"The Possibility of Short-term Market Adjustment Has Increased... Market Orders Significantly Decreased"

Summary

- A Crazzyblockk analyst stated that the possibility of a short-term adjustment in the virtual asset market has increased.

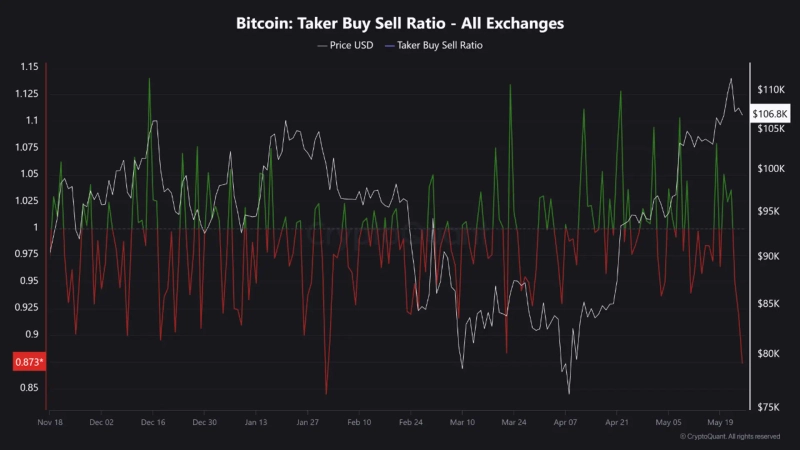

- The decrease in taker buy and sell volumes on centralized exchanges suggests a weakening of the market's short-term momentum.

- It is predicted that Bitcoin might retest the $105,000 support level.

An analysis has emerged suggesting that the possibility of a short-term adjustment in the virtual asset (cryptocurrency) market has increased.

On the 26th (local time), a Crazzyblockk Santiment analyst reported, "On-chain indicators suggesting the possibility of a short-term adjustment in the virtual asset market are emerging," and added, "The taker buy and sell volumes on centralized exchanges (CEX) have both significantly decreased." He continued, "This indicates a decrease in the market order ratio on both the buy and sell sides, suggesting a weakening of the market's short-term momentum."

Additionally, the decline in the taker buy-sell ratio was highlighted. He analyzed, "The taker buy-sell ratio has fallen by about 35% over the past 7 days, with the 7-day moving average reaching 1.2," and added, "At the same time, the 7-day price volatility indicator has surged, implying a significant change is approaching the market."

Furthermore, he predicted that Bitcoin (BTC) could reach $105,000. The analyst stated, "Due to the increase in selling pressure and volatility, the possibility of a short-term adjustment has become very high," and added, "Bitcoin is also likely to retest the $105,000 support level."

As of 6 PM, Bitcoin is trading at $109,659 on the Binance USDT market, up 2.38% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)