Summary

- It was reported that BlackRock's Bitcoin spot ETF, IBIT, recorded twice the capital inflow compared to the Gold ETF this year.

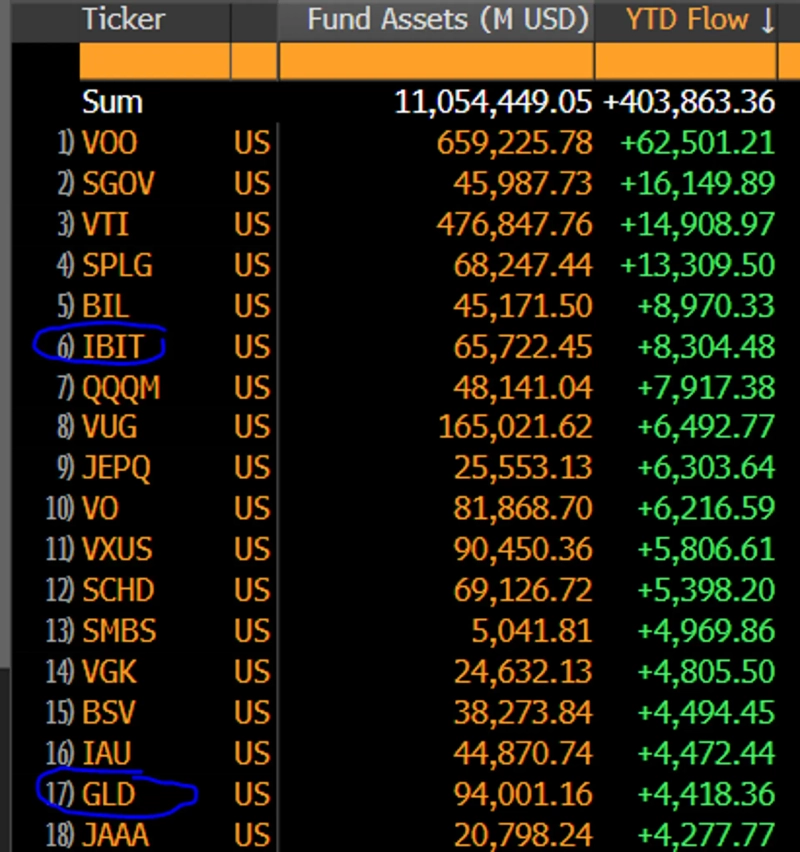

- Bloomberg analyst Eric Balchunas stated that IBIT has risen to 6th place in ETF capital inflow rankings, while GLD has fallen to 17th place.

- He mentioned the possibility that the difference in returns between Bitcoin and gold may not last long, indicating the potential for Bitcoin's rise.

This year, BlackRock's Bitcoin (BTC) spot Exchange Traded Fund (ETF), IBIT, has attracted twice the capital compared to the Gold ETF (GLD).

On the 19th (local time), Bloomberg ETF analyst Eric Balchunas stated on X (formerly Twitter), "IBIT has risen to 6th place in ETF capital inflow rankings this year, recording about twice the capital inflow compared to GLD." Meanwhile, GLD's capital inflow ranking has fallen to 17th place.

Furthermore, he noted, "Despite gold having twice the year-to-date return compared to Bitcoin, this result has occurred." He also suggested that the situation where the return difference is about twice is unlikely to last long, indicating the potential for Bitcoin's rise.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit