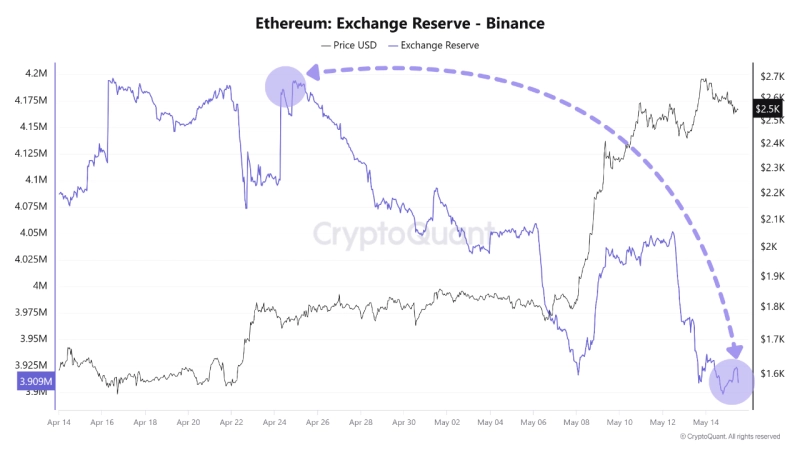

The global cryptocurrency exchange Binance's Ethereum (ETH) holdings have decreased by approximately 300,000 over the past month.

Amr Taha, a contributor to CryptoQuant, stated on the 16th through CryptoQuant, "Since the 14th of last month, Binance's Ethereum holdings have been continuously decreasing," and "As a result, Ethereum holdings have decreased by about 300,000 from mid-last month to the past month."

Amr Taha pointed to 'institutional investors' as the cause of the decrease in Ethereum holdings. Amr Taha analyzed, "Large investors may have withdrawn Ethereum for over-the-counter (OTC) trading, private investment, and staking, reducing the supply on exchanges," and "This trend lowers circulation without direct market selling." He added, "Investors may have moved Ethereum to cold wallets or DeFi protocols, reducing exchange circulation."

He also emphasized the possibility of upward price momentum. Amr Taha stated, "The 300,000 decrease in Binance's Ethereum holdings suggests a significant change in investor behavior," and "The decrease in supply within the exchange means reduced selling pressure." He continued, "If demand remains constant, the scarcity within the exchange could create upward price momentum for Ethereum."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)