Editor's PiCK

"Bitcoin Expected to Face Selling Pressure from Short-term Investors at $162,000"

Summary

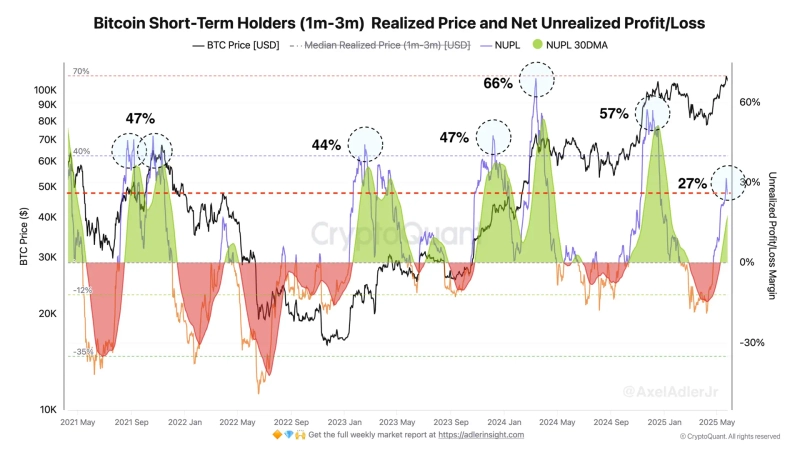

- Axel Adler Jr. analyzed that if Bitcoin reaches $162,000, selling pressure from short-term investors may increase.

- He reported that the Net Unrealized Profit/Loss (NUPL) indicator for short-term investors is currently at 27%, and selling tendencies increase when this indicator exceeds 40%.

- Considering the upward trend in NUPL, it is expected that Bitcoin might reach $162,000 around June 11th.

An analysis suggests that if Bitcoin (BTC) reaches the $162,000 level, selling pressure from short-term investors (holding for 1-3 months) may increase.

On the 26th (local time), Axel Adler Jr., a CryptoQuant contributor, stated on X (formerly Twitter) that "the NUPL (Net Unrealized Profit/Loss) indicator for short-term investors recorded 27%." He added, "Generally, when this indicator exceeds 40%, there is a tendency for increased selling pressure from short-term investors."

Furthermore, he noted, "Considering the current upward trend in NUPL, it is expected to reach 40% on June 11th (local time)," adding, "This would correspond to a Bitcoin price of approximately $162,000."

As of 4:16 PM, Bitcoin is trading at $109,747 on the Binance USDT market, up 1.88% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)