Summary

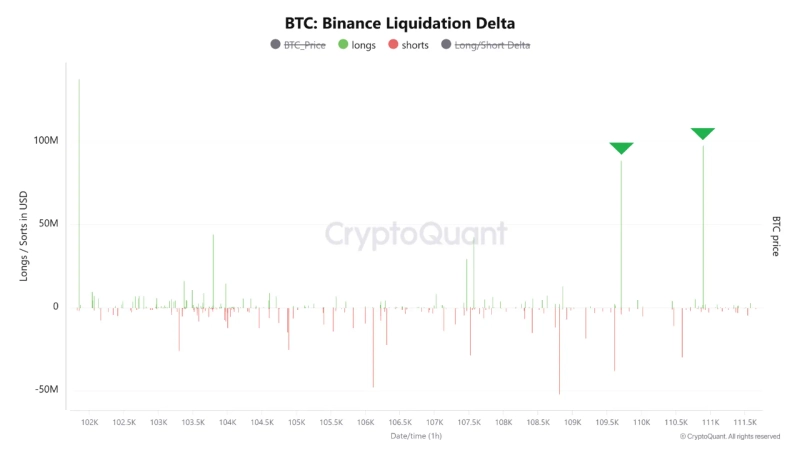

- Recently, as Bitcoin fell below $111,000, there were large-scale long position liquidations, but long-term investors reportedly used this as a buying opportunity.

- The realized market cap of long-term investors' Bitcoin is approaching $28 billion, which is expected to positively impact future upward trends.

- According to CryptoQuant's analysis, a total of $185 million in long position liquidations occurred during this decline.

Recently, as Bitcoin (BTC) fell below $111,000, resulting in large-scale long position liquidations, long-term holders (LTH) have reportedly taken the opportunity to accumulate more. On the 26th (local time), Amar Taha, a contributor to CryptoQuant, stated in a report, "Recently, Bitcoin on Binance fell below $111,000, leading to two large-scale long position liquidations," adding, "Long-term holders viewed the decline due to liquidations as a 'golden buying opportunity' and purchased more Bitcoin." He further noted, "Currently, the realized market cap of long-term holder Bitcoin is approaching $28 billion," evaluating that "this will serve as a positive foundation for Bitcoin's future upward trend." Meanwhile, according to CryptoQuant's liquidation delta indicator, a total of $185 million in long positions were liquidated at $110,900 and $109,000. As of 10:35 PM, Bitcoin is trading at $109,951 on Binance USDT market, up 2.23% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)