Summary

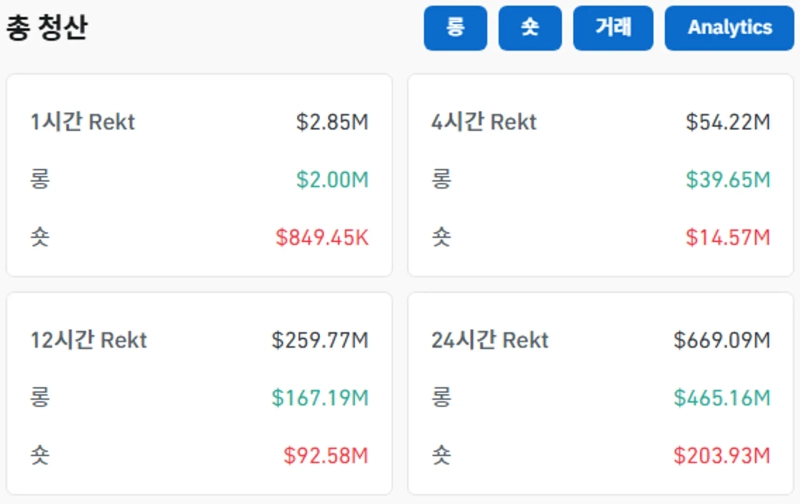

- In the past 24 hours, $669.09 million worth of positions were liquidated in the virtual asset perpetual futures market.

- Most liquidations occurred in long positions, with Bitcoin's price decline being a major factor.

- Ethereum recorded the largest liquidation volume with $264.24 million in position liquidations.

In the past 24 hours, the liquidation volume of positions in the virtual asset (cryptocurrency) perpetual futures market recorded $669.09 million.

According to CoinGlass data on the 19th (local time), a total of $669.09 million worth of futures positions were liquidated in the virtual asset market over the past 24 hours. Most of these were long (buy) position liquidations. The upward trend of Bitcoin (BTC) approaching an all-time high and then declining influenced this. Specifically, $465.16 million of long positions were liquidated, and $203.93 million of short (sell) positions were liquidated.

The asset with the largest liquidation volume was Ethereum (ETH). Ethereum saw $264.24 million in position liquidations over 24 hours, with $205.87 million in long positions and $58.37 million in short positions liquidated. Bitcoin ranked second during the same period with $173.58 million liquidated. The liquidation volumes for long and short positions were $82.27 million and $91.31 million, respectively.

As of 6:37 PM, based on Binance USDT market, Bitcoin and Ethereum are trading at $103,238 and $2,411, respectively, down 0.7% and 4.02% compared to 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit