Editor's PiCK

Last Week's Global Cryptocurrency Investment Products See $3.3 Billion Inflow for Six Consecutive Weeks

Summary

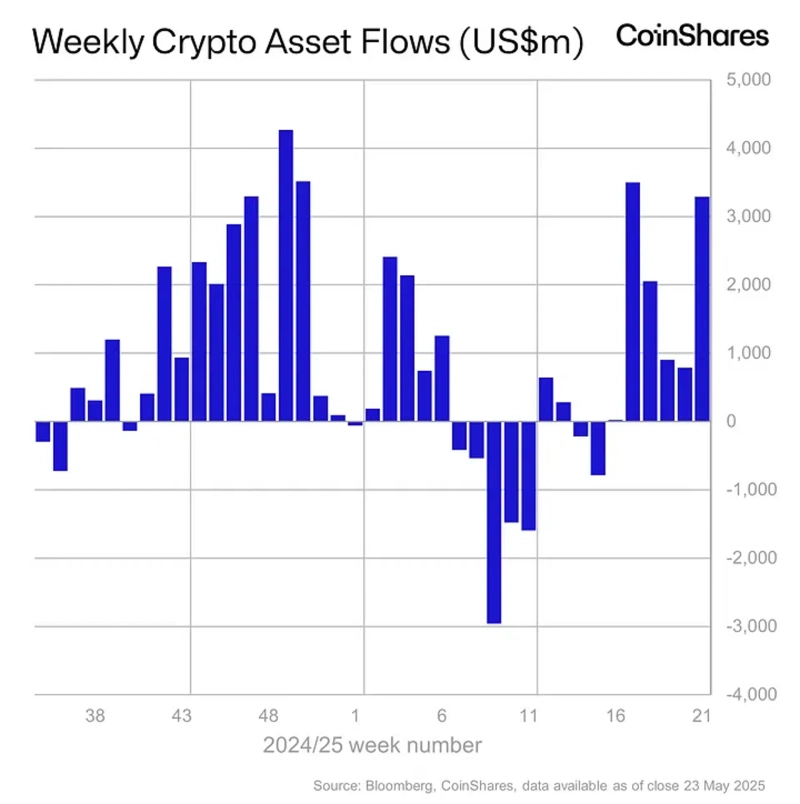

- Last week, $3.3 billion was inflowed into cryptocurrency investment products, marking six consecutive weeks of net inflows.

- Bitcoin products ranked first with a net inflow of $2.9 billion, while Ethereum products also attracted attention with an inflow of $326 million.

- The increase in cryptocurrency investments is attributed to Moody's downgrade of the credit rating, leading to higher treasury yields.

Last week, global cryptocurrency investment products saw an inflow of $3.3 billion, continuing a six-week streak of net inflows.

On the 26th (local time), CoinShares reported that "last week, $3.3 billion (4.5141 trillion KRW) flowed into cryptocurrency investment products, marking six consecutive weeks of net inflows." They further stated, "Since the beginning of the year, the funds inflow is nearing a record high of $10.8 billion," and "the total assets under management (AUM) also briefly hit a record high of $187.5 billion."

CoinShares attributed the increase in fund inflows to "investors seeking diversification through cryptocurrencies due to Moody's downgrade of the US credit rating and the surge in treasury yields."

By asset, Bitcoin (BTC) products recorded a net inflow of $2.9 billion, ranking first. This accounts for 25% of the total inflow for the entire last year. On the other hand, interest in short (sell) products also grew. Bitcoin short products saw an inflow of $12.7 million, marking the largest weekly inflow since December last year.

Ethereum (ETH) saw an inflow of $326 million, recording the largest weekly inflow in 15 weeks, continuing a five-week inflow trend. Additionally, Solana (SOL) and Sui (SUI) recorded net inflows of $4.3 million and $2.9 million, respectively.

In contrast, Ripple (XRP) products saw an outflow of $37.2 million, ending an 80-week streak of inflows. This is the largest outflow on record for XRP products.

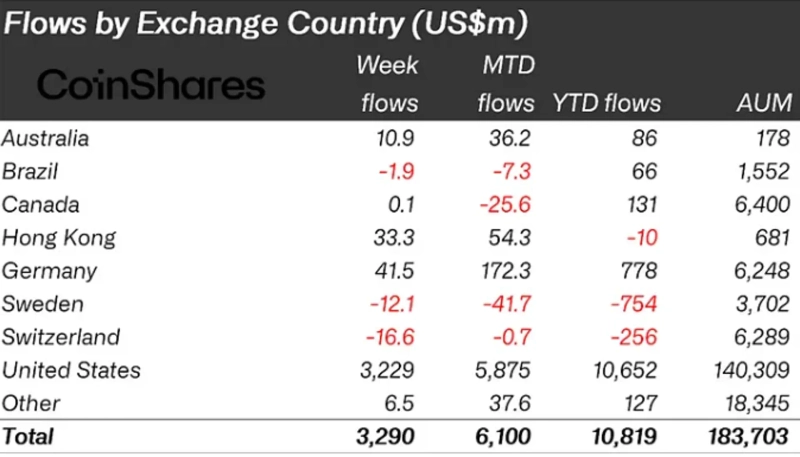

By country, the inflow from the US was strong. Approximately $3.2 billion was net inflowed from US-based cryptocurrency products, followed by Germany, Australia, and Hong Kong with inflows of $41.5 million, $10.9 million, and $33.3 million, respectively. In contrast, Switzerland and Sweden recorded net outflows of $16.6 million and $12.1 million, respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)